Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

Por um escritor misterioso

Last updated 18 fevereiro 2025

Extreme intraday price swings in government bonds, used as benchmarks for the pricing of a host of other assets, is another headache for officials navigating banking sector turmoil

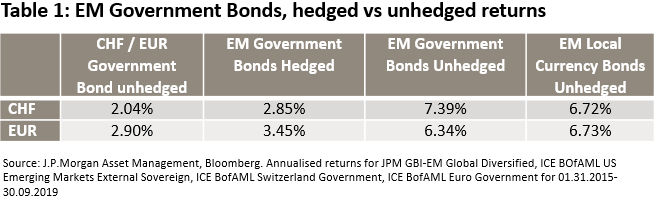

Emerging markets and the negative yield conundrum for fixed income investors

Municipal Bonds 101: Understanding Housing Authority Bond Investments - FasterCapital

Are there structural issues in U.S. bond markets?

Page 4783 of 24241 for Reuters

Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

How Illiquid Open-End Funds Can Amplify Shocks and Destabilize Asset Prices

Bond Market Turmoil Could Last a While. How to Ride It Out. - Barron's

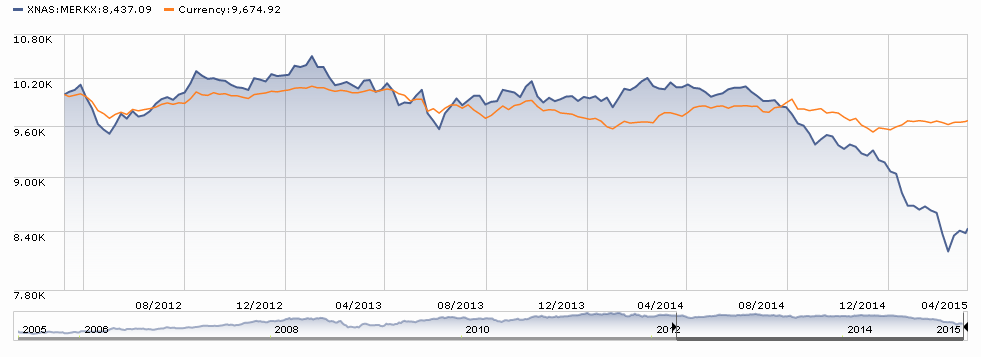

Search Results for SEEDX

vim/CVIMSYN/engspchk.dict at master · Tong-Chen/vim · GitHub

Books: risk tolerance

Recomendado para você

-

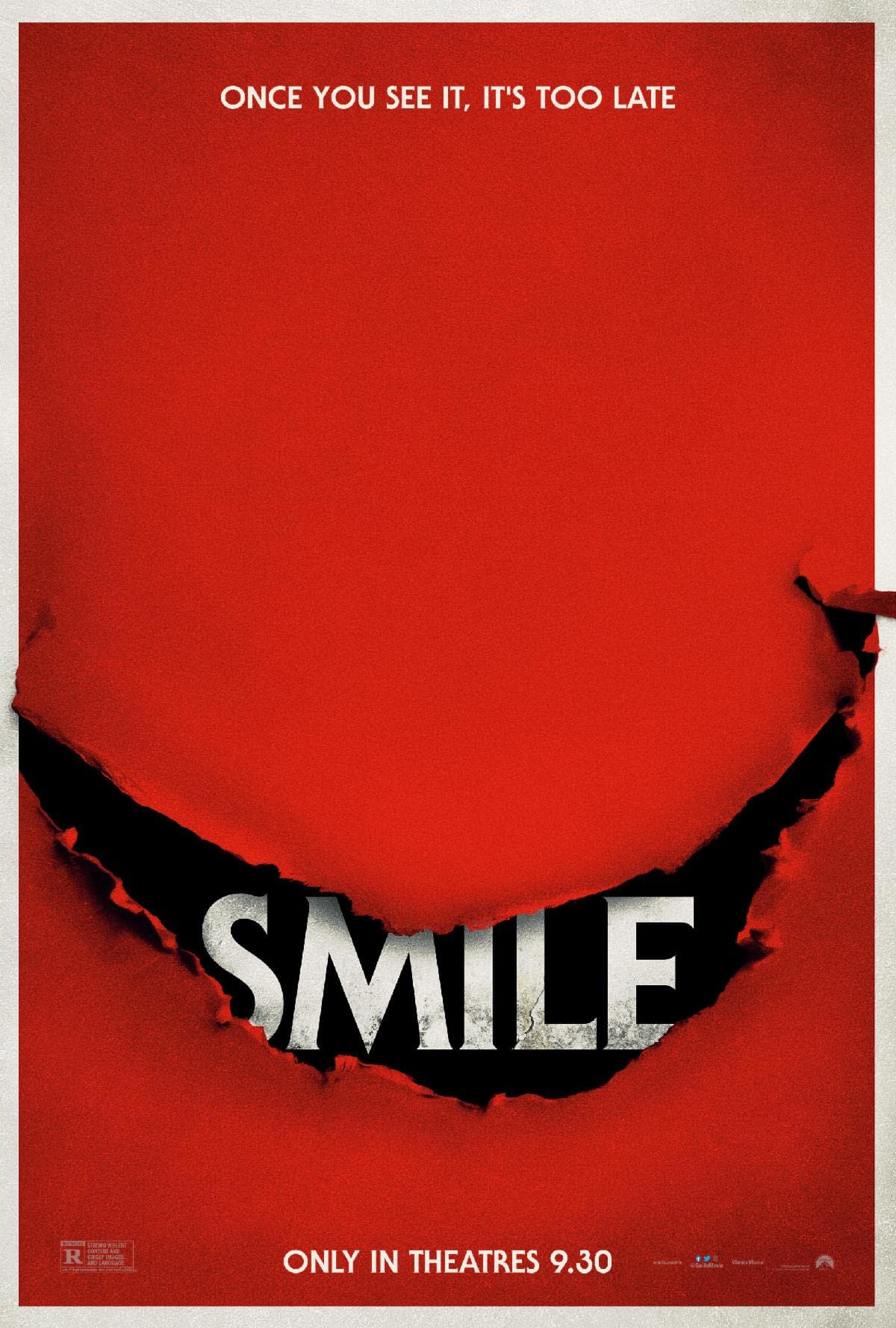

Smile Trailer Unnerves, Film Out In Theaters On September 30th18 fevereiro 2025

Smile Trailer Unnerves, Film Out In Theaters On September 30th18 fevereiro 2025 -

Senset @seupo it unnerves me that everything in animal crossing is cartoony and then we just have this fuckin hyper realistic turtle - iFunny Brazil18 fevereiro 2025

Senset @seupo it unnerves me that everything in animal crossing is cartoony and then we just have this fuckin hyper realistic turtle - iFunny Brazil18 fevereiro 2025 -

ILS/USD Shekel Volatility Bets Jump as Israeli Politics Unnerves Traders - Bloomberg18 fevereiro 2025

ILS/USD Shekel Volatility Bets Jump as Israeli Politics Unnerves Traders - Bloomberg18 fevereiro 2025 -

NNPC unnerves oil traders with sudden pricing change -…18 fevereiro 2025

-

Attack on Jerusalem graves unnerves Christians18 fevereiro 2025

Attack on Jerusalem graves unnerves Christians18 fevereiro 2025 -

Biden's Secrecy on Arms Transfers to 'Israel' Unnerves Some Democrats - Islam Times18 fevereiro 2025

Biden's Secrecy on Arms Transfers to 'Israel' Unnerves Some Democrats - Islam Times18 fevereiro 2025 -

Sudden arena idea angers, unnerves Philadelphia's Chinatown18 fevereiro 2025

Sudden arena idea angers, unnerves Philadelphia's Chinatown18 fevereiro 2025 -

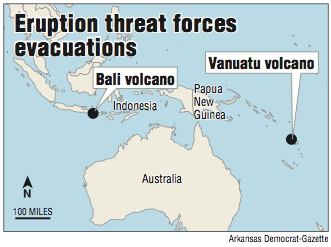

Bali volcano unnerves towns18 fevereiro 2025

Bali volcano unnerves towns18 fevereiro 2025 -

Mob attack on U.S. Capitol dominates overseas news, unnerves world: 'The mayhem is unlike any in living memory'18 fevereiro 2025

Mob attack on U.S. Capitol dominates overseas news, unnerves world: 'The mayhem is unlike any in living memory'18 fevereiro 2025 -

Jordan Peele's Us Unnerves in New Trailer - Paste Magazine18 fevereiro 2025

Jordan Peele's Us Unnerves in New Trailer - Paste Magazine18 fevereiro 2025

você pode gostar

-

Shadow the Hedgehog - PS218 fevereiro 2025

Shadow the Hedgehog - PS218 fevereiro 2025 -

Only play Performance Training High Waist Leggings Black18 fevereiro 2025

Only play Performance Training High Waist Leggings Black18 fevereiro 2025 -

The Last of Us Leaked on Tamilrockers & Telegram Channels for Free18 fevereiro 2025

The Last of Us Leaked on Tamilrockers & Telegram Channels for Free18 fevereiro 2025 -

Go Behind the Scenes of The Amazing Spider-Man (2012)18 fevereiro 2025

Go Behind the Scenes of The Amazing Spider-Man (2012)18 fevereiro 2025 -

Generator Rex Mutante rex, Desenhos tv cultura, Heróis unidos18 fevereiro 2025

Generator Rex Mutante rex, Desenhos tv cultura, Heróis unidos18 fevereiro 2025 -

galar moltres shiny|TikTok Search18 fevereiro 2025

galar moltres shiny|TikTok Search18 fevereiro 2025 -

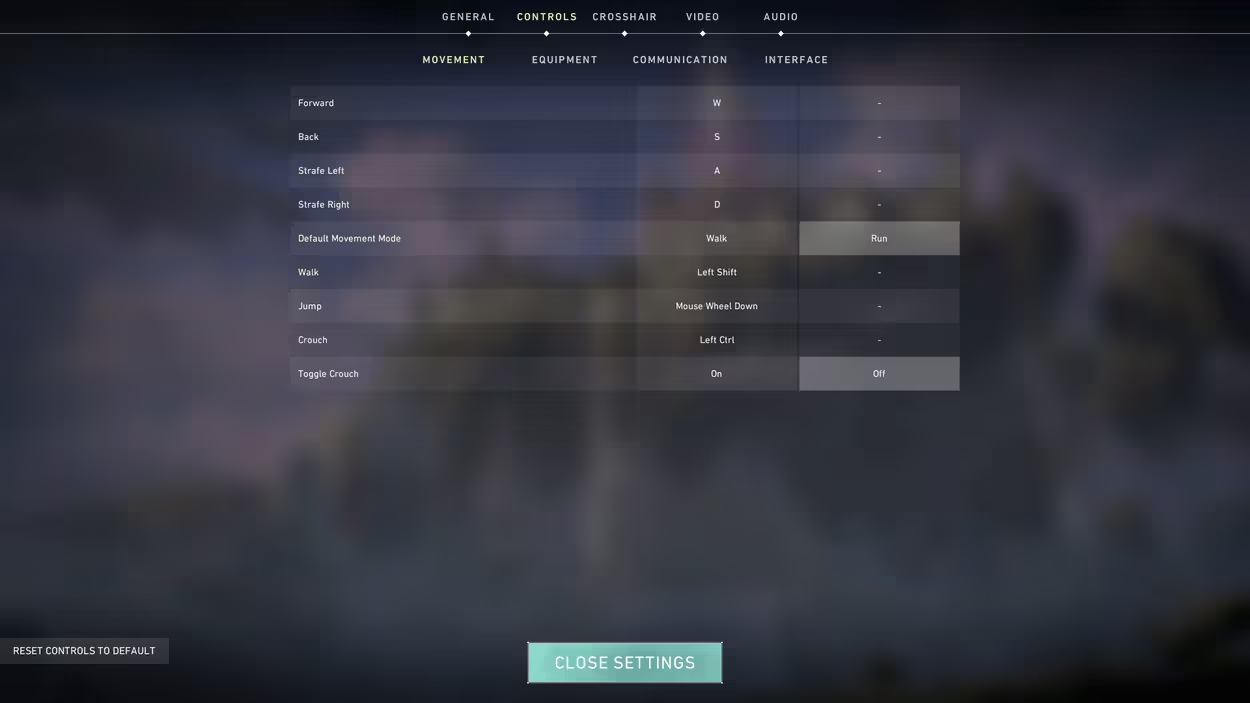

An Overview of All VALORANT Settings in the Settings Menu18 fevereiro 2025

An Overview of All VALORANT Settings in the Settings Menu18 fevereiro 2025 -

Como jogar de forma responsável18 fevereiro 2025

Como jogar de forma responsável18 fevereiro 2025 -

End Game Lyrics Spiral Notebook for Sale by queseraseraa18 fevereiro 2025

End Game Lyrics Spiral Notebook for Sale by queseraseraa18 fevereiro 2025 -

Damon & Elena. Journey back to each other: Tribute to Damon and Elena18 fevereiro 2025

Damon & Elena. Journey back to each other: Tribute to Damon and Elena18 fevereiro 2025