Cash App Taxes 2023 (Tax Year 2022) Review

Por um escritor misterioso

Last updated 26 novembro 2024

Cash App Taxes supports most IRS forms and schedules for federal and state returns, including Schedule C. It's the only service we've tested that doesn't cost a dime for preparation and filing, but it doesn't offer as much support as paid apps.

Free, comprehensive federal and state tax filing

Free, comprehensive federal and state tax filing

Cash App Taxes 2023 (Tax Year 2022) Review

Cash App Taxes 2023 (Tax Year 2022) Review

Cash App Taxes 2023 (Tax Year 2022) Review

When Are Taxes Due in 2022? – Forbes Advisor

Cash App Tax Review 2023, Tax Software

Cash App Income is Taxable; IRS Changes Rules in 2022

Cash App Review

How to Deduct Your Cell Phone Bill on Your Taxes

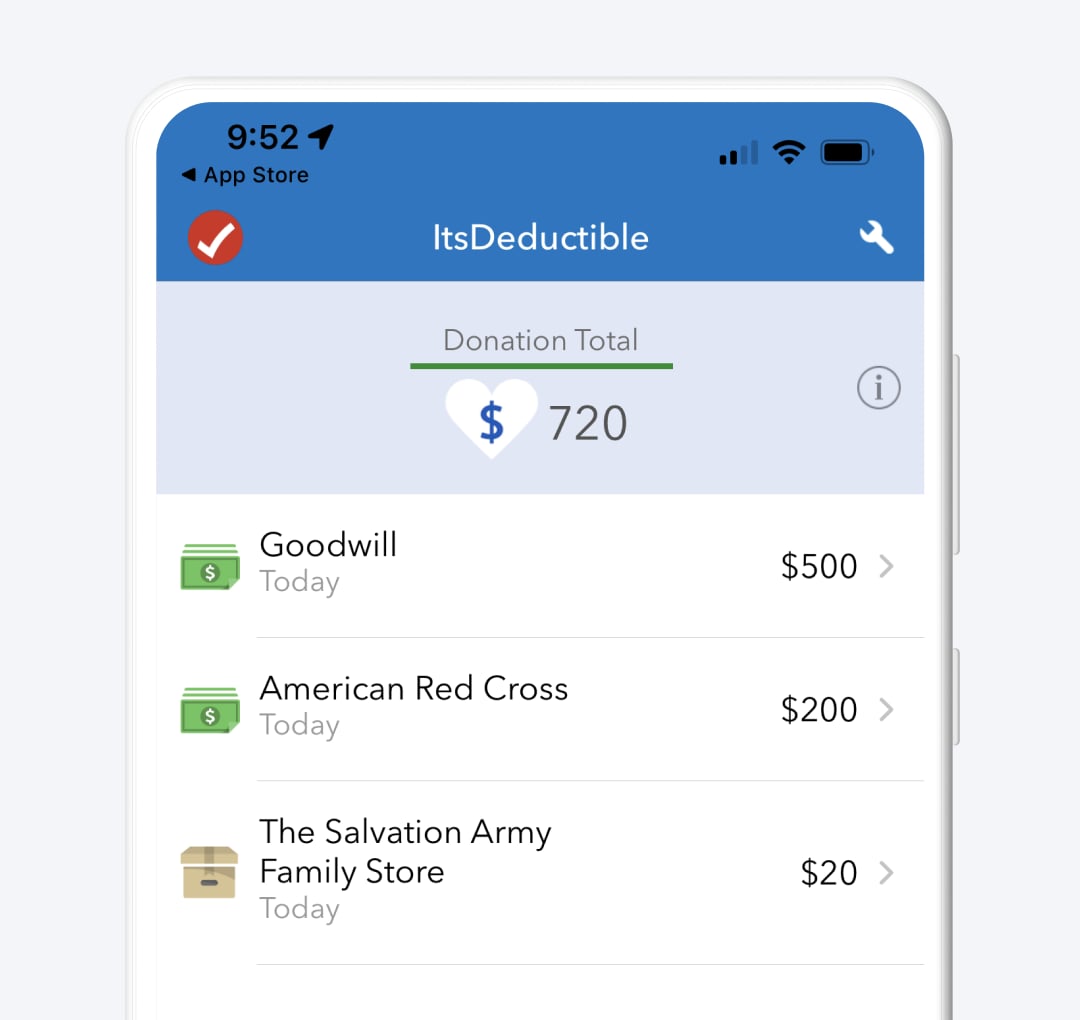

TurboTax® ItsDeductible - Track Charitable Donations for Tax Deductions

Royal Refunds

IRS: Americans Over $600 Threshold On Payment Apps Must Report It

Free Tax Calculators & Money Saving Tools 2023-2024

Cash App Taxes Review: Free Straightforward Preparation Service

Cash App on the App Store

Best Tax Software of January 2024

Recomendado para você

-

Roblox 101: How To Make Real Money From Your Video Games26 novembro 2024

Roblox 101: How To Make Real Money From Your Video Games26 novembro 2024 -

90% Marketplace Fee on Group Places - #22 by HilyrHere - Game Design Support - Developer Forum26 novembro 2024

90% Marketplace Fee on Group Places - #22 by HilyrHere - Game Design Support - Developer Forum26 novembro 2024 -

Game Thumbnail Tax Gamepass - Roblox26 novembro 2024

-

Petition · Lower the Roblox in-game taxes ·26 novembro 2024

Petition · Lower the Roblox in-game taxes ·26 novembro 2024 -

Tax System (Roblox Studio)26 novembro 2024

Tax System (Roblox Studio)26 novembro 2024 -

Turnip Boy Commits Tax Evasion joins PC Game Pass library26 novembro 2024

Turnip Boy Commits Tax Evasion joins PC Game Pass library26 novembro 2024 -

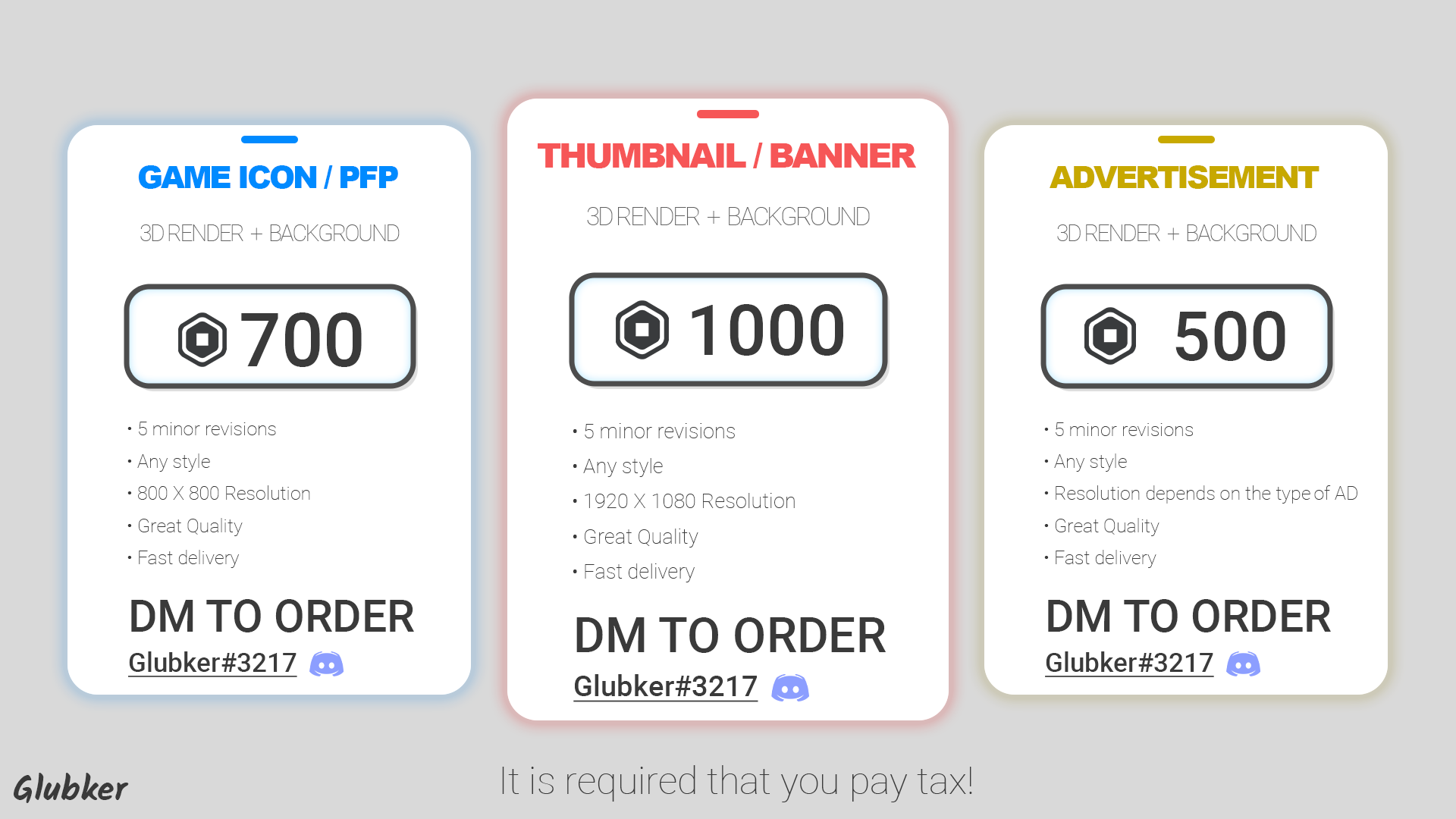

ROBLOX GFX Glubker's GFX Portfolio26 novembro 2024

ROBLOX GFX Glubker's GFX Portfolio26 novembro 2024 -

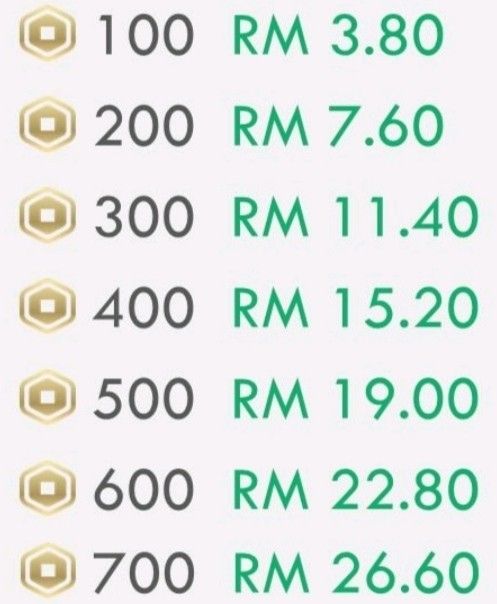

Robux Covered Tax Price 3.5k left, Video Gaming, Gaming Accessories, In-Game Products on Carousell26 novembro 2024

Robux Covered Tax Price 3.5k left, Video Gaming, Gaming Accessories, In-Game Products on Carousell26 novembro 2024 -

Liberty Tax 2023 (Tax Year 2022) Review26 novembro 2024

Liberty Tax 2023 (Tax Year 2022) Review26 novembro 2024 -

Robux Discounts26 novembro 2024

você pode gostar

-

TEM UMA MENINA ME COPIANDO NA CARA DURA MANO E AINDA FALA QUE FOI ELA26 novembro 2024

-

Jogos de Vestir - Joga Grátis Online26 novembro 2024

Jogos de Vestir - Joga Grátis Online26 novembro 2024 -

Moedas customizadas Rio 1808 (exclusividade da pré-venda) - Editora Vem pra Mesa Jogos26 novembro 2024

Moedas customizadas Rio 1808 (exclusividade da pré-venda) - Editora Vem pra Mesa Jogos26 novembro 2024 -

Standing here!… Ame realize!!!… : r/Hololive26 novembro 2024

Standing here!… Ame realize!!!… : r/Hololive26 novembro 2024 -

HD wallpaper: several animated character wallpaper, Anime, Katekyō26 novembro 2024

HD wallpaper: several animated character wallpaper, Anime, Katekyō26 novembro 2024 -

vastolord project mugetsu|TikTok Search26 novembro 2024

-

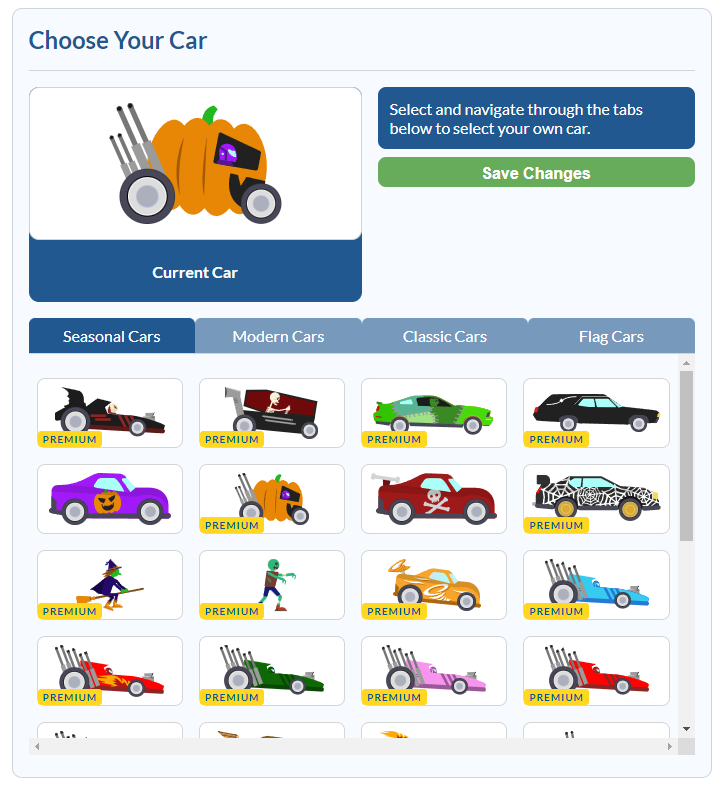

OVER 100+ NEW TypeRacer Cars OUT NOW! Includes Free Country flags26 novembro 2024

OVER 100+ NEW TypeRacer Cars OUT NOW! Includes Free Country flags26 novembro 2024 -

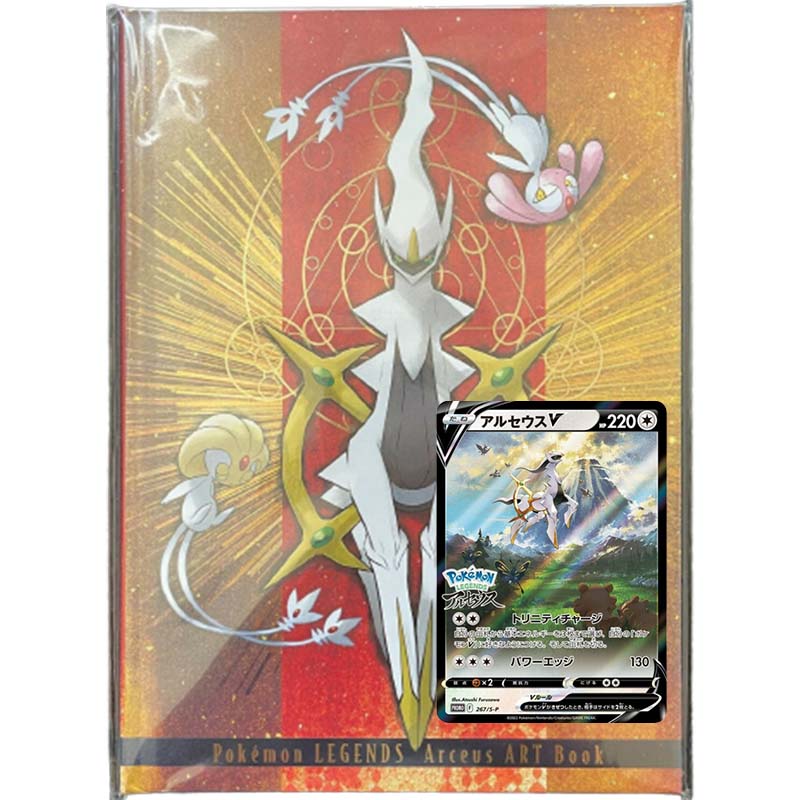

Pokemon Legends Arceus V 267/S-P Promo Card & ART Book Set Limited Pok — ToysOneJapan26 novembro 2024

Pokemon Legends Arceus V 267/S-P Promo Card & ART Book Set Limited Pok — ToysOneJapan26 novembro 2024 -

New Avião Controle Remoto, Guerra SU 27, com LED voo Noturno, 2 Baterias Alto Desempenho, Bico Emborrachado, Magalu Empresas26 novembro 2024

New Avião Controle Remoto, Guerra SU 27, com LED voo Noturno, 2 Baterias Alto Desempenho, Bico Emborrachado, Magalu Empresas26 novembro 2024 -

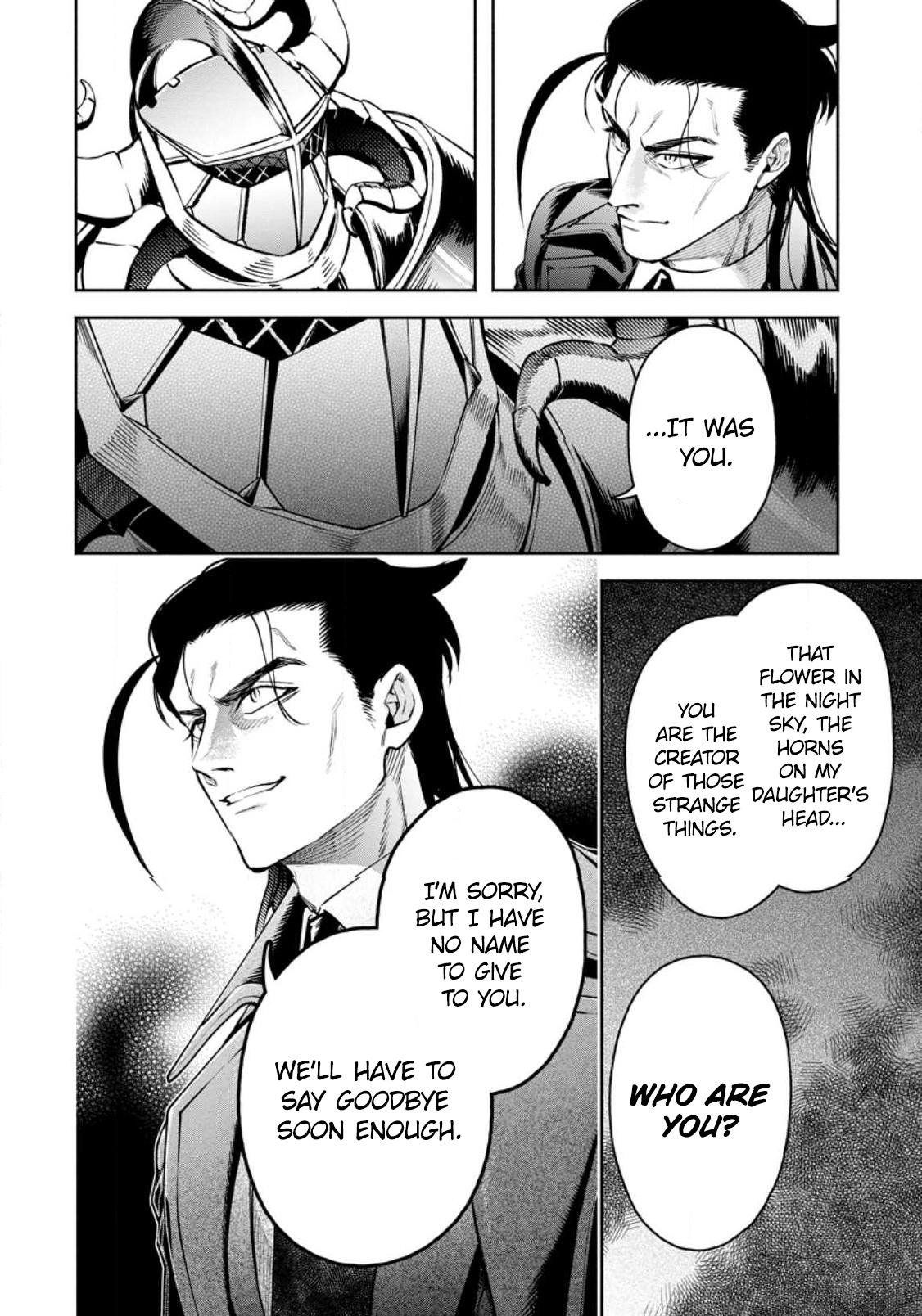

Maou-sama, Retry! R Vol.6 Ch.29 Page 17 - Mangago26 novembro 2024

Maou-sama, Retry! R Vol.6 Ch.29 Page 17 - Mangago26 novembro 2024