Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 31 março 2025

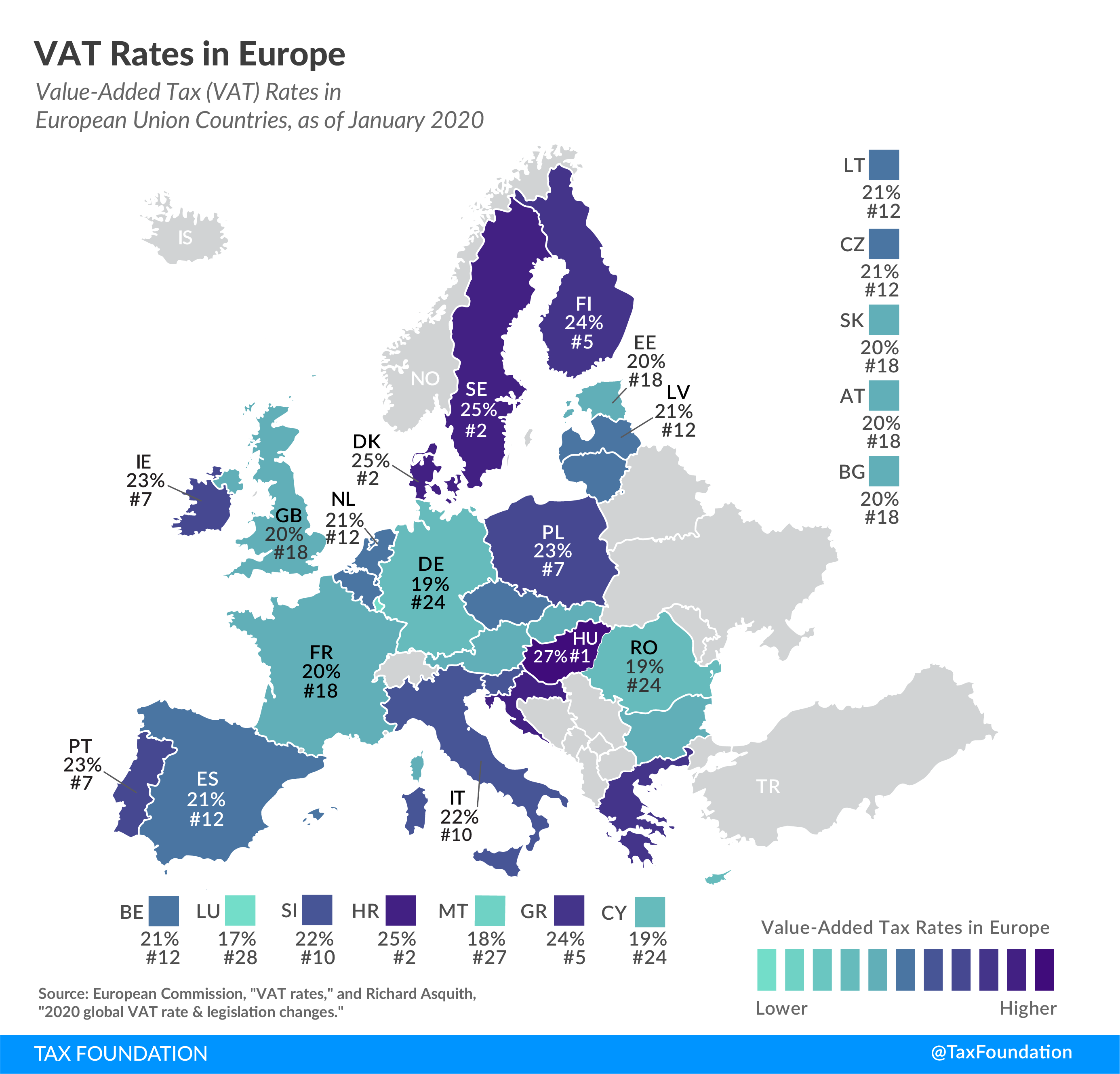

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

VAT between the UK and the US

Effects of taxes and benefits on UK household income - Office for National Statistics

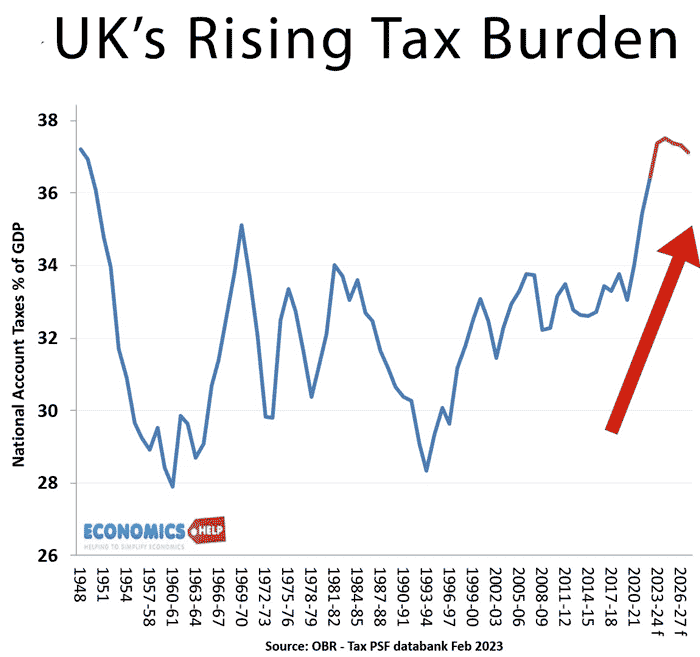

The rise of high-tax Britain - New Statesman

Taxes on Selling Stock: What You Pay & How to Pay Less

Value Added Tax (VAT) Definition, TaxEDU

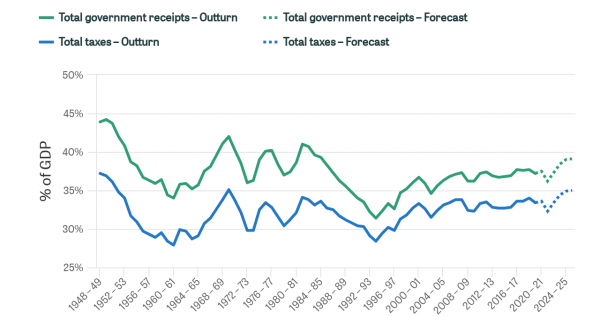

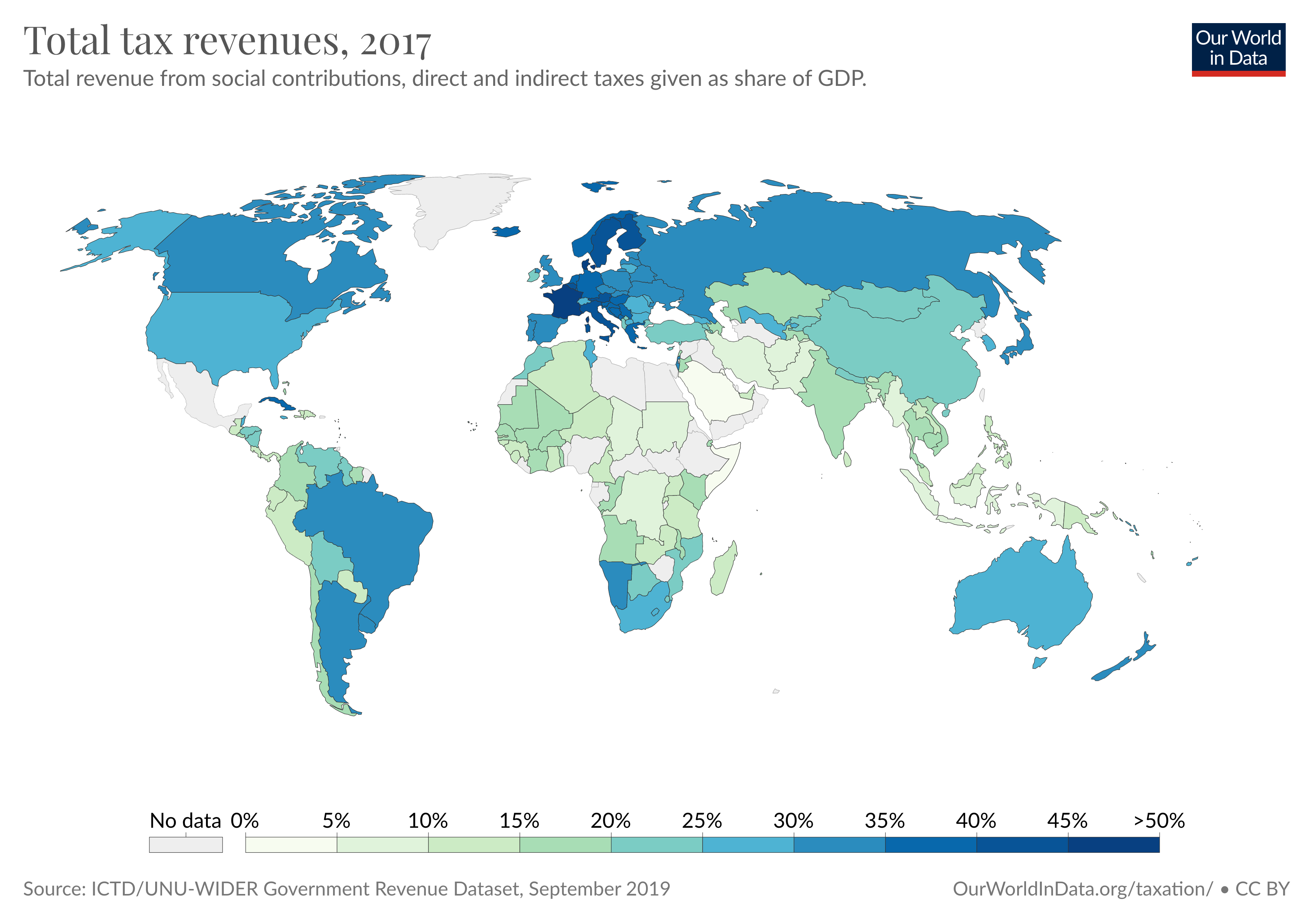

How have government revenues changed over time?

Why the UK Faces Higher Taxes and Less Public Services - Economics Help

Better Global Buying Experiences With Duties & Import Taxes at Checkout (2023)

Tax on wine: How much do you pay in the UK? - Ask Decanter

UK VAT (Value Added Tax) Guide - Updated for Post Brexit Impact

VAT: a brief history of tax, Tax

Taxation - Our World in Data

Recomendado para você

-

Open UK 2023 - Coming to Manchester and London31 março 2025

Open UK 2023 - Coming to Manchester and London31 março 2025 -

Uk - UK31 março 2025

Uk - UK31 março 2025 -

UK Dropshipping: Start Selling on UK @Dropship Academy31 março 2025

UK Dropshipping: Start Selling on UK @Dropship Academy31 março 2025 -

.co.uk (couk) - Profile31 março 2025

.co.uk (couk) - Profile31 março 2025 -

promotes marketing chief Eve Williams to UK boss31 março 2025

promotes marketing chief Eve Williams to UK boss31 março 2025 -

.co.uk - Is UK Down Right Now?31 março 2025

.co.uk - Is UK Down Right Now?31 março 2025 -

UK Trying To Lure Displaced Poshmark Sellers31 março 2025

UK Trying To Lure Displaced Poshmark Sellers31 março 2025 -

Environment Agency and crack down on illegal vehicle breakers31 março 2025

Environment Agency and crack down on illegal vehicle breakers31 março 2025 -

Who is UK's new general manager Eve Williams? - Internet Retailing31 março 2025

Who is UK's new general manager Eve Williams? - Internet Retailing31 março 2025 -

The Book: Essential tips for buying and selling on .co.uk31 março 2025

The Book: Essential tips for buying and selling on .co.uk31 março 2025

você pode gostar

-

Airport LFST (page 1) - FlightAware31 março 2025

-

File:Shinmai v03 000 color 03.jpg - Baka-Tsuki31 março 2025

File:Shinmai v03 000 color 03.jpg - Baka-Tsuki31 março 2025 -

Download FL Studio 21 free for PC, Mac - CCM31 março 2025

Download FL Studio 21 free for PC, Mac - CCM31 março 2025 -

Tabuada do 4║Ouvindo e Aprendendo a tabuada de Multiplicação por31 março 2025

Tabuada do 4║Ouvindo e Aprendendo a tabuada de Multiplicação por31 março 2025 -

Ash's Last Adventure in the Pokemon Anime Include Misty and Brock31 março 2025

Ash's Last Adventure in the Pokemon Anime Include Misty and Brock31 março 2025 -

Bubble Shooter Gem Puzzle Pop – Apps no Google Play31 março 2025

-

FNF Amanda The Adventurer Mod - Play Online Free - FNF GO31 março 2025

FNF Amanda The Adventurer Mod - Play Online Free - FNF GO31 março 2025 -

Como Criar um Email no Yahoo: Guia Simples e Rápido31 março 2025

Como Criar um Email no Yahoo: Guia Simples e Rápido31 março 2025 -

The Texas Chain Saw Massacre no Steam31 março 2025

The Texas Chain Saw Massacre no Steam31 março 2025 -

BIJOU - Your Love Lyrics31 março 2025

BIJOU - Your Love Lyrics31 março 2025