Tax Evasion: Meaning, Definition, and Penalties

Por um escritor misterioso

Last updated 23 março 2025

:max_bytes(150000):strip_icc()/taxevasion.asp_final-8be1e7bf4edc49d3add2ba8af2a2d521.png)

Tax evasion is an illegal practice where a person or entity intentionally does not pay due taxes.

SOLUTION: Tax evasion vs tax avoidance - Studypool

6 Determinants of Income Tax Evasion Role of Tax Rates, Shape of Tax Schedules, and Other Factors in: Supply-Side Tax Policy

A Guide to Tax Evasion Penalties in Hong Kong

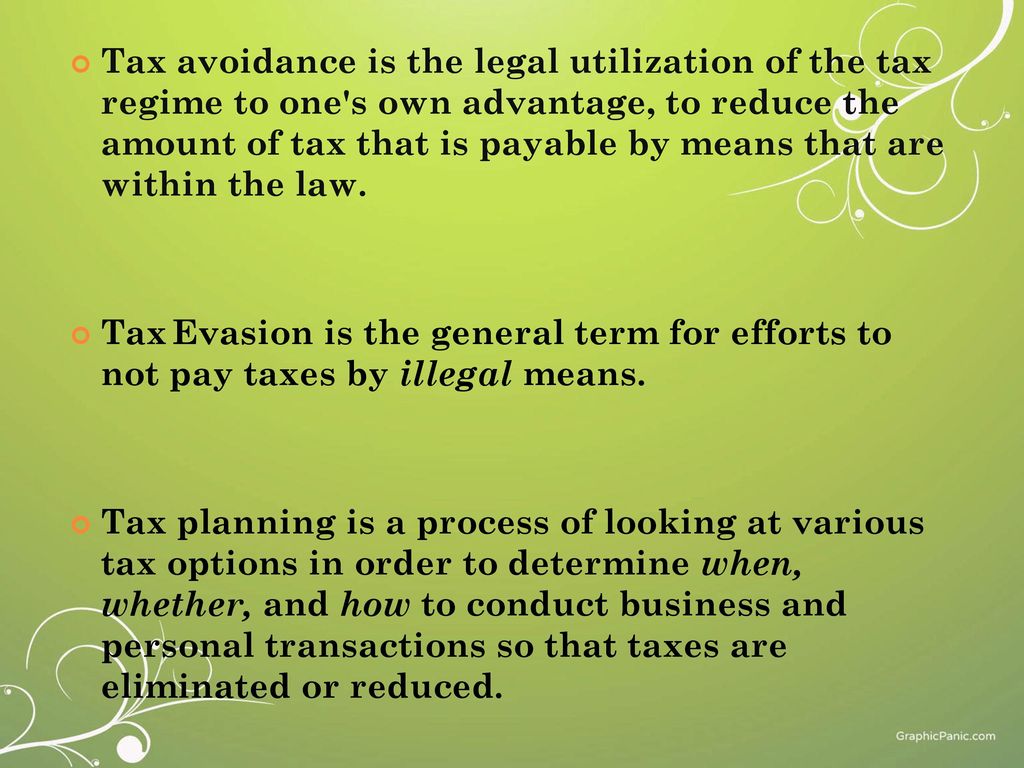

Difference Between Tax Planning

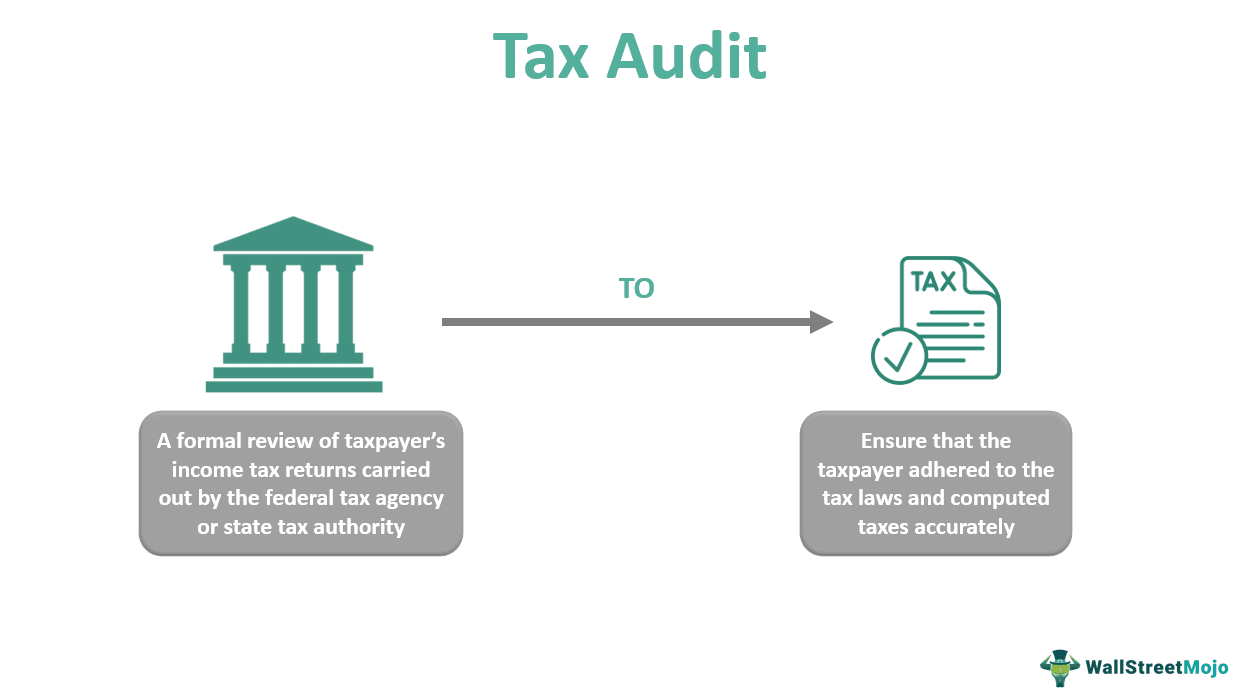

Tax Audit - What Is It, Types, Reasons, Example, Vs Statutory Audit

Tax Evasion vs. Tax Avoidance: What Are the Legal Risks? - Wampler & Passanise Criminal Defense Lawyers

What is the Difference Between Criminal Tax Penalties and Civil Tax Penalties?

What is Tax Evasion? The Law Firm of Lance R. Drury

Tax Evasion & Tax Avoidance: Definition, Comparison for Kids

Tax Avoidance & Tax Evasion. - ppt download

What is Tax Evasion? The Complete Guide

:max_bytes(150000):strip_icc()/95784802-5bfc2dcd46e0fb00260b8f26.jpg)

Tax Evasion: Meaning, Definition, and Penalties

Recomendado para você

-

Pay Re$pect Clothing Brand23 março 2025

Pay Re$pect Clothing Brand23 março 2025 -

Press F to Pay Respects: What Does F Mean Online?23 março 2025

Press F to Pay Respects: What Does F Mean Online?23 março 2025 -

:max_bytes(150000):strip_icc()/Contempt-court_final-428cf76a922241579e284031e50979d4.png) Contempt of Court: Definition, Essential Elements, and Example23 março 2025

Contempt of Court: Definition, Essential Elements, and Example23 março 2025 -

Why is press F to pay respects a thing? : r/OutOfTheLoop23 março 2025

Why is press F to pay respects a thing? : r/OutOfTheLoop23 março 2025 -

What does FRR mean in slang? - Quora23 março 2025

-

Online Terms, Slang and Acronyms you need to know // SMPerth23 março 2025

Online Terms, Slang and Acronyms you need to know // SMPerth23 março 2025 -

:max_bytes(150000):strip_icc()/financial-system_final-a9f735f765244e84829563e8a147abf2.jpg) Financial System: Definition, Types, and Market Components23 março 2025

Financial System: Definition, Types, and Market Components23 março 2025 -

F stands for friendzone?, Press F to Pay Respects23 março 2025

F stands for friendzone?, Press F to Pay Respects23 março 2025 -

What Is Brand Marketing? (Definition, Importance)23 março 2025

What Is Brand Marketing? (Definition, Importance)23 março 2025 -

Today is the Pigman's last day. Press F to pay respect for him in23 março 2025

Today is the Pigman's last day. Press F to pay respect for him in23 março 2025

você pode gostar

-

Forza Motorsport's latest update adds its first free DLC track23 março 2025

Forza Motorsport's latest update adds its first free DLC track23 março 2025 -

FIFA 18 Ultimate Team tips Your guide to earning more coins and23 março 2025

FIFA 18 Ultimate Team tips Your guide to earning more coins and23 março 2025 -

Toxic - Britney Spears - Cifra Club23 março 2025

Toxic - Britney Spears - Cifra Club23 março 2025 -

Am I practicing manga eyes the right way? : r/learnart23 março 2025

Am I practicing manga eyes the right way? : r/learnart23 março 2025 -

EA SPORTS FC on X: Daily Gifts are back in #FUT16! Log in to the Web or Companion App every day for a new gift. / X23 março 2025

EA SPORTS FC on X: Daily Gifts are back in #FUT16! Log in to the Web or Companion App every day for a new gift. / X23 março 2025 -

Como montar um salão de beleza em Curitiba - Attualize23 março 2025

Como montar um salão de beleza em Curitiba - Attualize23 março 2025 -

CHESSMASTER 4000 TURBO PC BIGBOX - Have you played a classic today?23 março 2025

CHESSMASTER 4000 TURBO PC BIGBOX - Have you played a classic today?23 março 2025 -

MAKE GPO GREAT AGAIN : r/GrandPieceOnline23 março 2025

MAKE GPO GREAT AGAIN : r/GrandPieceOnline23 março 2025 -

Code Vein - Xbox One : Bandai Namco Games Amer: Everything Else23 março 2025

Code Vein - Xbox One : Bandai Namco Games Amer: Everything Else23 março 2025 -

Prime Video: Ben 10: Alien Force - Season 323 março 2025

Prime Video: Ben 10: Alien Force - Season 323 março 2025