Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 25 março 2025

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

Credit for Employer Social Security and

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

The FICA Tax: How Social Security Is Funded – Social Security

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

FICA Tax Exemption for Nonresident Aliens Explained

Maximum Taxable Income Amount For Social Security Tax (FICA)

Social Security (United States) - Wikipedia

2019 Payroll Taxes Will Hit Higher Incomes

2021 Wage Cap Rises for Social Security Payroll Taxes

Social Security and Medicare • Teacher Guide

Recomendado para você

-

Social Security Administration - “What is FICA on my paycheck?” Find out25 março 2025

-

What are FICA Tax Payable? – SuperfastCPA CPA Review25 março 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review25 março 2025 -

FICA Refund: How to claim it on your 1040 Tax Return?25 março 2025

FICA Refund: How to claim it on your 1040 Tax Return?25 março 2025 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents25 março 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents25 março 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime25 março 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime25 março 2025 -

What Is FICA Tax?25 março 2025

What Is FICA Tax?25 março 2025 -

What is the FICA Tax Refund? - Boundless25 março 2025

What is the FICA Tax Refund? - Boundless25 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?25 março 2025

How Do I Get a FICA Tax Refund for F1 Students?25 março 2025 -

2019 US Tax Season in Numbers for Sprintax Customers25 março 2025

2019 US Tax Season in Numbers for Sprintax Customers25 março 2025 -

FICA Tax Tip Fairness Pro Beauty Association25 março 2025

FICA Tax Tip Fairness Pro Beauty Association25 março 2025

você pode gostar

-

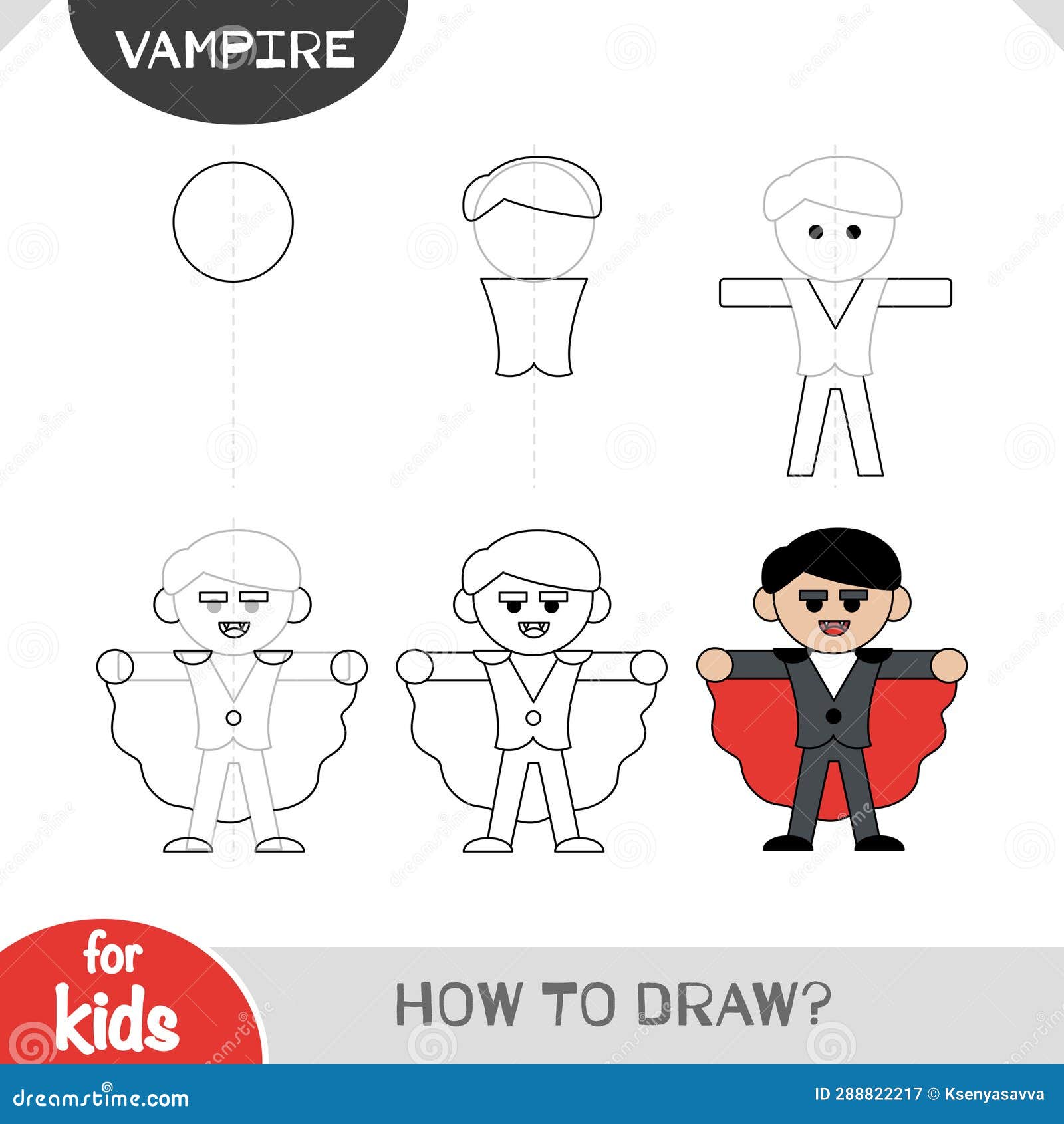

Como Desenhar Vampiro Para Crianças. Tutorial De Desenho Passo a Passo Ilustração do Vetor - Ilustração de kindergarten, tutorial: 28882221725 março 2025

Como Desenhar Vampiro Para Crianças. Tutorial De Desenho Passo a Passo Ilustração do Vetor - Ilustração de kindergarten, tutorial: 28882221725 março 2025 -

Apartment Confort ! Climatisation Carcassonne, France - book now, 2023 prices25 março 2025

-

Piano Vampire: albums, songs, playlists25 março 2025

Piano Vampire: albums, songs, playlists25 março 2025 -

Dubai becomes the host for the inaugural edition of the Global Chess League - Hindustan Times25 março 2025

Dubai becomes the host for the inaugural edition of the Global Chess League - Hindustan Times25 março 2025 -

Quanto o Atlético garantiu com premiação no Campeonato Brasileiro? - Superesportes25 março 2025

Quanto o Atlético garantiu com premiação no Campeonato Brasileiro? - Superesportes25 março 2025 -

✨Maddy Morphosis✨ on X: Biggie Cheese could've written “Here comes the sun”, but the Beatles couldn't have written “Mr Boombastic” / X25 março 2025

✨Maddy Morphosis✨ on X: Biggie Cheese could've written “Here comes the sun”, but the Beatles couldn't have written “Mr Boombastic” / X25 março 2025 -

Football Italy - League Serie B BKT 2019-2020 / ( Empoli Football Club ) - Leonardo Mancuso Stock Photo - Alamy25 março 2025

Football Italy - League Serie B BKT 2019-2020 / ( Empoli Football Club ) - Leonardo Mancuso Stock Photo - Alamy25 março 2025 -

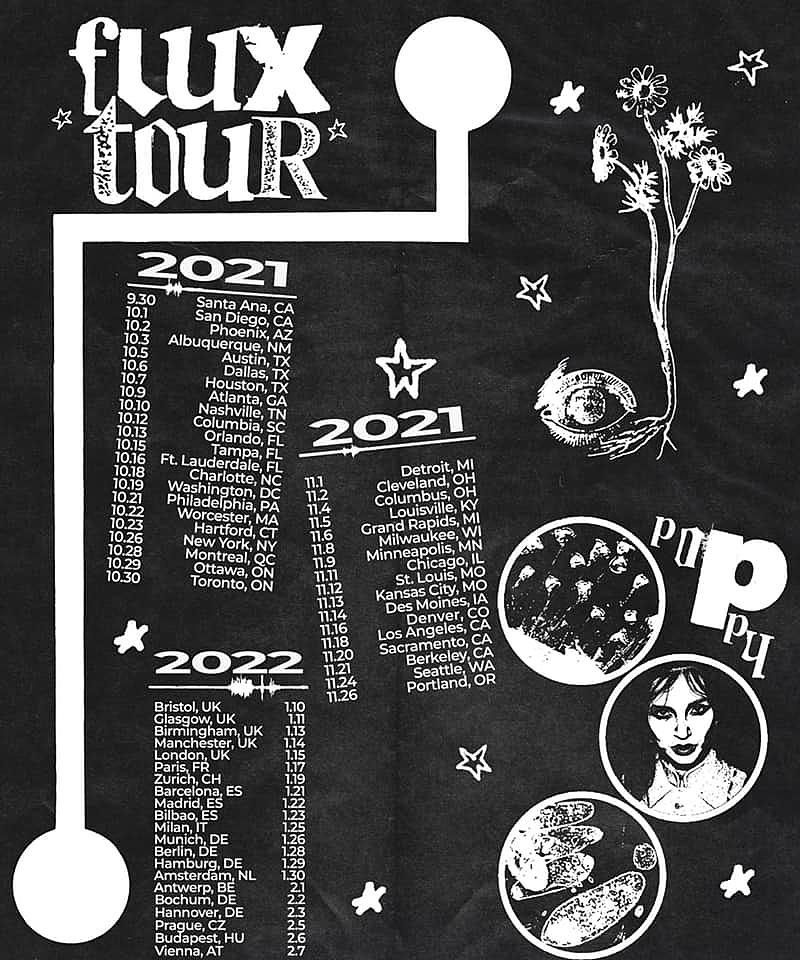

Poppy Announces Winter 2021 and 2022 Flux Tour Dates - mxdwn Music25 março 2025

Poppy Announces Winter 2021 and 2022 Flux Tour Dates - mxdwn Music25 março 2025 -

Minecraft: Story Mode The Complete Adventure - Xbox One | Xbox One | GameStop25 março 2025

-

Rickroll - Imgflip25 março 2025

Rickroll - Imgflip25 março 2025