Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Last updated 25 março 2025

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

Marginal Federal Tax Rates on Labor Income: 1962 to 2028

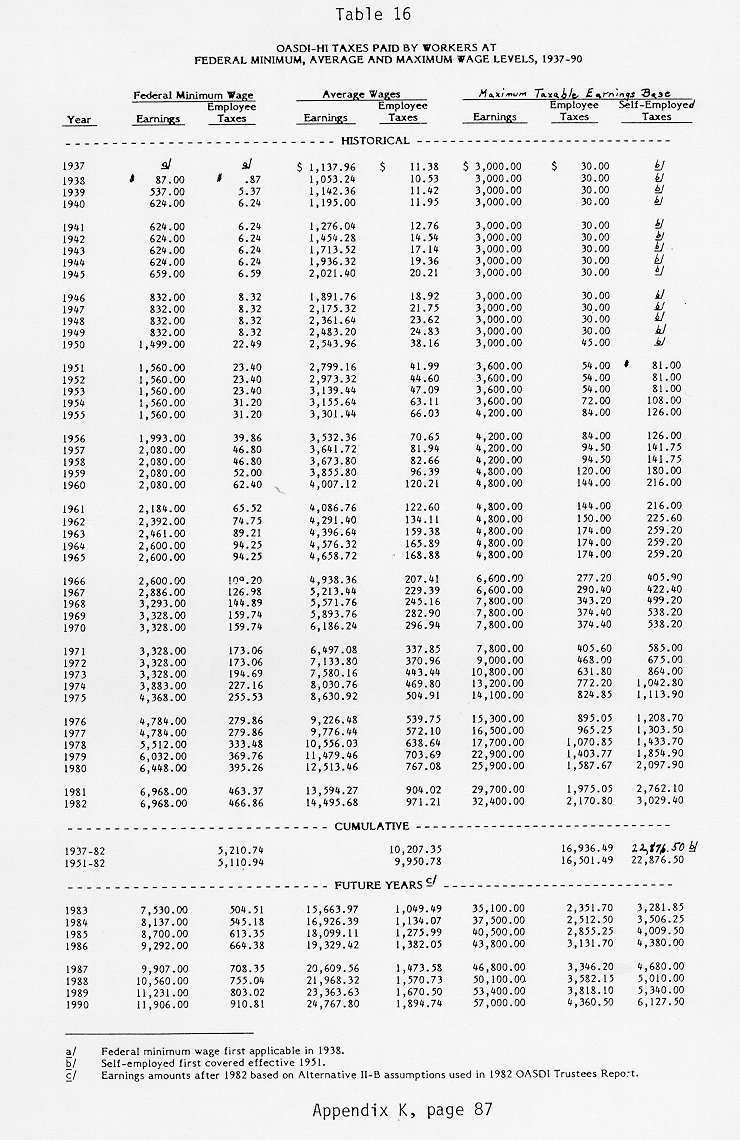

Social Security History

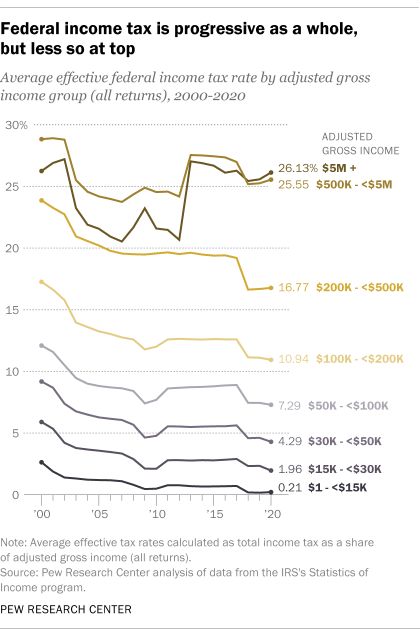

Who does and doesn't pay federal income tax in the U.S.

Research: Income Taxes on Social Security Benefits

Fast Facts & Figures About Social Security, 2020

Social Security COLA Increase for 2023: What You Need to Know - The New York Times

The ROI On Paying Social Security FICA Taxes

The Distribution of Household Income, 2019

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

Timeline of Key Events in the History of Social Security

What are FICA Taxes? 2022-2023 Rates and Instructions

Why Is Social Security Regressive?

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog25 março 2025

-

What are FICA Taxes? 2022-2023 Rates and Instructions25 março 2025

-

FICA Tax: What It is and How to Calculate It25 março 2025

FICA Tax: What It is and How to Calculate It25 março 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)25 março 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)25 março 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand25 março 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand25 março 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?25 março 2025

Do You Have To Pay Tax On Your Social Security Benefits?25 março 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and25 março 2025

-

How Do I Get a FICA Tax Refund for F1 Students?25 março 2025

How Do I Get a FICA Tax Refund for F1 Students?25 março 2025 -

2017 FICA Tax: What You Need to Know25 março 2025

2017 FICA Tax: What You Need to Know25 março 2025 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books25 março 2025

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books25 março 2025

você pode gostar

-

Where was The Mandalorian season 3 shot? Filming locations explored25 março 2025

Where was The Mandalorian season 3 shot? Filming locations explored25 março 2025 -

Quem é o melhor jogador da história? Perguntamos pra 100 pessoas25 março 2025

Quem é o melhor jogador da história? Perguntamos pra 100 pessoas25 março 2025 -

Ludopedia, Fórum, Bode of War - Regras para 2 Jogadores e Sorteio de um jogo25 março 2025

Ludopedia, Fórum, Bode of War - Regras para 2 Jogadores e Sorteio de um jogo25 março 2025 -

Budujemy kurnik krok po kroku Las Książek25 março 2025

Budujemy kurnik krok po kroku Las Książek25 março 2025 -

Code Project New World mới nhất tháng 12/2023, hướng dẫn nhập code25 março 2025

Code Project New World mới nhất tháng 12/2023, hướng dẫn nhập code25 março 2025 -

Campeonato Uruguayo, Wiki25 março 2025

Campeonato Uruguayo, Wiki25 março 2025 -

Lei recém aprovada permite que cidades brasileiras sejam pulverizadas por veneno jogado de aviões25 março 2025

Lei recém aprovada permite que cidades brasileiras sejam pulverizadas por veneno jogado de aviões25 março 2025 -

Roblox Ao Vivo em Diadema25 março 2025

Roblox Ao Vivo em Diadema25 março 2025 -

2023 Suzuki Intruder M1800R : Price, Images, Specs & Reviews25 março 2025

2023 Suzuki Intruder M1800R : Price, Images, Specs & Reviews25 março 2025 -

Create Teams on Quizizz – Help Center25 março 2025