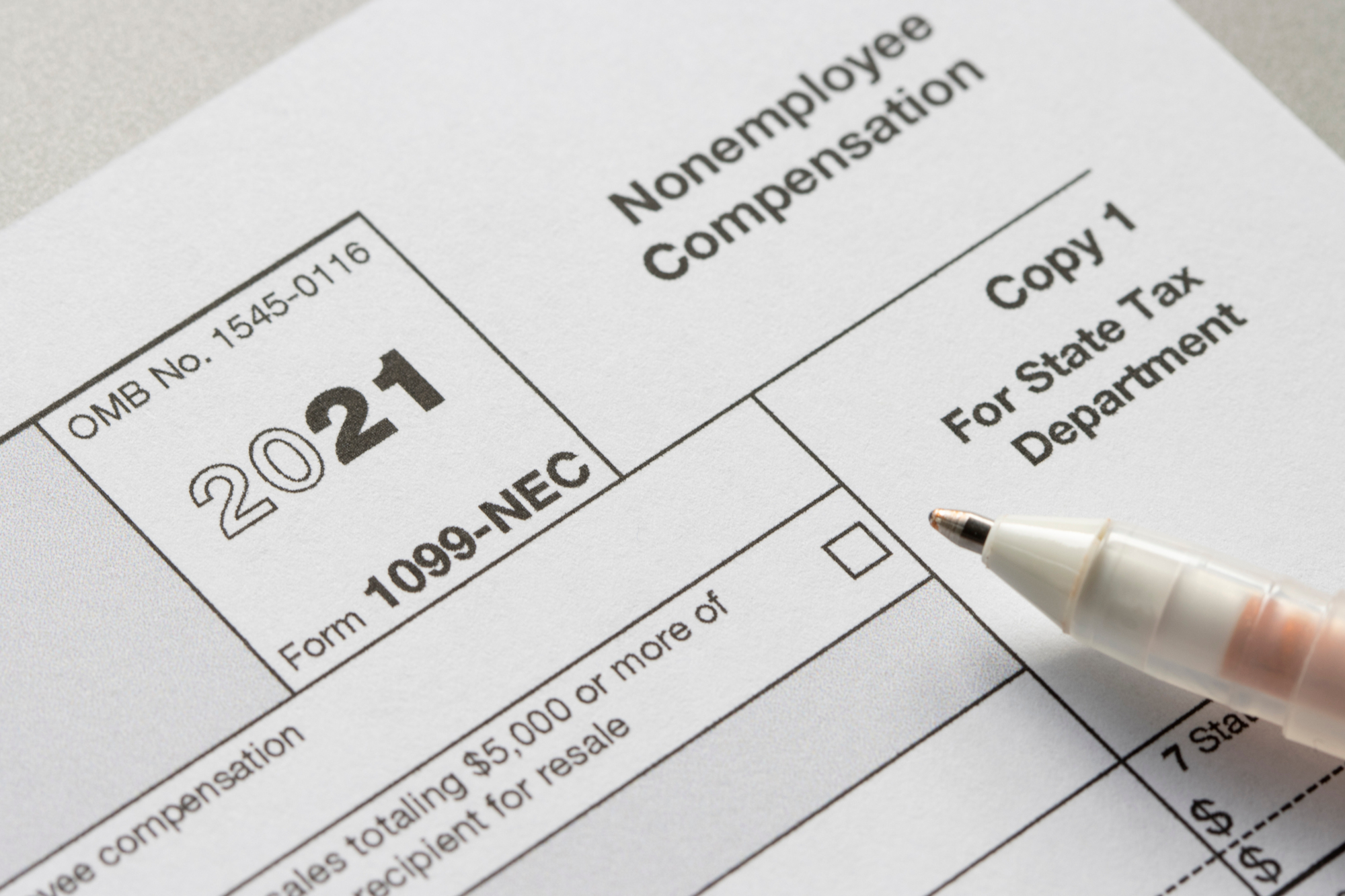

or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Last updated 25 novembro 2024

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

IRS delays $600 Form 1099-K threshold, plans to phase in compliance at $5,000

1099 c 2008

IRS $600 Reporting Rule: Here's What You Need To Know

1099-NEC: When You Should & Shouldn't Be Filing - Eric Nisall

new 600 dollar SALES threshold for IRS Reporting , - The Community

Form 1099-K - IRS Tax Changes and Business Accounts

IRS Suspends $600 Form 1099-K Reporting - What You Need to Know

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

NEW 1099-K $600 REPORTING THRESHHOLD: Facts and Myths

Jobber Payments and 1099-K – Jobber Help Center

Support recommendations and FAQ templates

Meet 1099-K: What to Know About Payment Apps at Tax Time

Recomendado para você

-

says open to accepting to cryptocurrencies in future25 novembro 2024

says open to accepting to cryptocurrencies in future25 novembro 2024 -

Could Announce Decision on Crypto Payments March 1025 novembro 2024

Could Announce Decision on Crypto Payments March 1025 novembro 2024 -

Import to25 novembro 2024

Import to25 novembro 2024 -

is launching an interactive live shopping platform25 novembro 2024

is launching an interactive live shopping platform25 novembro 2024 -

Business & Revenue Model Explained - InfoStride25 novembro 2024

Business & Revenue Model Explained - InfoStride25 novembro 2024 -

What To Expect From Stock?25 novembro 2024

What To Expect From Stock?25 novembro 2024 -

Open 202325 novembro 2024

Open 202325 novembro 2024 -

Magical Journey of Becoming Global E-Commerce Business Leader - weDevs25 novembro 2024

Magical Journey of Becoming Global E-Commerce Business Leader - weDevs25 novembro 2024 -

Home - The Community25 novembro 2024

-

DIY Takes Center-stage In 's Latest Pre-loved Product Push25 novembro 2024

DIY Takes Center-stage In 's Latest Pre-loved Product Push25 novembro 2024

você pode gostar

-

Desenho para colorir Boneca preta e branca · Creative Fabrica25 novembro 2024

Desenho para colorir Boneca preta e branca · Creative Fabrica25 novembro 2024 -

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2020/y/o/cfjIGTQ9ObsujVpoJdKA/p11.jpg) Como jogar Free Fire no PC com o emulador MEmu App Player25 novembro 2024

Como jogar Free Fire no PC com o emulador MEmu App Player25 novembro 2024 -

Jogo Tabuleiro Xadrez E Dama 2811 Presente Pais E Filhos - Jogo de25 novembro 2024

Jogo Tabuleiro Xadrez E Dama 2811 Presente Pais E Filhos - Jogo de25 novembro 2024 -

Bojji Icons Ilustrasi karakter, Gambar profil, Ilustrasi25 novembro 2024

Bojji Icons Ilustrasi karakter, Gambar profil, Ilustrasi25 novembro 2024 -

VSHOP Shockproof Crystal Clear for OnePlus Nord CE 2 Lite 5G Back Cover Case25 novembro 2024

VSHOP Shockproof Crystal Clear for OnePlus Nord CE 2 Lite 5G Back Cover Case25 novembro 2024 -

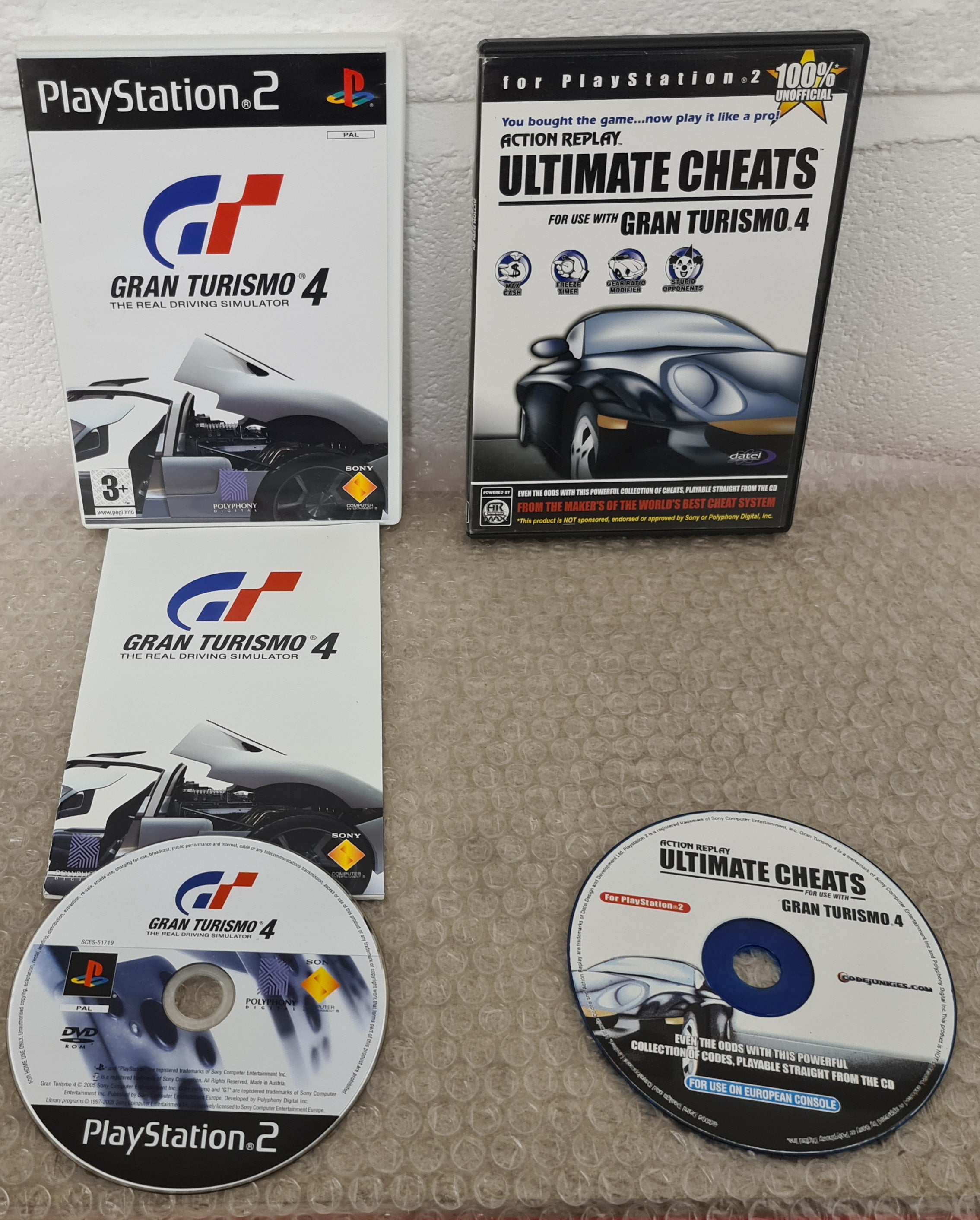

Gran Turismo 4 with Action Replay Ultimate Cheats Sony Playstation 2 ( – Retro Gamer Heaven25 novembro 2024

Gran Turismo 4 with Action Replay Ultimate Cheats Sony Playstation 2 ( – Retro Gamer Heaven25 novembro 2024 -

Why I'm driving around in the smallest, slowest car in Forza25 novembro 2024

Why I'm driving around in the smallest, slowest car in Forza25 novembro 2024 -

Logo Quiz Level 3 ▷ All the answers ☆25 novembro 2024

Logo Quiz Level 3 ▷ All the answers ☆25 novembro 2024 -

COMO GANAR a los 3 LÍDERES del TEAM GO ROCKET (SIERRA, ARLO y CLIFF) MUY FÁCILMENTE en POKEMON GO25 novembro 2024

COMO GANAR a los 3 LÍDERES del TEAM GO ROCKET (SIERRA, ARLO y CLIFF) MUY FÁCILMENTE en POKEMON GO25 novembro 2024 -

Premier League Handbook, Season 2019/20.25 novembro 2024

Premier League Handbook, Season 2019/20.25 novembro 2024