Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Last updated 20 fevereiro 2025

:max_bytes(150000):strip_icc()/Tier_1_Capital_Ratio_final_v3-057aabaee3b247228bde4b73c66ae9de.png)

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

:max_bytes(150000):strip_icc()/tier-1-common-capital-ratio.asp_Final-b5a7f9fdb545410196aa866931a57040.png)

Tier 1 Common Capital Ratio: Meaning, Overview, Example

What Is the Tier 1 Capital Ratio?

Multiple on Invested Capital (MOIC)

Tier 1 Capital - The Easy Way to See the Strength of a Bank's Balance Sheet

Tier 1 Capital - The Easy Way to See the Strength of a Bank's Balance Sheet

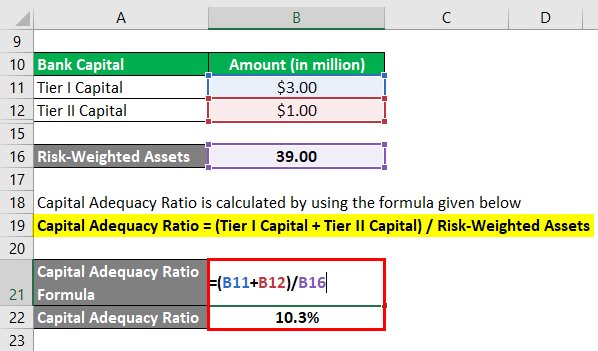

Capital Adequacy Ratio Step by Step calculation of CAR with Advantages

Tier 1 Capital: Understanding the Core of Capital Adequacy Ratio - FasterCapital

Debt To Equity Ratio - Basics, Formula, Calculations, and Interpretation - GETMONEYRICH

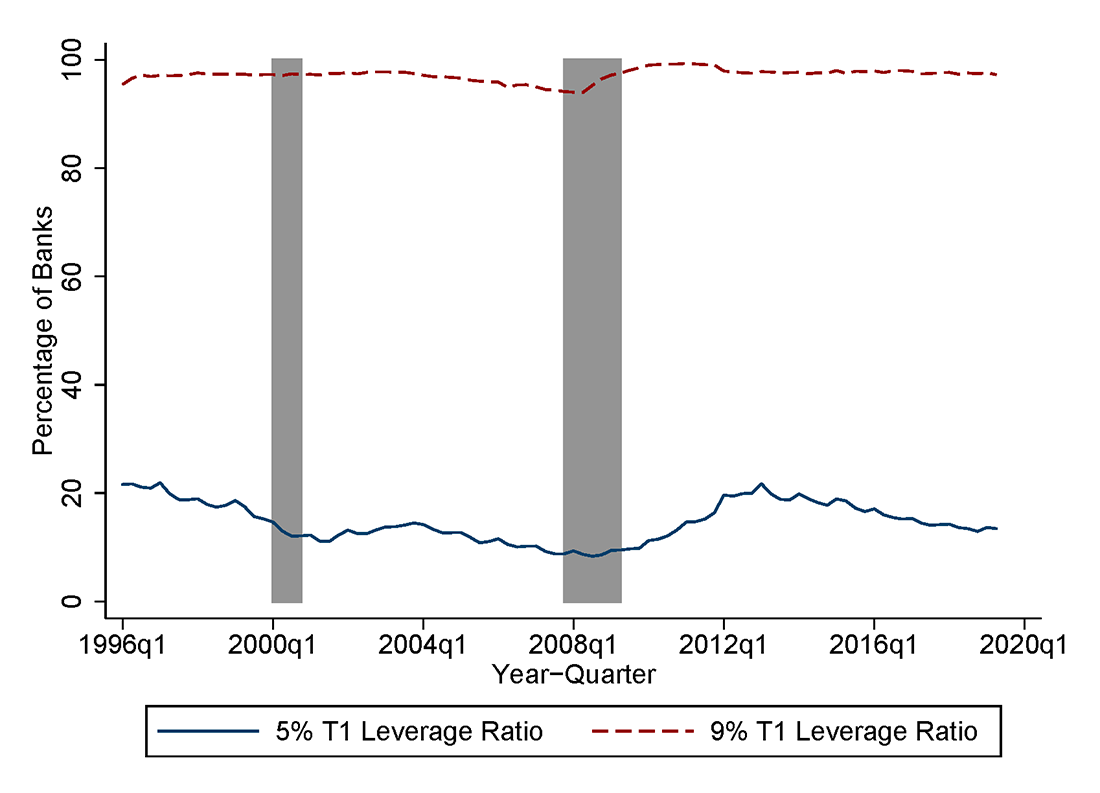

The Fed - Analyzing the Community Bank Leverage Ratio

Capital Adequacy Requirements (CAR) Chapter 1 – Overview of Risk-based Capital Requirements

Capital ratio equation and overview of CRD IV measures

Common Equity Tier 1 Capital Ratio Calculator

Recomendado para você

-

Genshin Impact Character Tier List: Best Characters20 fevereiro 2025

Genshin Impact Character Tier List: Best Characters20 fevereiro 2025 -

Top Tier synonyms - 505 Words and Phrases for Top Tier20 fevereiro 2025

Top Tier synonyms - 505 Words and Phrases for Top Tier20 fevereiro 2025 -

Top-tier Synonyms. Similar word for Top-tier.20 fevereiro 2025

Top-tier Synonyms. Similar word for Top-tier.20 fevereiro 2025 -

top tier meaning deutsch|TikTok Search20 fevereiro 2025

top tier meaning deutsch|TikTok Search20 fevereiro 2025 -

Pin by Soljurni on Randomness Everyday quotes, Daily inspiration20 fevereiro 2025

Pin by Soljurni on Randomness Everyday quotes, Daily inspiration20 fevereiro 2025 -

How Do You Assemble a Top Tier SaaS Marketing Strategy?20 fevereiro 2025

How Do You Assemble a Top Tier SaaS Marketing Strategy?20 fevereiro 2025 -

Tier 1 network - Wikipedia20 fevereiro 2025

Tier 1 network - Wikipedia20 fevereiro 2025 -

top tier Meaning, Pronunciation, Numerology and More20 fevereiro 2025

top tier Meaning, Pronunciation, Numerology and More20 fevereiro 2025 -

Tier List - Meaning + How-To + Lists20 fevereiro 2025

Tier List - Meaning + How-To + Lists20 fevereiro 2025 -

Behind the Ballot: The top tier remains the same, but who's No. 120 fevereiro 2025

Behind the Ballot: The top tier remains the same, but who's No. 120 fevereiro 2025

você pode gostar

-

Chelsea press conference LIVE - Mauricio Pochettino on Brighton, Reece James and injury news20 fevereiro 2025

Chelsea press conference LIVE - Mauricio Pochettino on Brighton, Reece James and injury news20 fevereiro 2025 -

Em 'Acesso Total', diretor do Botafogo revela procura por treinadores renomados no início da temporada, Botafogo20 fevereiro 2025

Em 'Acesso Total', diretor do Botafogo revela procura por treinadores renomados no início da temporada, Botafogo20 fevereiro 2025 -

Candidate-SE - Secretaria Nacional de Organização do PT20 fevereiro 2025

-

Genshin Impact x Prime Gaming Genshin Impact20 fevereiro 2025

Genshin Impact x Prime Gaming Genshin Impact20 fevereiro 2025 -

Rameshbabu Praggnanandha, Wiki20 fevereiro 2025

Rameshbabu Praggnanandha, Wiki20 fevereiro 2025 -

Assistir Yakusoku no Neverland - ver séries online20 fevereiro 2025

-

Weekend PC Download Deals for Dec. 2: Free Battlefield 2042 Steam weekend20 fevereiro 2025

Weekend PC Download Deals for Dec. 2: Free Battlefield 2042 Steam weekend20 fevereiro 2025 -

Placar da Globo na estreia da Copa só aparece aos 10 minutos de20 fevereiro 2025

Placar da Globo na estreia da Copa só aparece aos 10 minutos de20 fevereiro 2025 -

Teste de Ansiedade, Depressão e Estresse - Responda agora!20 fevereiro 2025

Teste de Ansiedade, Depressão e Estresse - Responda agora!20 fevereiro 2025 -

Talking Ben PNG by eliabnatnael on DeviantArt20 fevereiro 2025

Talking Ben PNG by eliabnatnael on DeviantArt20 fevereiro 2025