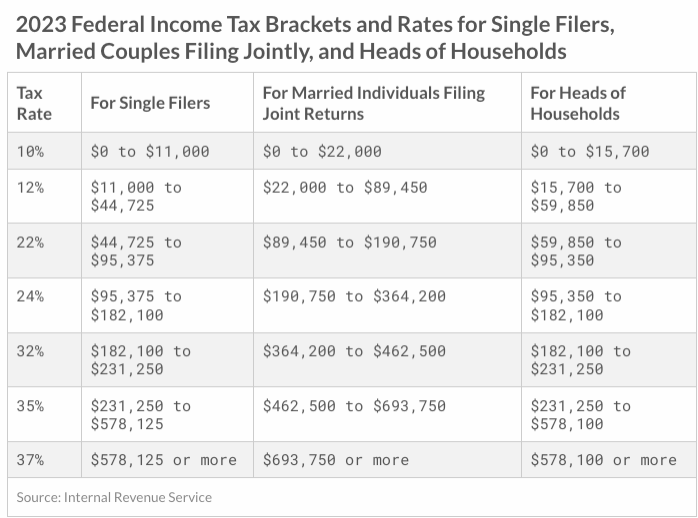

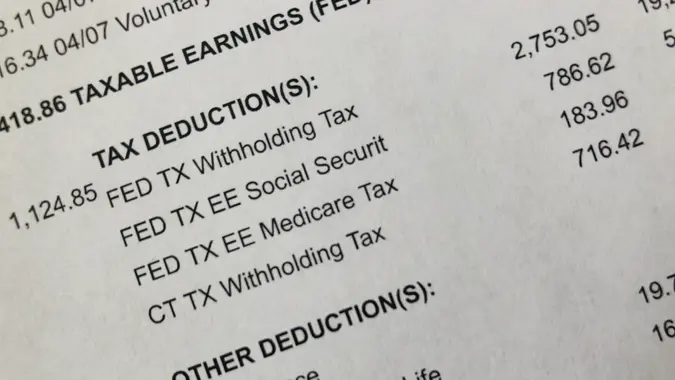

FICA explained: Social Security and Medicare tax rates to know in 2023

Por um escritor misterioso

Last updated 08 julho 2024

Overview of FICA Tax- Medicare & Social Security

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

What Is And How To Calculate FICA Taxes Explained, Social Security

What 8.7% Social Security COLA for 2023 means for taxes on benefits

Income Taxes: What You Need to Know - The New York Times

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

2023 Tax Brackets, Social Security Benefits Increase, and Other

Social Security COLA Increase for 2023: What You Need to Know

What is the FICA Tax? - 2023 - Robinhood

What is the FICA Tax and How Does it Connect to Social Security

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

How To Calculate, Find Social Security Tax Withholding - Social

FICA and Withholding: Everything You Need to Know - TurboTax Tax

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes08 julho 2024

Learn About FICA, Social Security, and Medicare Taxes08 julho 2024 -

What is FICA08 julho 2024

What is FICA08 julho 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks08 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks08 julho 2024 -

What Is the FICA Tax and Why Does It Exist? - TheStreet08 julho 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet08 julho 2024 -

FICA Tax Exemption for Nonresident Aliens Explained08 julho 2024

FICA Tax Exemption for Nonresident Aliens Explained08 julho 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand08 julho 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand08 julho 2024 -

What is the FICA Tax? - 2023 - Robinhood08 julho 2024

-

What Is FICA on a Paycheck? FICA Tax Explained - Chime08 julho 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime08 julho 2024 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax08 julho 2024

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax08 julho 2024 -

What Are FICA Taxes And Why Do They Matter? - Quikaid08 julho 2024

What Are FICA Taxes And Why Do They Matter? - Quikaid08 julho 2024

você pode gostar

-

Glenn Frey - News - IMDb08 julho 2024

Glenn Frey - News - IMDb08 julho 2024 -

Minato segurando a lâmina para colorir08 julho 2024

Minato segurando a lâmina para colorir08 julho 2024 -

Glitch and shadow {doors} by KittyFl00f on DeviantArt08 julho 2024

Glitch and shadow {doors} by KittyFl00f on DeviantArt08 julho 2024 -

What's your favorite Jojo's Bizarre Adventure pose?08 julho 2024

What's your favorite Jojo's Bizarre Adventure pose?08 julho 2024 -

Solarpunk ganha edição italiana – Blog da Editora Draco08 julho 2024

Solarpunk ganha edição italiana – Blog da Editora Draco08 julho 2024 -

Xiaomi 13 Pro vs iPhone 14 Pro: celular top da Xiaomi faz frente à Apple?08 julho 2024

-

caio_r_sim_eu_as_vezes_esqueco_de_mim_e_de_minha_fragil_l0gno6y.jpg08 julho 2024

caio_r_sim_eu_as_vezes_esqueco_de_mim_e_de_minha_fragil_l0gno6y.jpg08 julho 2024 -

Adaptada de Parlebas 9 Download Scientific Diagram08 julho 2024

Adaptada de Parlebas 9 Download Scientific Diagram08 julho 2024 -

JBX9001 on X: So I stopped by the Super Mario Wiki to see if they had a page for the Super Mario RPG remake, and noticed something particular of interest; Square Enix08 julho 2024

JBX9001 on X: So I stopped by the Super Mario Wiki to see if they had a page for the Super Mario RPG remake, and noticed something particular of interest; Square Enix08 julho 2024 -

Final Fantasy XVI Has an 'Expansive' Skill Tree System Built for Unique Character Growth08 julho 2024

Final Fantasy XVI Has an 'Expansive' Skill Tree System Built for Unique Character Growth08 julho 2024