Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 25 março 2025

GST in India 2023 - Detailed Guide about Goods & Services Tax

:max_bytes(150000):strip_icc()/GoodsandServicesTax-36b9fbf71b1048a8ad617e0318af9c6b.jpg)

Goods and Services Tax (GST): Definition, Types, and How It's Calculated

What is GST in India? Tax Rates, Key Terms, and Concepts Explained - India Briefing News

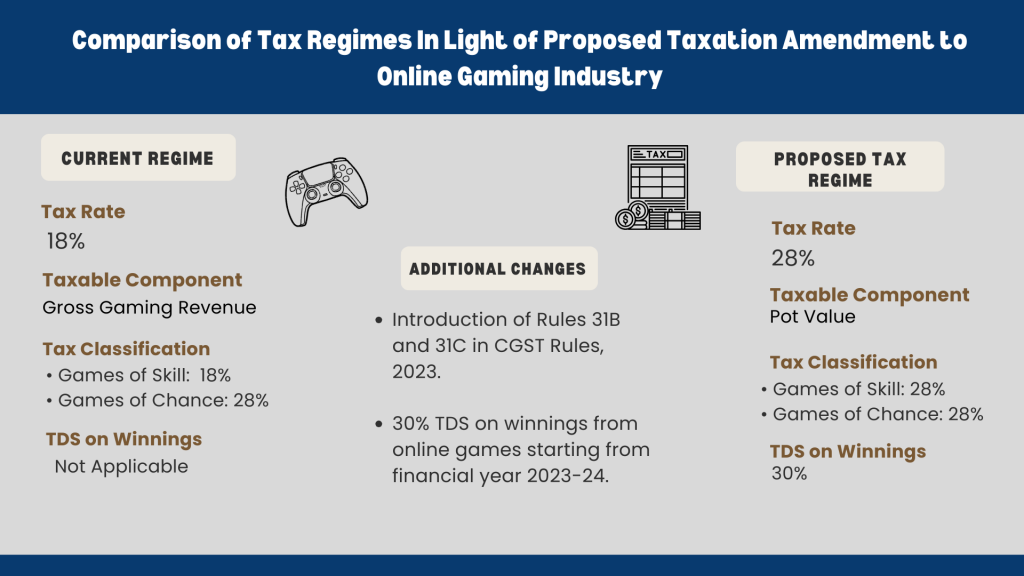

How The 28% GST On Online Gaming Will Influence The Development Of The Gaming Market In India

TAXING ONLINE GAMING: KILLING THE 'ACE' OF THE INDUSTRY? – Centre for Tax Laws

GST Council Meeting highlights: 28% GST rate on full value of online gaming seen as setback for Indian players

India's New Gaming Tax Plan Demands $12B From Online Operators

Online Games: Valuation & Classification of Service: GST Law of India

Taxability of Online Gaming under the GST Regime

gst: Online gaming companies plan to move court; term GST demand “retrospective” - The Economic Times

Goods and Services Tax on Metaverse Transactions in India

New tax regime on online money games kicks in

CBDT notifies CGST (Third Amendment) Rules, 2023

Recomendado para você

-

All in one Game, All Games – Apps no Google Play25 março 2025

-

Backgammon Legends Online - Apps on Google Play25 março 2025

-

The 25 best online games to play today25 março 2025

The 25 best online games to play today25 março 2025 -

10 Free Online Games to Teach Third Grade Math Skills - eSpark25 março 2025

10 Free Online Games to Teach Third Grade Math Skills - eSpark25 março 2025 -

7 traditional board games that you can play online25 março 2025

7 traditional board games that you can play online25 março 2025 -

11 Online Games For Virtual Gatherings, by Kevin Lin25 março 2025

11 Online Games For Virtual Gatherings, by Kevin Lin25 março 2025 -

Multiplayer Games Online 🕹️25 março 2025

Multiplayer Games Online 🕹️25 março 2025 -

10 Best Online Games In The World25 março 2025

10 Best Online Games In The World25 março 2025 -

Online Gaming Solution - CDNetworks25 março 2025

Online Gaming Solution - CDNetworks25 março 2025 -

Intramural Online Games Registration25 março 2025

Intramural Online Games Registration25 março 2025

você pode gostar

-

Kit para Pintura de UNHAS GO GLAM Nail Stamper + Daydream SUNNY – Starhouse Mega Store25 março 2025

Kit para Pintura de UNHAS GO GLAM Nail Stamper + Daydream SUNNY – Starhouse Mega Store25 março 2025 -

I Love You Gif Download Free @25 março 2025

I Love You Gif Download Free @25 março 2025 -

Digital Foundry: como Resident Evil 4 Remake roda nos consoles25 março 2025

Digital Foundry: como Resident Evil 4 Remake roda nos consoles25 março 2025 -

Red Dead Redemption: Game of the Year Edition - IGN25 março 2025

Red Dead Redemption: Game of the Year Edition - IGN25 março 2025 -

ONE piece WIKI25 março 2025

-

DIY VESTIDO ARLEQUINA (HARLEY QUINN CLUBE DRESS) 3 Formas25 março 2025

DIY VESTIDO ARLEQUINA (HARLEY QUINN CLUBE DRESS) 3 Formas25 março 2025 -

1500 Euro very high-end gaming pc. by TheToolofLight - AMD Ryzen 525 março 2025

1500 Euro very high-end gaming pc. by TheToolofLight - AMD Ryzen 525 março 2025 -

EmuOS: run retro games and apps right in your browser - gHacks Tech News25 março 2025

EmuOS: run retro games and apps right in your browser - gHacks Tech News25 março 2025 -

Game of Thrones Logo PNG vector in SVG, PDF, AI, CDR format25 março 2025

Game of Thrones Logo PNG vector in SVG, PDF, AI, CDR format25 março 2025 -

Vampire Hunter D (@VHDtheseries) / X25 março 2025

Vampire Hunter D (@VHDtheseries) / X25 março 2025