Bona Fide Residence test explained for US expats - 1040 Abroad

Por um escritor misterioso

Last updated 26 março 2025

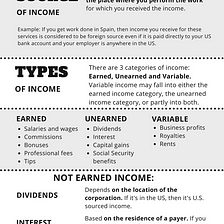

How can US expat qualify for the Foreign Earned Income exclusion? Passing Bona Fide Residence Test and meeting its requirements explained in tax infographic.

The Foreign Earned Income Exclusion and the Pandemic

Don't Believe The Lies! The True Story Of Expat Tax

1040 Abroad – Medium

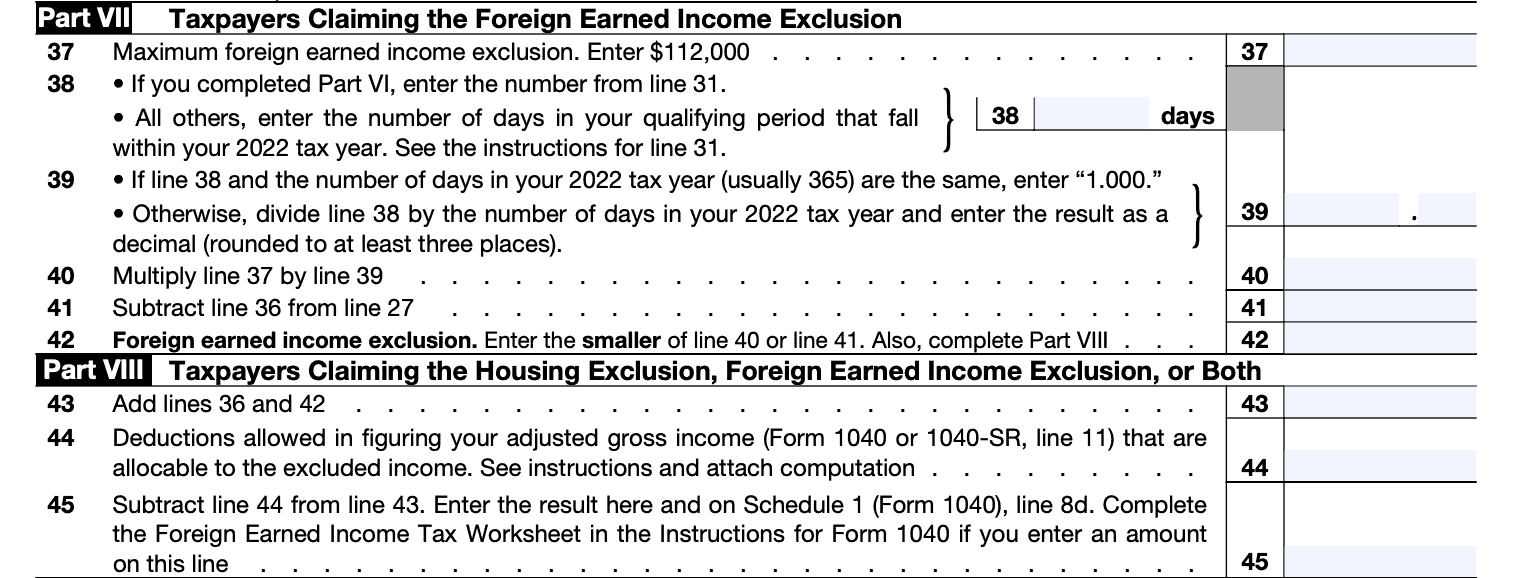

IRS Form 2555 and the Foreign Earned Income Exclusion - A Practical Guide (for 2022) • Cartagena Explorer

Form 2555-EZ: U.S Expat Taxes - Community Tax

US expat tax deductions and credits - 1040 Abroad

Bona Fide Residence Test For U.S. Expats Explained

Keyword:bona fide resident - FasterCapital

IRS Form 2555: A Foreign Earned Income Guide

How to not get caught off-guard by the IRS when claiming the Bona Fide Residence status as an American Expat

Filing U.S. Taxes as an Expat: 4 Things You Need to Know

Recomendado para você

-

BULLETChess2014's Blog • FİDE titles •26 março 2025

BULLETChess2014's Blog • FİDE titles •26 março 2025 -

Chess FIDE Ratings (2015 - 2021)26 março 2025

Chess FIDE Ratings (2015 - 2021)26 março 2025 -

Preview: FIDE World Chess Championship 202326 março 2025

Preview: FIDE World Chess Championship 202326 março 2025 -

Updated List of Chess FIDE World Cup Winners (2000-2023)26 março 2025

Updated List of Chess FIDE World Cup Winners (2000-2023)26 março 2025 -

Standard Flat Tournament Chess Board (FIDE) - Henry Chess Sets26 março 2025

Standard Flat Tournament Chess Board (FIDE) - Henry Chess Sets26 março 2025 -

Bona Fide a Friend - Wizard Academy26 março 2025

Bona Fide a Friend - Wizard Academy26 março 2025 -

Top news26 março 2025

Top news26 março 2025 -

FIDE World Championship 2023 becomes 2nd most popular chess event ever26 março 2025

FIDE World Championship 2023 becomes 2nd most popular chess event ever26 março 2025 -

Chess: Magnus Carlsen beats India's Praggnanandhaa to win FIDE World Cup, News26 março 2025

Chess: Magnus Carlsen beats India's Praggnanandhaa to win FIDE World Cup, News26 março 2025 -

World Championship Chess Pieces Set 3.75 FIDE type+ 21 Ebony Chess Board COMBO26 março 2025

World Championship Chess Pieces Set 3.75 FIDE type+ 21 Ebony Chess Board COMBO26 março 2025

você pode gostar

-

GTA6 Concept map (red dots indicate the leaked locations) : r/GTA626 março 2025

GTA6 Concept map (red dots indicate the leaked locations) : r/GTA626 março 2025 -

Fantasia para Crianças Meninas 2 3 4 5 Anos de Idade Roupa em Promoção na Americanas26 março 2025

Fantasia para Crianças Meninas 2 3 4 5 Anos de Idade Roupa em Promoção na Americanas26 março 2025 -

Místicos Online - misticosonline #misticos #tarot #bomdia26 março 2025

-

BOKUTO'S REALIZATION: THE WAY OF THE ACE SENPAI! HAIKYUU! SEASON 4 EPISODE 12 LIVE REACTION26 março 2025

BOKUTO'S REALIZATION: THE WAY OF THE ACE SENPAI! HAIKYUU! SEASON 4 EPISODE 12 LIVE REACTION26 março 2025 -

One Punch Man chapter 165: Garou goes nuclear, steals Saitama's26 março 2025

One Punch Man chapter 165: Garou goes nuclear, steals Saitama's26 março 2025 -

Call of War (1.0 Version) Isolation Fan Game, Day 1 EP 126 março 2025

Call of War (1.0 Version) Isolation Fan Game, Day 1 EP 126 março 2025 -

resultados de jogos (Futebol Épico)26 março 2025

-

![Read Level 1 Player Manga English [New Chapters] Online Free](https://cdn1.mangaclash.com/temp/manga_62282370a1e43/871581aaab9dbcb54249065174f48e32/2.jpg) Read Level 1 Player Manga English [New Chapters] Online Free26 março 2025

Read Level 1 Player Manga English [New Chapters] Online Free26 março 2025 -

Since we have FHJ-18 that can fire at will, how about JOKR that'll only lock on and fire scorestreaks? : r/CallOfDutyMobile26 março 2025

Since we have FHJ-18 that can fire at will, how about JOKR that'll only lock on and fire scorestreaks? : r/CallOfDutyMobile26 março 2025 -

Camisa Work Fio Tinto Micro Xadrez Azul - 2504gwz48802 - vilaromana-mobile26 março 2025

Camisa Work Fio Tinto Micro Xadrez Azul - 2504gwz48802 - vilaromana-mobile26 março 2025