Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 15 julho 2024

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

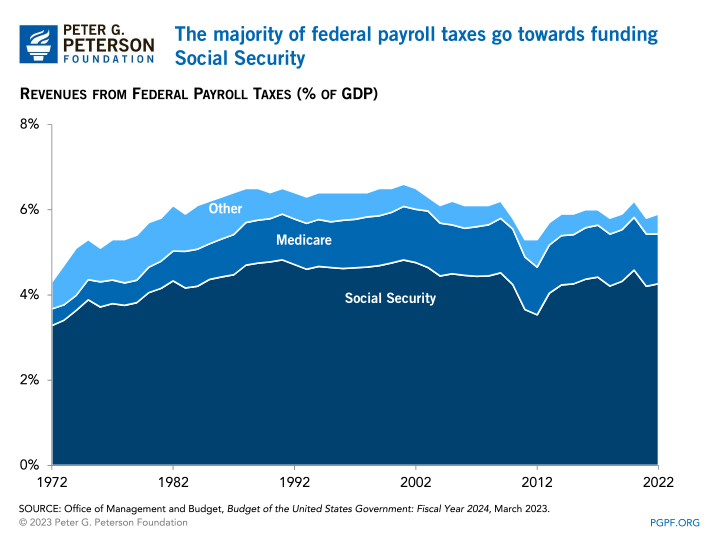

Payroll Taxes: What Are They and What Do They Fund?

Understanding Your Tax Forms: The W-2

Employers responsibility for FICA payroll taxes

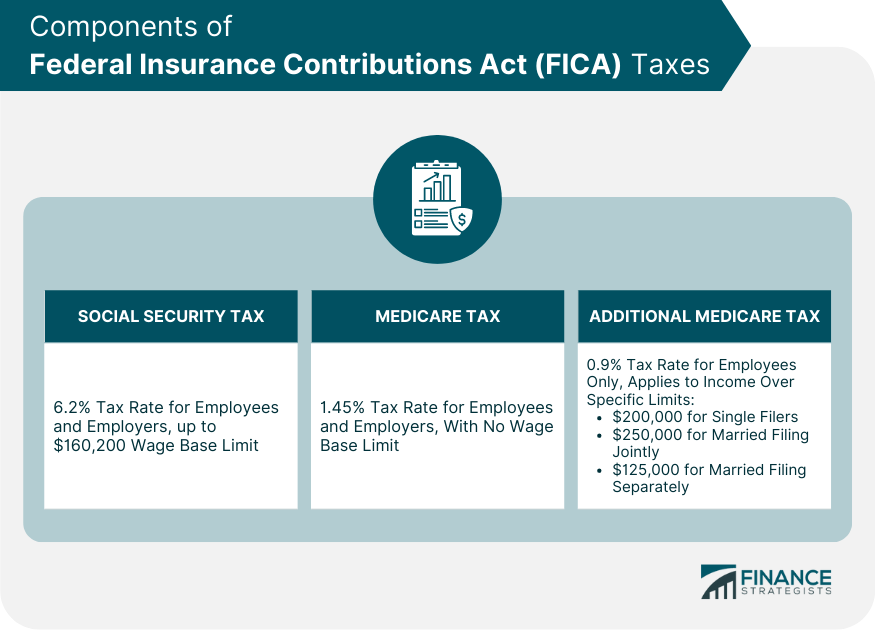

Federal Insurance Contributions Act (FICA)

How to Calculate Payroll Taxes

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Understanding solo 401(k) after-tax / total additions limit for

Understanding FICA Taxes and Wage Base Limit

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

2024 Social Security Wage Base

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions15 julho 2024

-

What is Fica Tax?, What is Fica on My Paycheck15 julho 2024

What is Fica Tax?, What is Fica on My Paycheck15 julho 2024 -

What is FICA tax?15 julho 2024

What is FICA tax?15 julho 2024 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays15 julho 2024

Federal Insurance Contributions Act (FICA): What It Is, Who Pays15 julho 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes15 julho 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes15 julho 2024 -

Do You Have To Pay Tax On Your Social Security Benefits?15 julho 2024

Do You Have To Pay Tax On Your Social Security Benefits?15 julho 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime15 julho 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime15 julho 2024 -

What is the FICA Tax Refund? - Boundless15 julho 2024

What is the FICA Tax Refund? - Boundless15 julho 2024 -

.jpg) What is FICA tax? Understanding FICA for small business15 julho 2024

What is FICA tax? Understanding FICA for small business15 julho 2024 -

2019 US Tax Season in Numbers for Sprintax Customers15 julho 2024

2019 US Tax Season in Numbers for Sprintax Customers15 julho 2024

você pode gostar

-

Quebra-cabeça Magnético Infantil, Quebra-cabeça Para Educação Infantil, Quadro De Doodle De Madeira, Cognição Geométrica De Meninos E Meninas, Brinquedos De Quebra-cabeça, Quebra-cabeças Interessantes De Desenho E Escrita, Jogos De Quebra-cabeça15 julho 2024

Quebra-cabeça Magnético Infantil, Quebra-cabeça Para Educação Infantil, Quadro De Doodle De Madeira, Cognição Geométrica De Meninos E Meninas, Brinquedos De Quebra-cabeça, Quebra-cabeças Interessantes De Desenho E Escrita, Jogos De Quebra-cabeça15 julho 2024 -

Aulas de xadrez engajam estudantes que vão confeccionar seus próprios tabuleiros15 julho 2024

Aulas de xadrez engajam estudantes que vão confeccionar seus próprios tabuleiros15 julho 2024 -

SENTRY LOCKING STORAGE DASH - DoubleTake® - Club Car® DS – GOLF15 julho 2024

SENTRY LOCKING STORAGE DASH - DoubleTake® - Club Car® DS – GOLF15 julho 2024 -

Pirate Cove, Five Nights at Freddy's Wiki15 julho 2024

Pirate Cove, Five Nights at Freddy's Wiki15 julho 2024 -

Quebra-cabeça (puzzle) 26 Peças Alfabeto Do A Ao Z15 julho 2024

Quebra-cabeça (puzzle) 26 Peças Alfabeto Do A Ao Z15 julho 2024 -

W888 RTH RTH Lubbers Scania R380 Higline wagon & drag cran…15 julho 2024

W888 RTH RTH Lubbers Scania R380 Higline wagon & drag cran…15 julho 2024 -

Filtro Hidráulico Colheitadeira 2454D Escavadeira Hidráulica15 julho 2024

Filtro Hidráulico Colheitadeira 2454D Escavadeira Hidráulica15 julho 2024 -

O que é e como usar o Pokémon Home - Canaltech15 julho 2024

O que é e como usar o Pokémon Home - Canaltech15 julho 2024 -

Game Home, Free online games and video15 julho 2024

Game Home, Free online games and video15 julho 2024 -

The Late Shift: Who's Poised to Be the Next King (or Queen) of Nighttime Talk?15 julho 2024

The Late Shift: Who's Poised to Be the Next King (or Queen) of Nighttime Talk?15 julho 2024