Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 31 março 2025

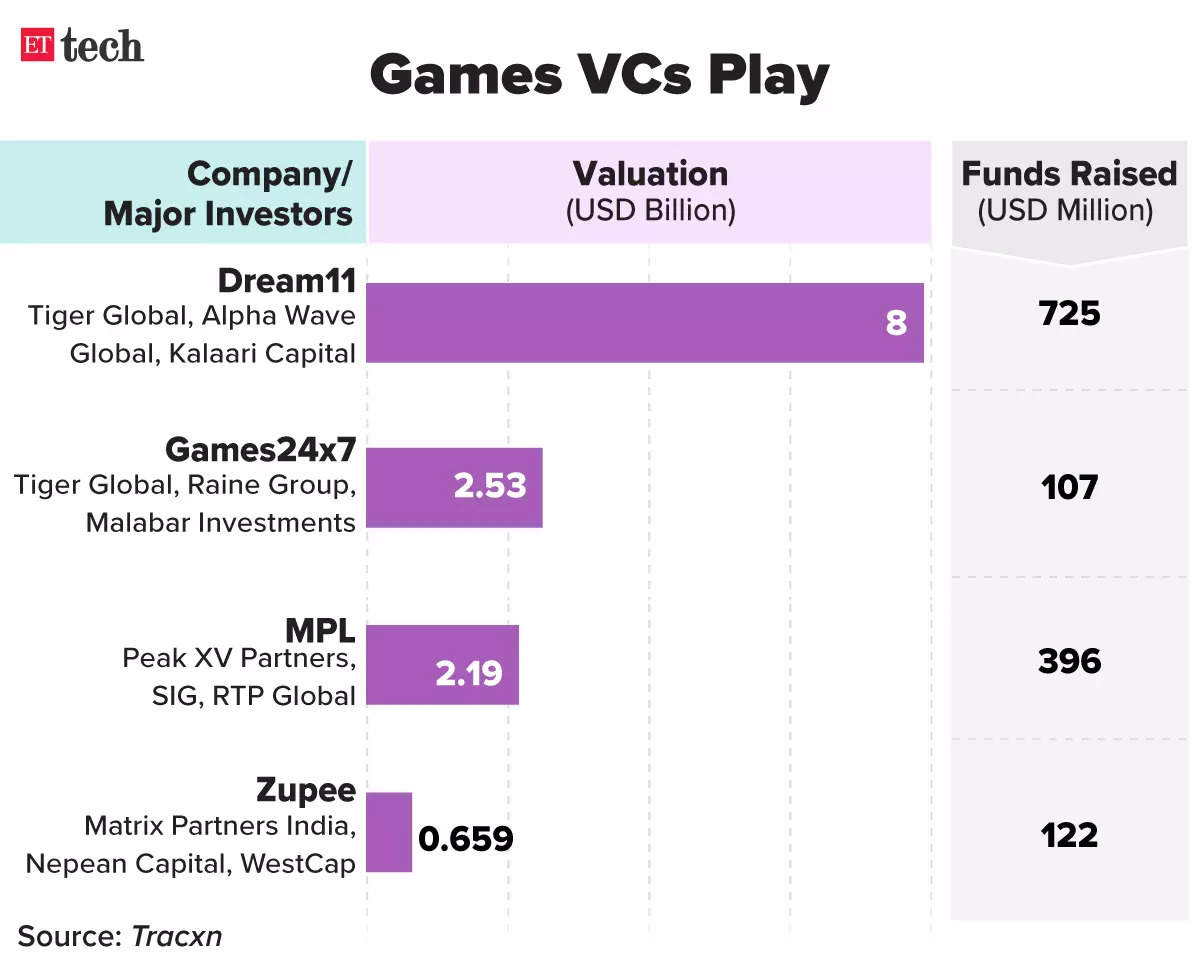

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

India's $3-billion Online Gaming Industry is Battling the Odds

Online Gaming Companies Say 28% GST To Hit Their Business

India: 28% tax on casinos, online gaming likely to go into effect

28% GST Decision Will Wipe Out Entire Industry: Online Gaming Firms

Uniform 28% tax on online gaming: What the GST Council's decision

GST council to levy 28% tax on online gaming, casinos, horse

Going in for the Kill: Indian Online Gaming Industry Hit With 28% GST

Online gaming industry for 28% GST on gross gaming revenue not on

Online Gaming Industry Asks For GST To Be Levied Only On Gross

online gaming investors news: Online gaming investors say 28% GST

Recomendado para você

-

The best cloud gaming services in 202331 março 2025

The best cloud gaming services in 202331 março 2025 -

esports: Millions watch as others compete in online video gaming31 março 2025

esports: Millions watch as others compete in online video gaming31 março 2025 -

Expert insights: How does one upskill their talent on an online gaming platform?31 março 2025

Expert insights: How does one upskill their talent on an online gaming platform?31 março 2025 -

Cross platform play online gaming concept icon Vector Image31 março 2025

Cross platform play online gaming concept icon Vector Image31 março 2025 -

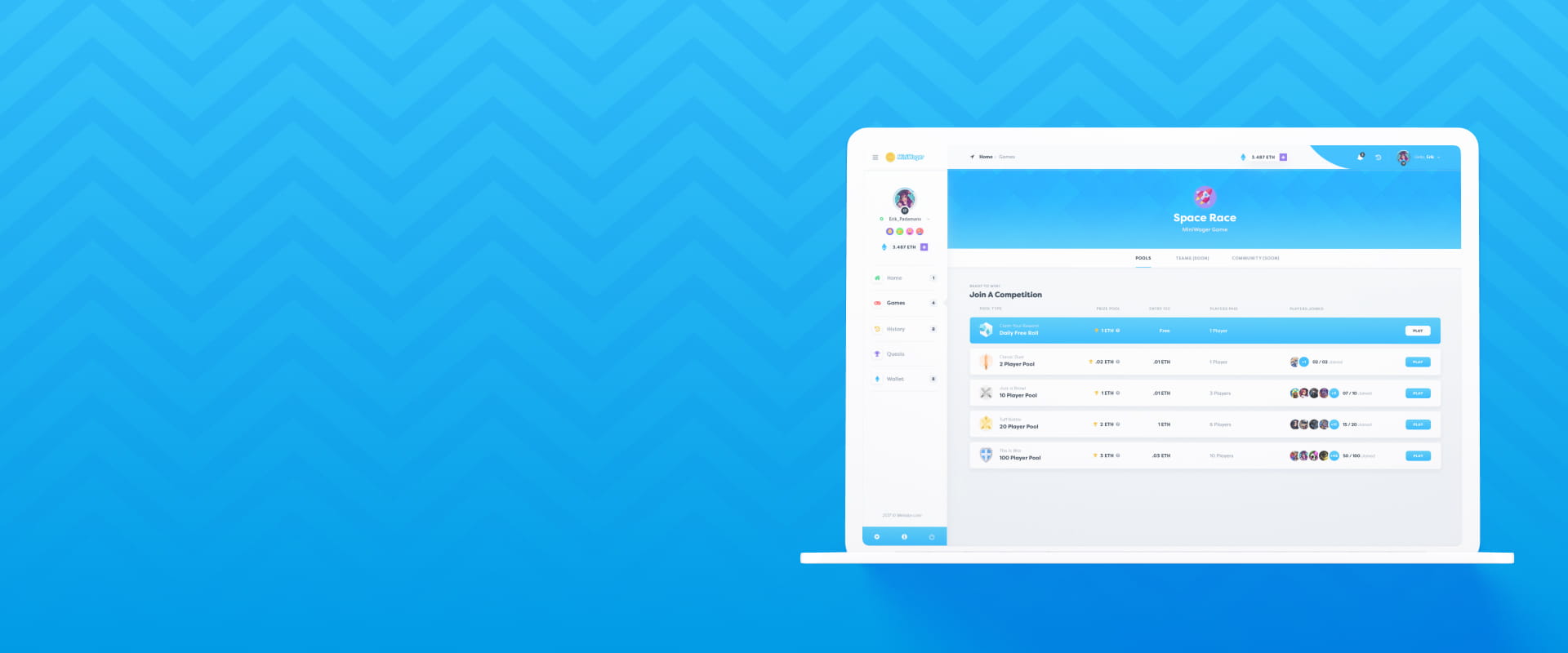

Miniwager - Ethereum-Based Decentralized Online Gaming Platform31 março 2025

Miniwager - Ethereum-Based Decentralized Online Gaming Platform31 março 2025 -

Why BC.Game Is A Top Online Slot Gaming Platform31 março 2025

Why BC.Game Is A Top Online Slot Gaming Platform31 março 2025 -

Customize Your Own Online Game Platform Orion Stars/Noble/Juwa /Golden Dragon Online Game App Software Online Fishing Gaming USA - AliExpress31 março 2025

Customize Your Own Online Game Platform Orion Stars/Noble/Juwa /Golden Dragon Online Game App Software Online Fishing Gaming USA - AliExpress31 março 2025 -

explores online gaming for its platform - Neowin31 março 2025

explores online gaming for its platform - Neowin31 março 2025 -

China approves new online games as crackdown eases31 março 2025

China approves new online games as crackdown eases31 março 2025 -

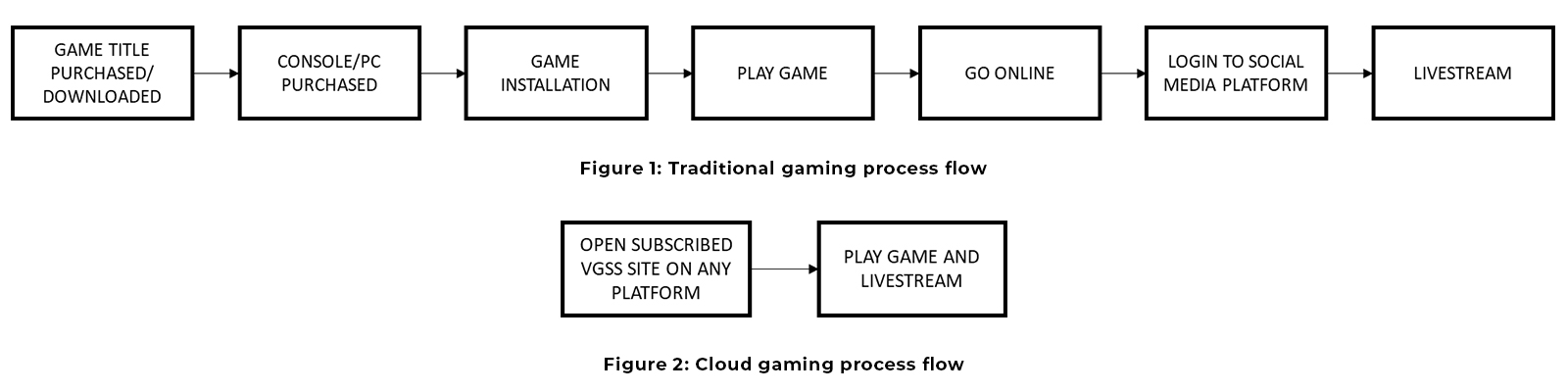

Video Game Streaming Service Benefits Challenges31 março 2025

Video Game Streaming Service Benefits Challenges31 março 2025

você pode gostar

-

Discord Unblocked31 março 2025

-

Ver Honzuki no Gekokujou: Shisho ni Naru Tame ni wa Shudan wo Erandeiraremasen 3rd Season Online - Episodios de Honzuki no Gekokujou: Shisho ni Naru Tame ni wa Shudan wo Erandeiraremasen 3rd31 março 2025

Ver Honzuki no Gekokujou: Shisho ni Naru Tame ni wa Shudan wo Erandeiraremasen 3rd Season Online - Episodios de Honzuki no Gekokujou: Shisho ni Naru Tame ni wa Shudan wo Erandeiraremasen 3rd31 março 2025 -

Glitch Productions – Aythan Maconachie31 março 2025

Glitch Productions – Aythan Maconachie31 março 2025 -

Tokyo Ghoul (Dublado) – Episódio 03 - AniTube31 março 2025

Tokyo Ghoul (Dublado) – Episódio 03 - AniTube31 março 2025 -

:max_bytes(150000):strip_icc()/Survivor-45-Cast-083123-1-68f6dc28d59e4e16aaa9281ae69c16d0.jpg) Survivor 45' players share first impressions of their castmates31 março 2025

Survivor 45' players share first impressions of their castmates31 março 2025 -

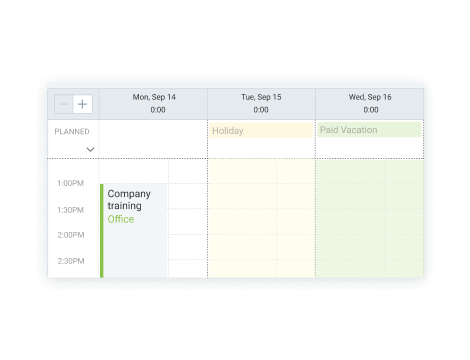

Calendário - Ferramentas Clockify31 março 2025

Calendário - Ferramentas Clockify31 março 2025 -

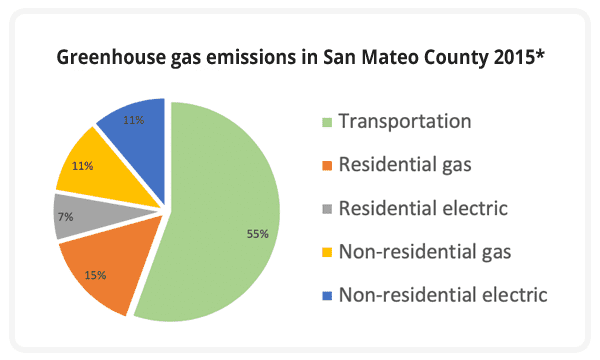

What is emitting the most greenhouse gas in our community?31 março 2025

What is emitting the most greenhouse gas in our community?31 março 2025 -

Futebol ao vivo e futebol on-line no celular31 março 2025

Futebol ao vivo e futebol on-line no celular31 março 2025 -

Yasuo - KillerSkins31 março 2025

Yasuo - KillerSkins31 março 2025 -

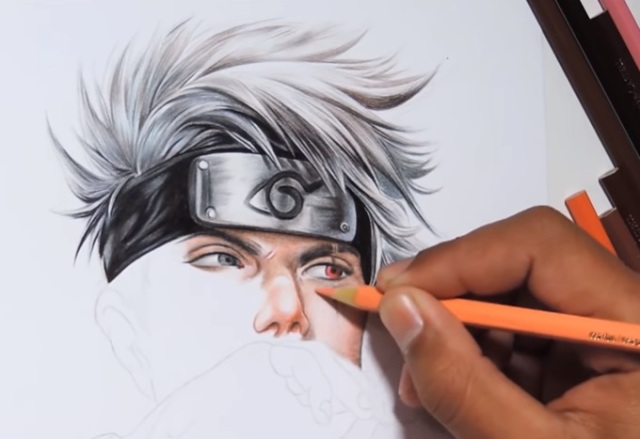

Como Desenhar Pele Realista Com Lápis de Cor – Dicas da Hora Blog31 março 2025

Como Desenhar Pele Realista Com Lápis de Cor – Dicas da Hora Blog31 março 2025