What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Last updated 24 março 2025

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

TaxTouchdown - The TurboTax Blog

Are Social Security Benefits Taxable? - The TurboTax Blog

What Are FICA Taxes? – Forbes Advisor

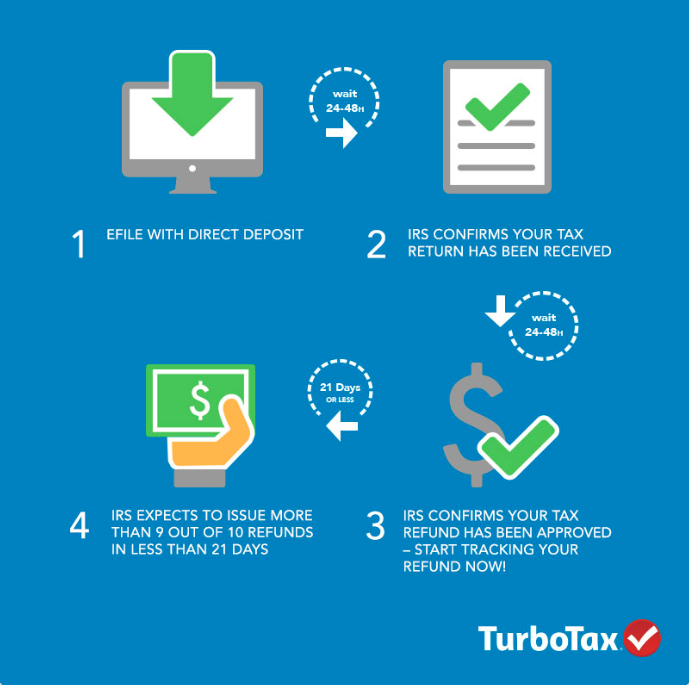

Where's My Tax Refund? - The TurboTax Blog

OPT Student Taxes Explained

Withholding FICA Tax on Nonresident employees and Foreign Workers

How FICA & Federal Income Taxes Work - TaxSlayer®

What are self-employment taxes? - TurboTax Support Video

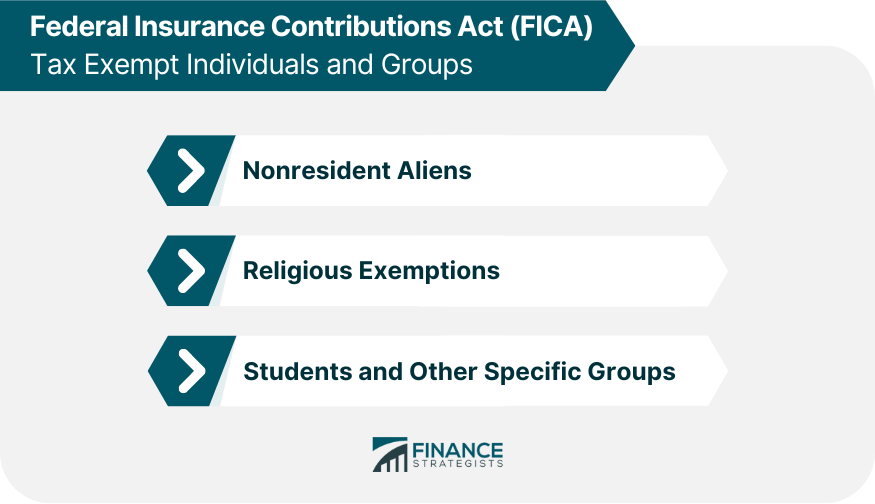

FICA Tax Exemption for Nonresident Aliens Explained

Health Care Archives - The TurboTax Blog

What is FICA Tax? - The TurboTax Blog

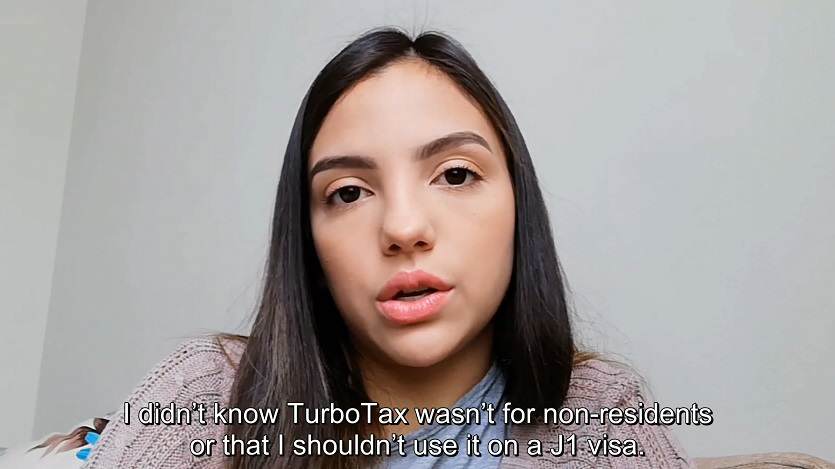

Claiming Your J1 Tax Refund - Turbotax vs Sprintax

Recomendado para você

-

What is FICA24 março 2025

What is FICA24 março 2025 -

What is the FICA Tax and How Does It Work? - Ramsey24 março 2025

What is the FICA Tax and How Does It Work? - Ramsey24 março 2025 -

What Is the FICA Tax and Why Does It Exist? - TheStreet24 março 2025

What Is the FICA Tax and Why Does It Exist? - TheStreet24 março 2025 -

What is the FICA Tax? - 2023 - Robinhood24 março 2025

-

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents24 março 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents24 março 2025 -

Withholding FICA Tax on Nonresident employees and Foreign Workers24 março 2025

Withholding FICA Tax on Nonresident employees and Foreign Workers24 março 2025 -

What Eliminating FICA Tax Means for Your Retirement24 março 2025

-

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.24 março 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.24 março 2025 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —24 março 2025

Students on an F1 Visa Don't Have to Pay FICA Taxes —24 março 2025 -

Federal Insurance Contributions Act (FICA)24 março 2025

Federal Insurance Contributions Act (FICA)24 março 2025

você pode gostar

-

Withered chica's orange clawed feet. five nights at freddy's 2.24 março 2025

Withered chica's orange clawed feet. five nights at freddy's 2.24 março 2025 -

Dragons Nine Realms: Feathers & Alex 7108324 março 2025

Dragons Nine Realms: Feathers & Alex 7108324 março 2025 -

Arsenal Aimbot - Aimbot, ESP + Others - Lua Internal24 março 2025

Arsenal Aimbot - Aimbot, ESP + Others - Lua Internal24 março 2025 -

Pin en Little things I love24 março 2025

Pin en Little things I love24 março 2025 -

GitHub - firefw/RobloxWild-Predictor: RblxWild Predictor. Supports24 março 2025

-

Dinosaur GIFs - Get the best gif on GIFER24 março 2025

Dinosaur GIFs - Get the best gif on GIFER24 março 2025 -

Busto Boneca Charmosa Faça Penteados Maquiagem Fala Com Você no Shoptime24 março 2025

Busto Boneca Charmosa Faça Penteados Maquiagem Fala Com Você no Shoptime24 março 2025 -

.jpg) Kit Mania Fest: Bolo Roblox24 março 2025

Kit Mania Fest: Bolo Roblox24 março 2025 -

YU YU HAKUSHO LIVE ACTION - A PRIMEIRA APARIÇÃO DE KURAMA -DUBLADO EM PT-BR24 março 2025

YU YU HAKUSHO LIVE ACTION - A PRIMEIRA APARIÇÃO DE KURAMA -DUBLADO EM PT-BR24 março 2025 -

La FIFA también se suma al fútbol gratis por streaming: llega FIFA Plus con partidos históricos y en directo24 março 2025

La FIFA también se suma al fútbol gratis por streaming: llega FIFA Plus con partidos históricos y en directo24 março 2025