Sustainability, Free Full-Text

Por um escritor misterioso

Last updated 21 março 2025

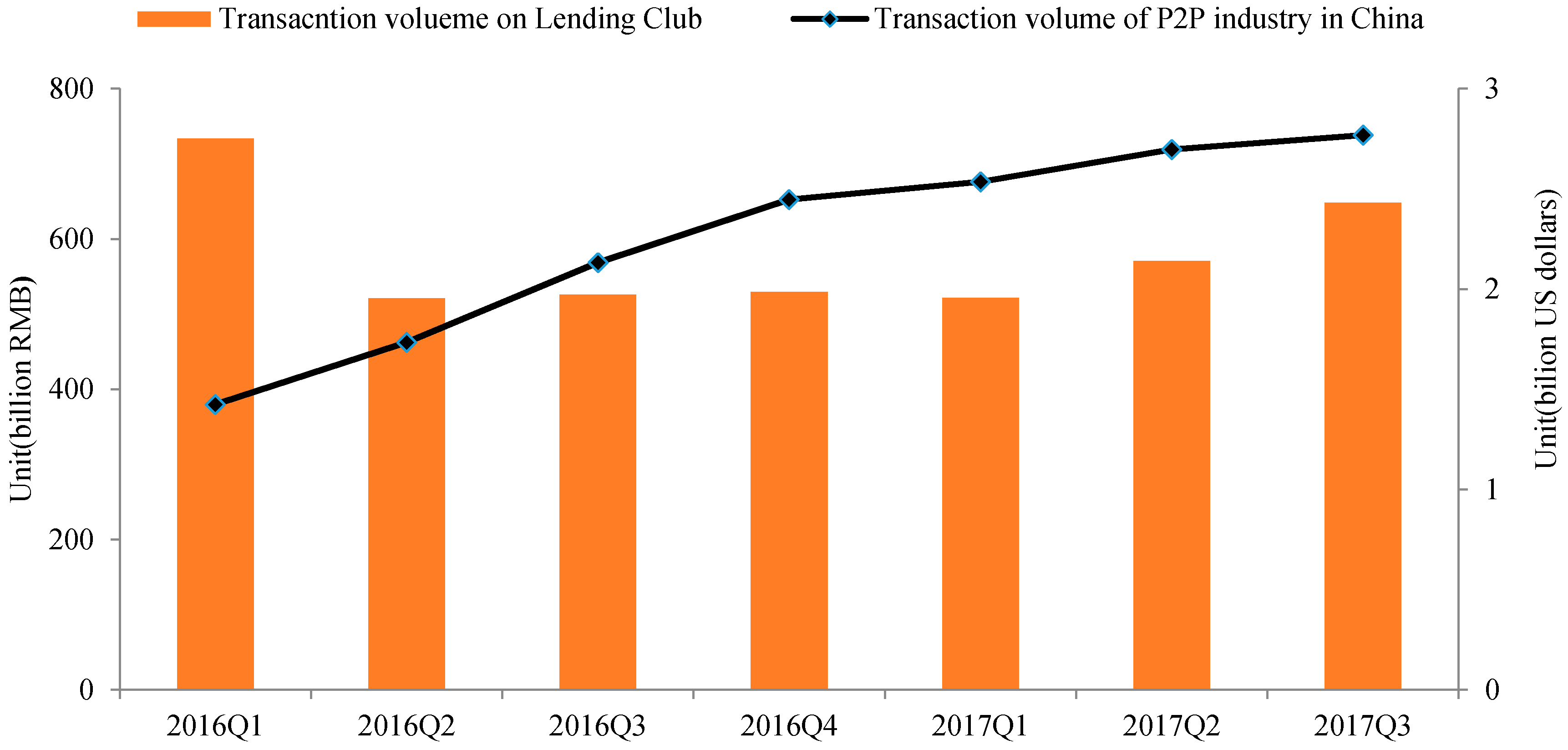

In this paper we intend to check the performance of Peer-to-Peer online lending platforms in China. Different from commercial banks, Peer-to-Peer (P2P) platforms’ business process is divided into the market-expanding stage and the risk-managing stage. In the market-expanding stage, platforms are intended to help borrowers attain more money, and in the risk-managing stage, platforms try their best to ensure that the lenders’ money is repaid on time. Thus, with a sample of 66 leading big P2P platforms, and a novel two-stage slacks-based measure data envelopment analysis with non-cooperative game, the performance efficiency of each stage as well as the comprehensive efficiency are evaluated. The results show that the leading big platforms are good at managing the risk, although risk management is not the major concern of most P2P platforms in China. We also find that average performance efficiency of the platforms that are located in non-first tier cities is higher than that in first tier cities. This unexpected result indicates that development of the P2P industry may relieve the severe distortion of resource allocation and efficiency loss arising from unbalanced regional development. Then dividing the platforms into different groups according to different types of ownership, we verify that performance efficiency of the P2P platforms from the state-owned enterprise group is in a dominant position, and the robustness check indicates that the major advantage of the state-owned enterprise (SOE) group mainly lies in the risk management. We also make a further study to figure out the sources of inefficiency, finding that it mainly arises from the shortage of lenders, the lack of average borrowing balance, and the insufficient transparency of information disclosure. In the last section we conclude our research and propose some advice.

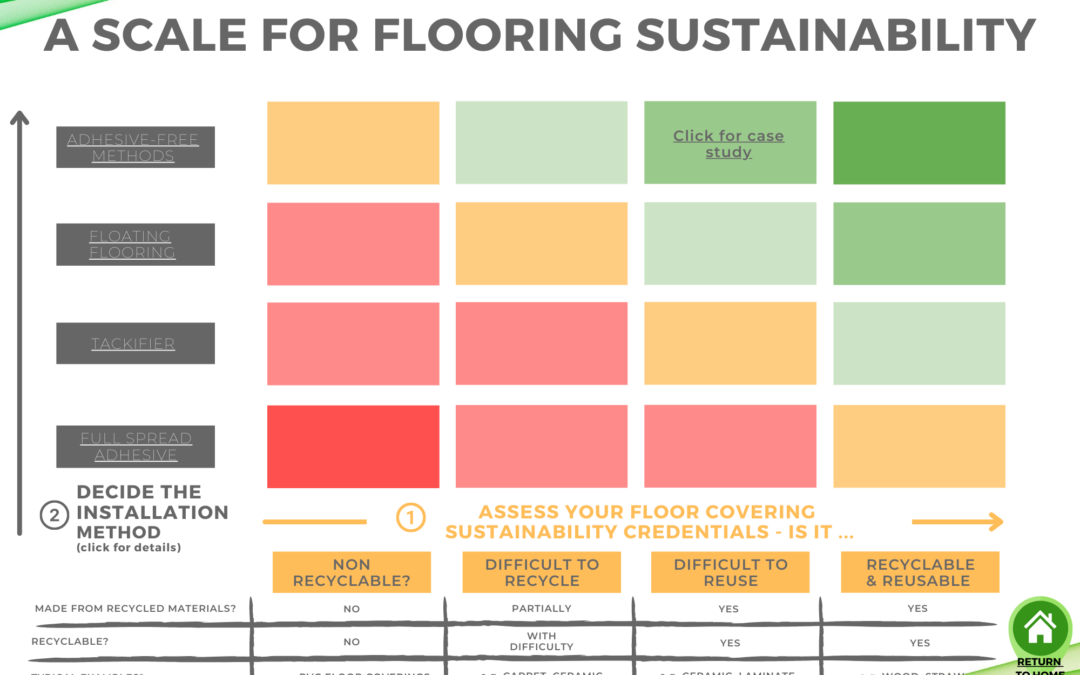

ARTICLE: IOBAC launch Scale for Flooring Sustainability - IOBAC

Sustainability, Free Full-Text, Train-Induced Building Vibration and Radiated Noise by Considering S…

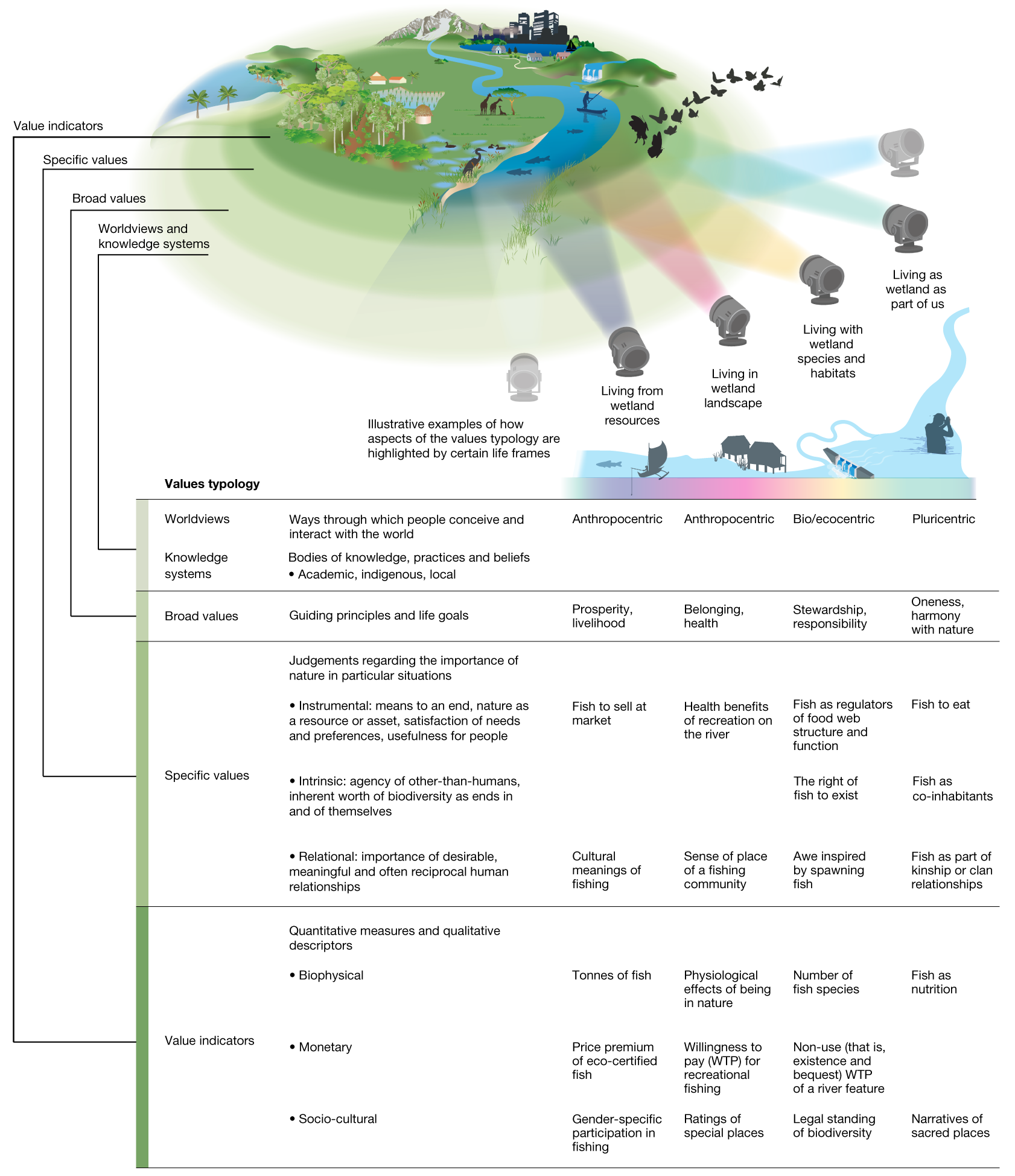

Diverse values of nature for sustainability

Premium Photo Abstract 3d leaves forming sustainability text on white background, creative eco environment innovation, clean sustainable energy industrial business trend

PDF] Sustainability by Maurie J. Cohen eBook

Sustainable business model for climate finance. Key drivers for the commercial banking sector - ScienceDirect

Sustainability Word Cloud Concept. Vector Illustration Royalty Free SVG, Cliparts, Vectors, and Stock Illustration. Image 35845895.

Saint Mary's College Sustainability

Sustainability, Free Full-Text

Recomendado para você

-

Codigo secreto do seu celular 😱🚨 #dicas #dicas_utilidades21 março 2025

Codigo secreto do seu celular 😱🚨 #dicas #dicas_utilidades21 março 2025 -

Yarichin Bitch Club, Vol. 5 (Yaoi Manga) See more21 março 2025

Yarichin Bitch Club, Vol. 5 (Yaoi Manga) See more21 março 2025 -

Batman, Vol. 5: The Rules of Engagement by Tom King21 março 2025

Batman, Vol. 5: The Rules of Engagement by Tom King21 março 2025 -

Pokémon Omega Ruby & Alpha Sapphire, Vol. 121 março 2025

Pokémon Omega Ruby & Alpha Sapphire, Vol. 121 março 2025 -

Related Review: Pretty Boy Detective Club~ The Dark Star that21 março 2025

Related Review: Pretty Boy Detective Club~ The Dark Star that21 março 2025 -

New Era Atlanta Braves Aux Pack Vol 2 40th Anniversary Patch21 março 2025

New Era Atlanta Braves Aux Pack Vol 2 40th Anniversary Patch21 março 2025 -

BATMAN AND ROBIN VOL. 4: REQUIEM FOR DAMIAN21 março 2025

BATMAN AND ROBIN VOL. 4: REQUIEM FOR DAMIAN21 março 2025 -

Pokémon Omega Ruby & Alpha Sapphire, Vol. 3 (3)21 março 2025

Pokémon Omega Ruby & Alpha Sapphire, Vol. 3 (3)21 março 2025 -

PDF) Understanding the factors affecting consumers' continuance21 março 2025

PDF) Understanding the factors affecting consumers' continuance21 março 2025 -

L'Oreal Paris Voluminous Original Washable Volume Building Mascara21 março 2025

L'Oreal Paris Voluminous Original Washable Volume Building Mascara21 março 2025

você pode gostar

-

Sad Boy21 março 2025

-

Five Nights at Freddy's' Domestic Box Office Aims to Break21 março 2025

Five Nights at Freddy's' Domestic Box Office Aims to Break21 março 2025 -

Naruto Shippuden - Todos os filmes e OVAs em ordem cronológica21 março 2025

Naruto Shippuden - Todos os filmes e OVAs em ordem cronológica21 março 2025 -

Dinossauros para colorir 193 – – Desenhos para Colorir21 março 2025

Dinossauros para colorir 193 – – Desenhos para Colorir21 março 2025 -

New Mutants Casting Call - New Mutants - Comic Vine21 março 2025

New Mutants Casting Call - New Mutants - Comic Vine21 março 2025 -

Classic Anime Tv Series Movie One Punch Man Cartoon Posters Canvas Painting Wall Art Prints Pictures For Living Room Home Decor - Painting & Calligraphy - AliExpress21 março 2025

Classic Anime Tv Series Movie One Punch Man Cartoon Posters Canvas Painting Wall Art Prints Pictures For Living Room Home Decor - Painting & Calligraphy - AliExpress21 março 2025 -

Assistir Pokémon Generations online - todas as temporadas21 março 2025

-

How To Escape The Depths In Deepwoken - Gamer Tweak21 março 2025

How To Escape The Depths In Deepwoken - Gamer Tweak21 março 2025 -

Lauryn Hill Quote: “I play my enemies like a game of chess.”21 março 2025

Lauryn Hill Quote: “I play my enemies like a game of chess.”21 março 2025 -

jogador de futebol desenhos - Pesquisa Google Soccer silhouette, Football players, Soccer players21 março 2025

jogador de futebol desenhos - Pesquisa Google Soccer silhouette, Football players, Soccer players21 março 2025