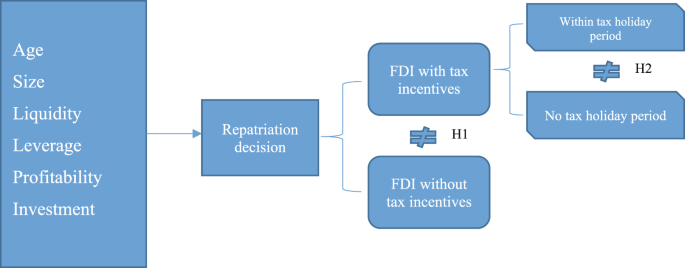

Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Last updated 07 julho 2024

Foreign Direct Investment in Southeastern Europe: How (and How

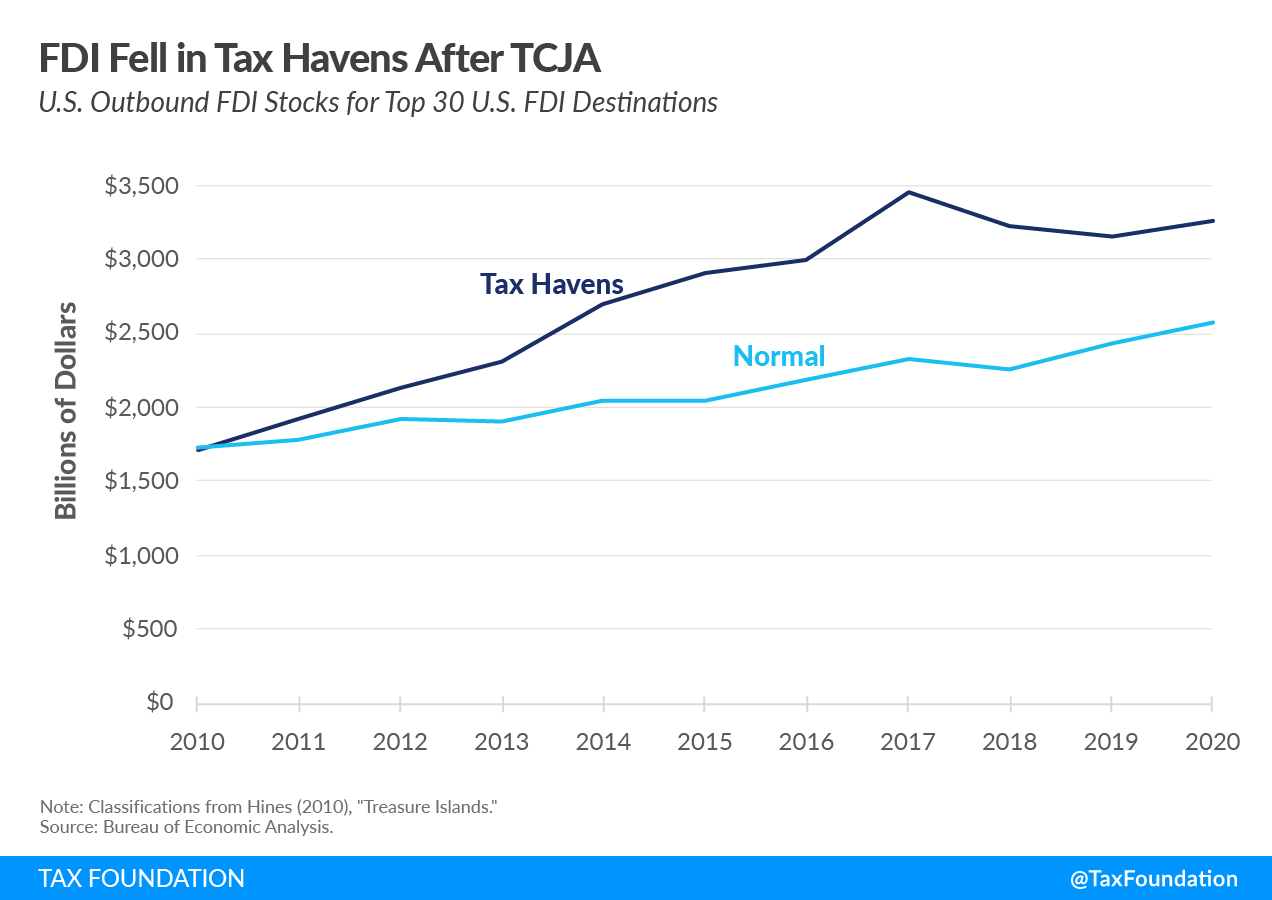

US Tax Data Explorer Taxes in the United States

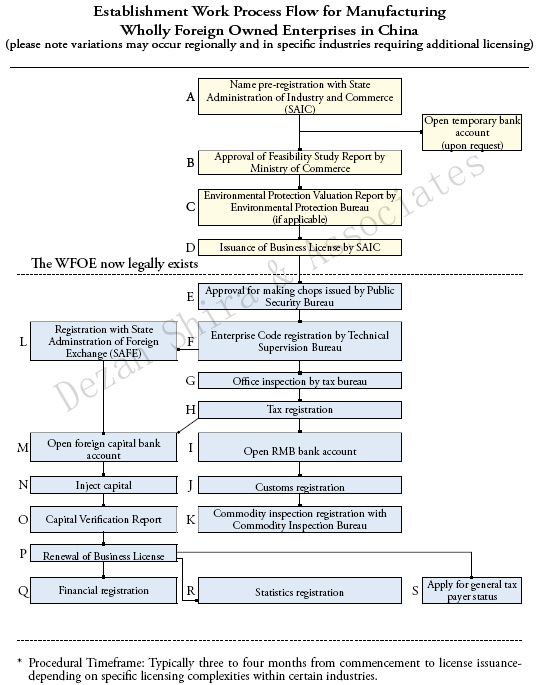

China Incorporations. Let's Get Real: They are a Tax-Based, not

Skilled Labor Force - FasterCapital

Foreign Direct Investment in Latin America and the Caribbean 2019

Ownership chain 3: The interaction effect in the periphery

IV Disinflation, Growth, and Foreign Direct Investment in

4. Investment Impacts of Pillar One and Pillar Two

Czech Republic Foreign Direct Investment

Recomendado para você

-

Home - Time Group07 julho 2024

Home - Time Group07 julho 2024 -

Domínio de tecnologia relacionado a contabilidade e Internet of things07 julho 2024

Domínio de tecnologia relacionado a contabilidade e Internet of things07 julho 2024 -

Time Control Contabilidade07 julho 2024

-

Digital Leaders Spotlight: Portal Mais Transparência, Portugal07 julho 2024

Digital Leaders Spotlight: Portal Mais Transparência, Portugal07 julho 2024 -

Vetores de Aviões De Transporte Entrega No Tempo Contabilidade De Computador Controle E Contabilização De Mercadorias Logística E Entrega Set Coleção Ícones Em Desenho Animado Estilo Isométrico Vector Símbolo Conservado Em Estoque07 julho 2024

Vetores de Aviões De Transporte Entrega No Tempo Contabilidade De Computador Controle E Contabilização De Mercadorias Logística E Entrega Set Coleção Ícones Em Desenho Animado Estilo Isométrico Vector Símbolo Conservado Em Estoque07 julho 2024 -

Ciclo da contabilidade de custos07 julho 2024

Ciclo da contabilidade de custos07 julho 2024 -

Framework for aircraft dispatch decision support.07 julho 2024

Framework for aircraft dispatch decision support.07 julho 2024 -

Control Gracias, Querido Dios, Por Ayudarme07 julho 2024

Control Gracias, Querido Dios, Por Ayudarme07 julho 2024 -

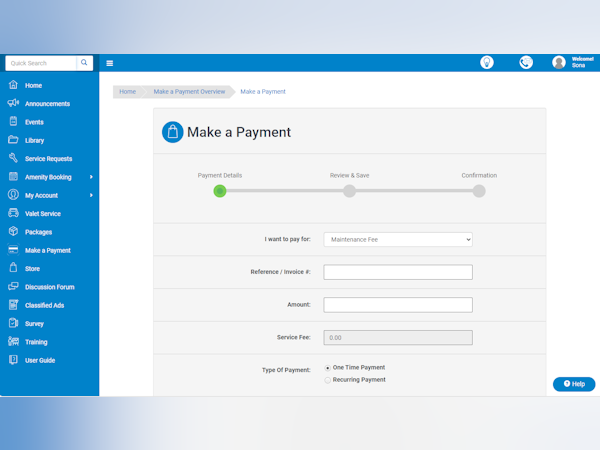

Condo Control - Preço, avaliações e classificação - Capterra07 julho 2024

Condo Control - Preço, avaliações e classificação - Capterra07 julho 2024 -

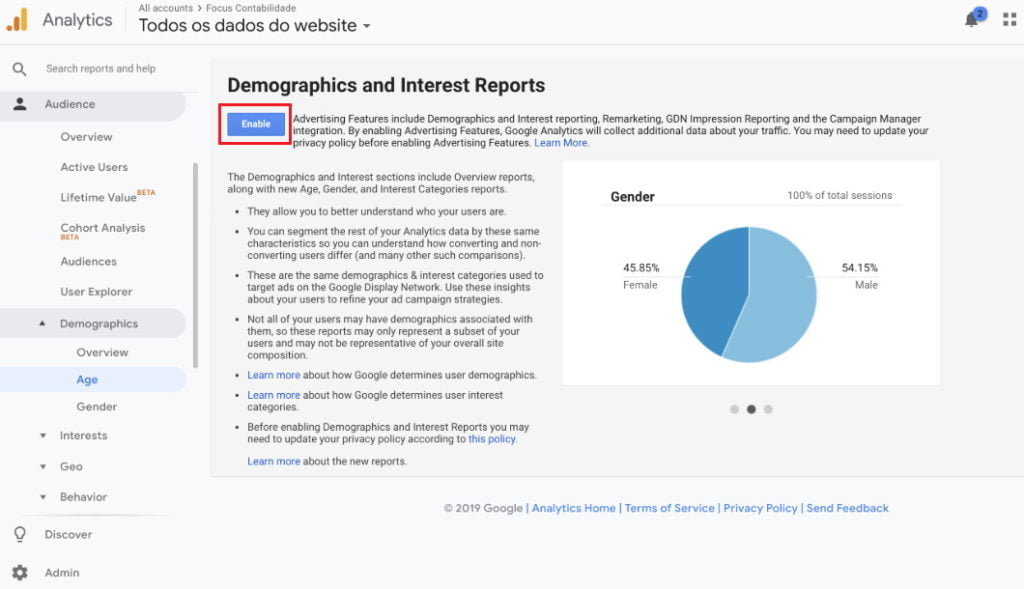

The Google Analytics graphs does not appear. What should I do? - Reportei07 julho 2024

The Google Analytics graphs does not appear. What should I do? - Reportei07 julho 2024

você pode gostar

-

Conheça Nossa Linha Exclusiva Para Selaria07 julho 2024

Conheça Nossa Linha Exclusiva Para Selaria07 julho 2024 -

O boletim de Touro ♉ Gostou das disciplinas?! Beijos da Maria Talismã 🔮 . ▷@amariatalisma, #Astroloucamente #mariatalismã #signos #s…07 julho 2024

O boletim de Touro ♉ Gostou das disciplinas?! Beijos da Maria Talismã 🔮 . ▷@amariatalisma, #Astroloucamente #mariatalismã #signos #s…07 julho 2024 -

Si Se Puede Foundation07 julho 2024

-

Monster High: O Filme Live-Action ganha data de estreia07 julho 2024

Monster High: O Filme Live-Action ganha data de estreia07 julho 2024 -

POKI BOWL - 11 Photos & 18 Reviews - 8610 Potranco Rd, San Antonio07 julho 2024

POKI BOWL - 11 Photos & 18 Reviews - 8610 Potranco Rd, San Antonio07 julho 2024 -

This is the poem I read at my Uncle Bruce's funeral. The man who first taught me how to love my people *out loud.* Who sat us down at…07 julho 2024

-

Quanto você sabe sobre Pokemon XYZ e XY ?07 julho 2024

Quanto você sabe sobre Pokemon XYZ e XY ?07 julho 2024 -

U.S. iPhone Sales By Outlet - John Paczkowski - News - AllThingsD07 julho 2024

U.S. iPhone Sales By Outlet - John Paczkowski - News - AllThingsD07 julho 2024 -

Pokémon Ultra Sun and Pokémon Ultra Moon: The Official Alola07 julho 2024

Pokémon Ultra Sun and Pokémon Ultra Moon: The Official Alola07 julho 2024 -

Botched' star Dr. Paul Nassif gets engaged07 julho 2024

Botched' star Dr. Paul Nassif gets engaged07 julho 2024