Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 21 março 2025

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

How US citizens and Green Card holders living in India can file tax - The Economic Times

Double Taxation Agreements

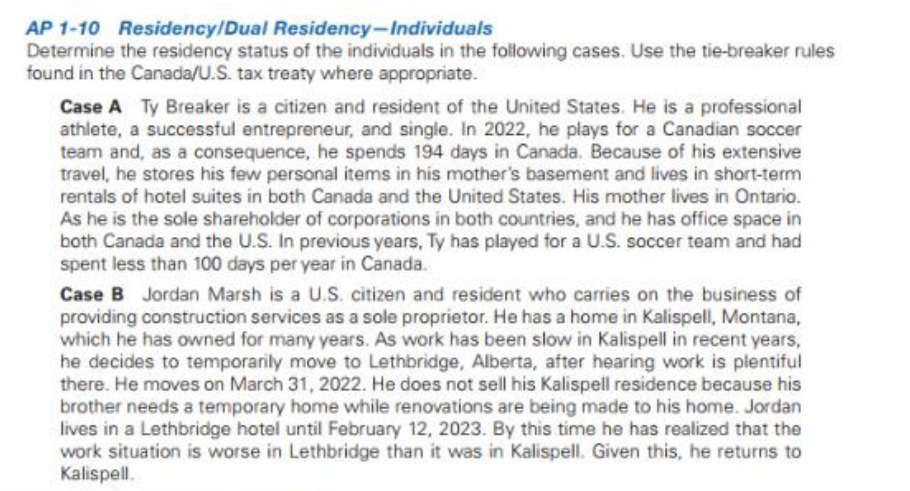

Solved P1-10 Residency/Dual Residency-Individuals etermine

Article 4(2) - Tie breaker Rule in case of an individual - +91-9667714335

Residency Tie Breaker Rules & Relevance

Who Claims A Child On Taxes When There Is Shared Custody?

Non-US Citizens: How to Avoid Becoming a Tax Resident in the US

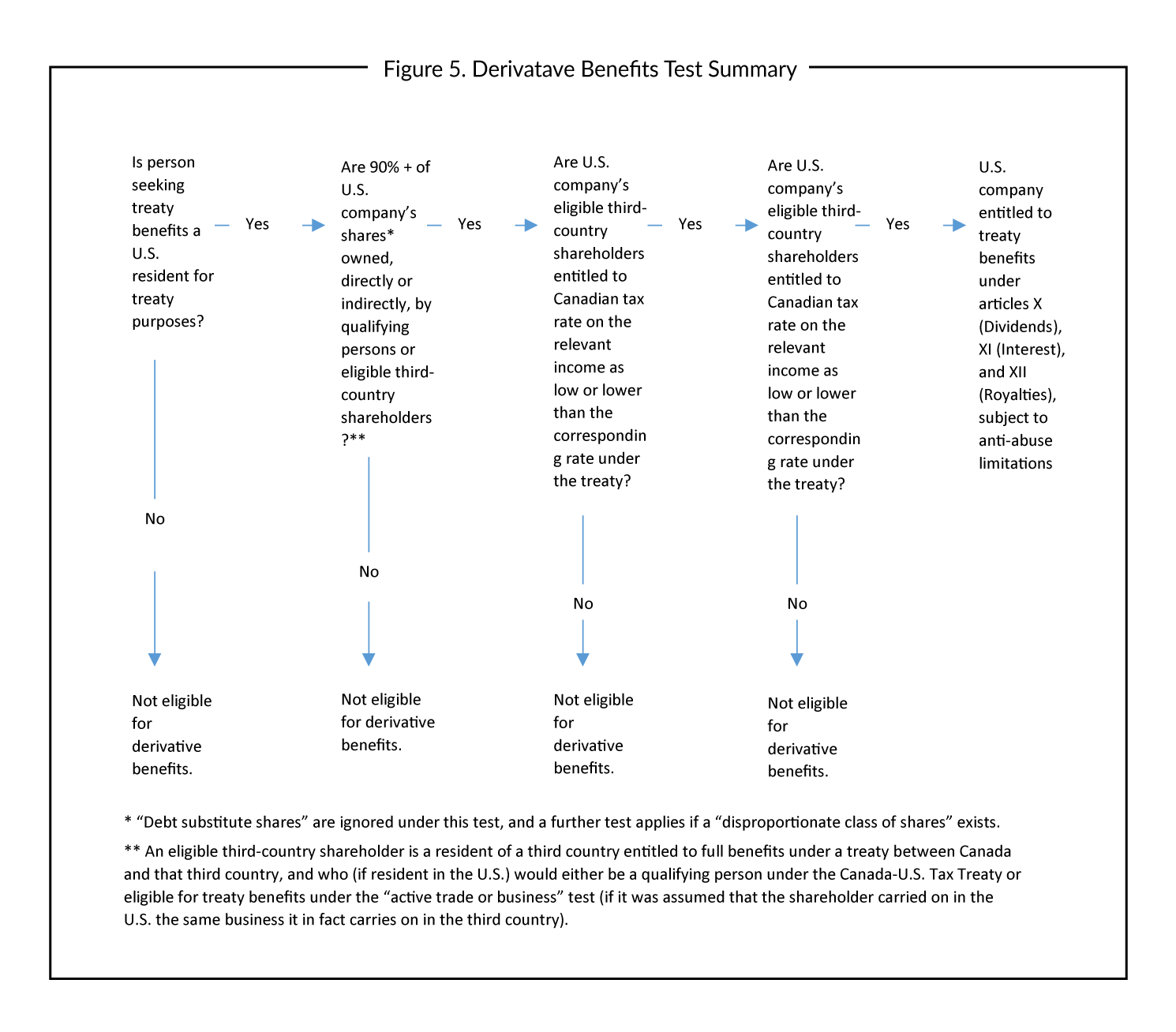

Tax Treaties Business Tax Canada

How To Handle Dual Residents: IRS Tiebreakers

Closer Connection Test or a Treaty Tie-Breaker Provision

The Evolving Global Mobility Landscape Tax Considerations

Navigating Tax Treaties: Insights from IRS Publication 519 - FasterCapital

Tax guide for American expats in the UK

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

Updated guidance on tax treaties and the impact of the COVID-19 crisis - OECD

Recomendado para você

-

General Knowledge Tiebreaker Questions21 março 2025

General Knowledge Tiebreaker Questions21 março 2025 -

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event21 março 2025

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event21 março 2025 -

How to Play a Tiebreaker in Tennis - Tennis Blog21 março 2025

How to Play a Tiebreaker in Tennis - Tennis Blog21 março 2025 -

Tiebreaker - Anywhere But Here (Official video)21 março 2025

Tiebreaker - Anywhere But Here (Official video)21 março 2025 -

Tie breaker baby baby announcement Third baby announcements, New baby products, Baby announcement to husband21 março 2025

Tie breaker baby baby announcement Third baby announcements, New baby products, Baby announcement to husband21 março 2025 -

ADC Tie Breaker CQC Knife Kit DE - Gunmetal/Red21 março 2025

ADC Tie Breaker CQC Knife Kit DE - Gunmetal/Red21 março 2025 -

Premium Tie Breaker - Product Detail Page21 março 2025

Premium Tie Breaker - Product Detail Page21 março 2025 -

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker21 março 2025

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker21 março 2025 -

How Does the Express Entry Tie Breaker Rule Work?21 março 2025

How Does the Express Entry Tie Breaker Rule Work?21 março 2025 -

The Head And The Heart Shares New Single “Tiebreaker21 março 2025

The Head And The Heart Shares New Single “Tiebreaker21 março 2025

você pode gostar

-

Novo visual e trailer do 2º cour de Shokugeki no Souma 321 março 2025

Novo visual e trailer do 2º cour de Shokugeki no Souma 321 março 2025 -

Free Coop Puzzle Games? : r/CoOpGaming21 março 2025

Free Coop Puzzle Games? : r/CoOpGaming21 março 2025 -

MO962 Moto Metal21 março 2025

MO962 Moto Metal21 março 2025 -

Pega em flagrante, Agatha tenta reverter situação, mas leva xeque21 março 2025

Pega em flagrante, Agatha tenta reverter situação, mas leva xeque21 março 2025 -

Top 10 Free Telegram Bots to Download Movies & TV Series21 março 2025

Top 10 Free Telegram Bots to Download Movies & TV Series21 março 2025 -

The Harry Potter 3D Experience Movie Pack PS3 bundle21 março 2025

The Harry Potter 3D Experience Movie Pack PS3 bundle21 março 2025 -

Pokemon Scarlet and Violet Shiny Slowpoke 6IV-EV Trained21 março 2025

Pokemon Scarlet and Violet Shiny Slowpoke 6IV-EV Trained21 março 2025 -

Sekai Saikou no Ansatsusha terá uma segunda temporada - Anime United21 março 2025

Sekai Saikou no Ansatsusha terá uma segunda temporada - Anime United21 março 2025 -

Southern Anteater (Tamandua tetradactyla) in defensive posture21 março 2025

Southern Anteater (Tamandua tetradactyla) in defensive posture21 março 2025 -

El Club Atlético Independiente listo para la vuelta de las semifinales de la Copa Centroamericana 202321 março 2025

El Club Atlético Independiente listo para la vuelta de las semifinales de la Copa Centroamericana 202321 março 2025