Banks chart course in stormy waters - SWI

Por um escritor misterioso

Last updated 06 janeiro 2025

After another difficult year, Switzerland’s largest banks, UBS and Credit Suisse, have adopted divergent strategies to minimise the risk of damaging the Swiss economy while remaining competitive in the global markets. Both banks are walking a tightrope, with a regulatory abyss on one side and the yawning chasm of missed opportunity and lost profits on the other. Shareholders, competitors and sharp-eyed regulators circle overhead, waiting to pounce on any mistake. From the mid-1990s, the dominant rivals progressively converged on a similar strategy that drained capital away from their established wealth management strongholds to build up their investment banking capabilities. In doing so, they chased the same fictional riches as most of the global powerhouse banks. While Credit Suisse saw the trap closing before most rivals, both Swiss banks got their fingers burned – with UBS blundering to the brink of ruin before being saved by a state bail-out in 2008. The last four years have hardly enhanced the reputation of either bank. UBS has been beset by a series of further calamities: a tax evasion sting that precipitated the collapse of Swiss banking secrecy, implication in the Libor fixing probe and a rogue trading scandal. Credit Suisse has also been implicated in the first two issues to a lesser degree, but has faced criticism for failing to capitalize on its perceived advantage over its rival. Furthermore, it bore the brunt of a stinging rebuke from the Swiss National Bank (SNB) in June that accused both banks of failing to implement new regulations fast enough. Forced separation The autumn of 2012 brought a twist – new strategies that put both banks on a different future course. UBS announced the dismantling of its investment banking operations, stripping out everything bar corporate advisory services and functions that support its wealth and asset management franchises. Credit Suisse said it would significantly reduce risky investment banking assets, but would continue to retain all business lines – including those that bet the bank’s own money on riskier trades. It’s only concession was a reorganization that hinted at separating such risky operations from the rest of the group. The country’s regulator, the Swiss Financial Markets Supervisory Authority (Finma), refused to say which path it prefers. However, Mark Branson, charged by Finma to oversee banks, supported the emergence of divergent strategies. “It is in some way encouraging that global investment banks are making more differentiated decisions than in the past,” he told . “One of the lessons of the crisis was that all investment banks were exposed to products that became contaminated. If you are applying a ‘me too’ strategy then you can end up very exposed when markets turn against you.” Global picture The action of the two banks appears to have placated the SNB. Speaking in December, the central bank’s vice-chairman Jean-Pierre Danthine said that the situation had “improved” at both banks, particularly Credit Suisse. “Both institutions are planning to further expand their loss-absorbing capital, to reduce their risks and, in particular, trim their balance sheets as well as to pursue a policy of dividend restraint,” Danthine said. However, he warned that the risks of either bank incurring large losses if the European debt crisis worsens “remain considerable”. Investors gave a very clear signal about which strategy they thought was best. UBS shares shot up on the news of the bank’s radical plan, while those of Credit Suisse dipped when it made its own announcement. How either bank will fare on a global stage against international rivals is at present far from clear cut. The enhanced “Swiss finish” regulations, that start coming into force from January 1, 2013, compel UBS and Credit Suisse to hold back far greater insurance capital than the international standard. On the face of it, this puts the Swiss duo at a competitive disadvantage, but institutions elsewhere – be they in the European Union or the United States - have yet to finalise their own domestic rules to complement the Basel III global recommendations. Risks remain The European Banking Federation has asked that the implementation of the Basel III regulations themselves – that start coming into force on January 1, 2013 - be delayed for a year to allow banks more time to prepare. The US has already announced a six-month delay. Despite the “Swiss finish” regulations being tougher than the global standard, the fact that banks know exactly what is required of them could give them a competitive edge over global rivals, according to observers. This at least gives UBS and Credit Suisse greater certainty about the future and allows them to put their strategies into action. Both banks are well on course to fulfil the requirements of the new regulations, according to many observers, although UBS’s safety first strategy makes it easier for the bank to satisfy capital requirements. Credit Suisse’s continued attachment to investment banking does not surprise analysts the bank’s heavier reliance on such trading. However, doubts remain about Credit Suisse’s strategy of remaining a global investment banking player given the continued volatility of the business. UBS and Credit Suisse: where they stand In October, following criticism from the SNB in June, both Swiss banks announced further cost cutting measures. UBS extended its savings programme to SFr5.4 billion by the end of 2015, shedding 10,000 jobs and many investment banking activities in the process. The group plans to reduce its riskiest assets from SFr300 billion (3rd quarter 2012) by a third to SFr200 billion by the end of 2017. Risky investment banking assets would drop from SFr162 billion to SFr70 billion. Its Basel III tier 1 ratio is forecast to improve from 9.3% to 11.5% by the middle of next year and 13% in 2014. Credit Suisse had already announced the raising of SFr15.3 billion in extra capital from the markets in the summer. It plans to cut costs by SFr4 billion by the end of 2015. It targets group Basel III risk weighted assets to stand at SFr300 billion by the end of 2013. Its Basel III tier 1 ratio is expected to reach 9.3% by the end of 2012, 10% by mid-2013 and approach 12% by the end of next year. UBS’s balance sheet stands at SFr1.37 trillion compared with just over SFr1 trillion at Credit Suisse.

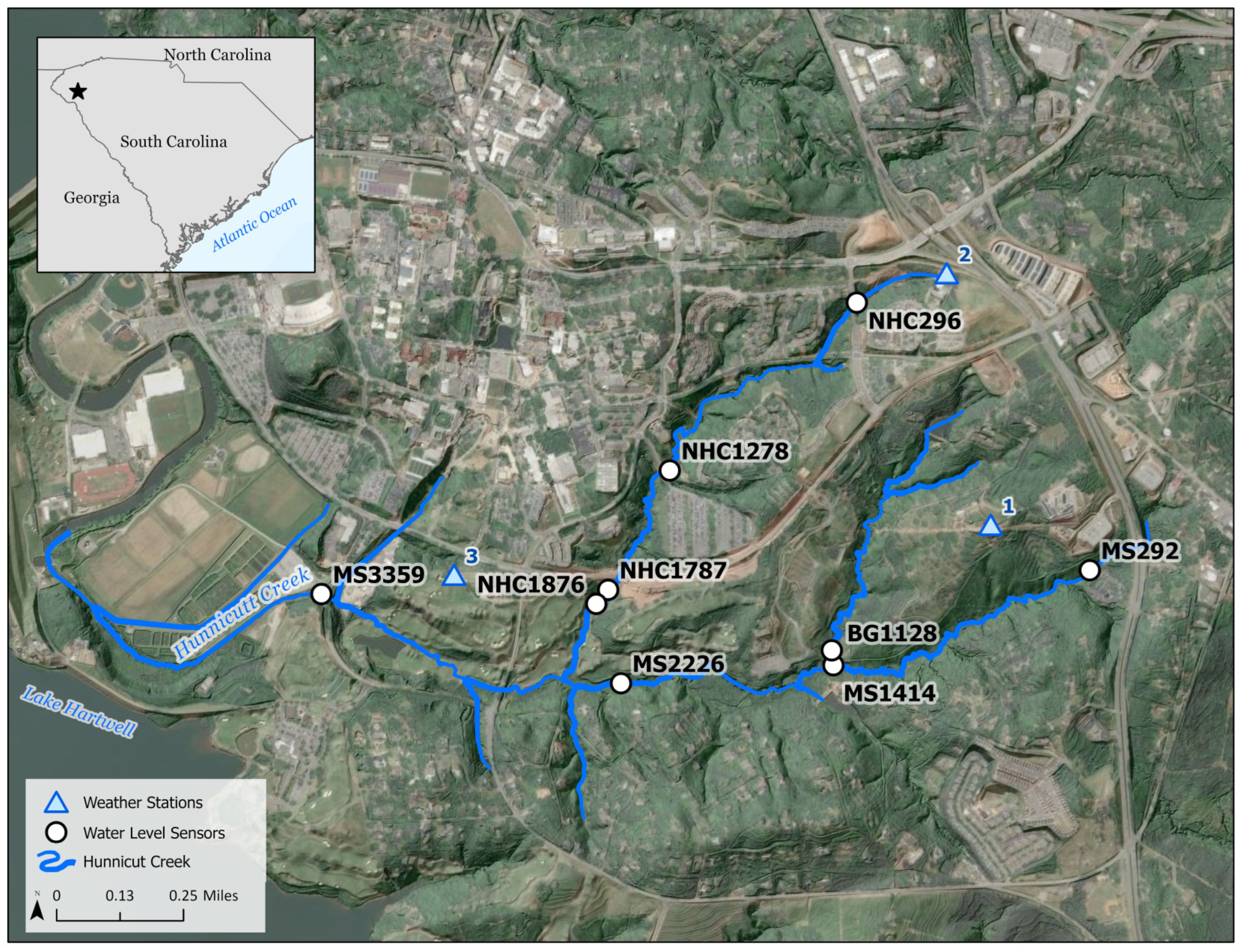

Water, Free Full-Text

How to stay safe in dangerous flooding

A Quick Guide to Sea Safety - Power & Motoryacht

Tropical Storm Bret racing toward Caribbean as forecasters monitor Tropical Depression Four

Louisiana's Disappearing Coast

California storm: Fierce weather has taken 14 lives in state, Newsom says

Water, Free Full-Text

Gulf of Maine (U.S. National Park Service)

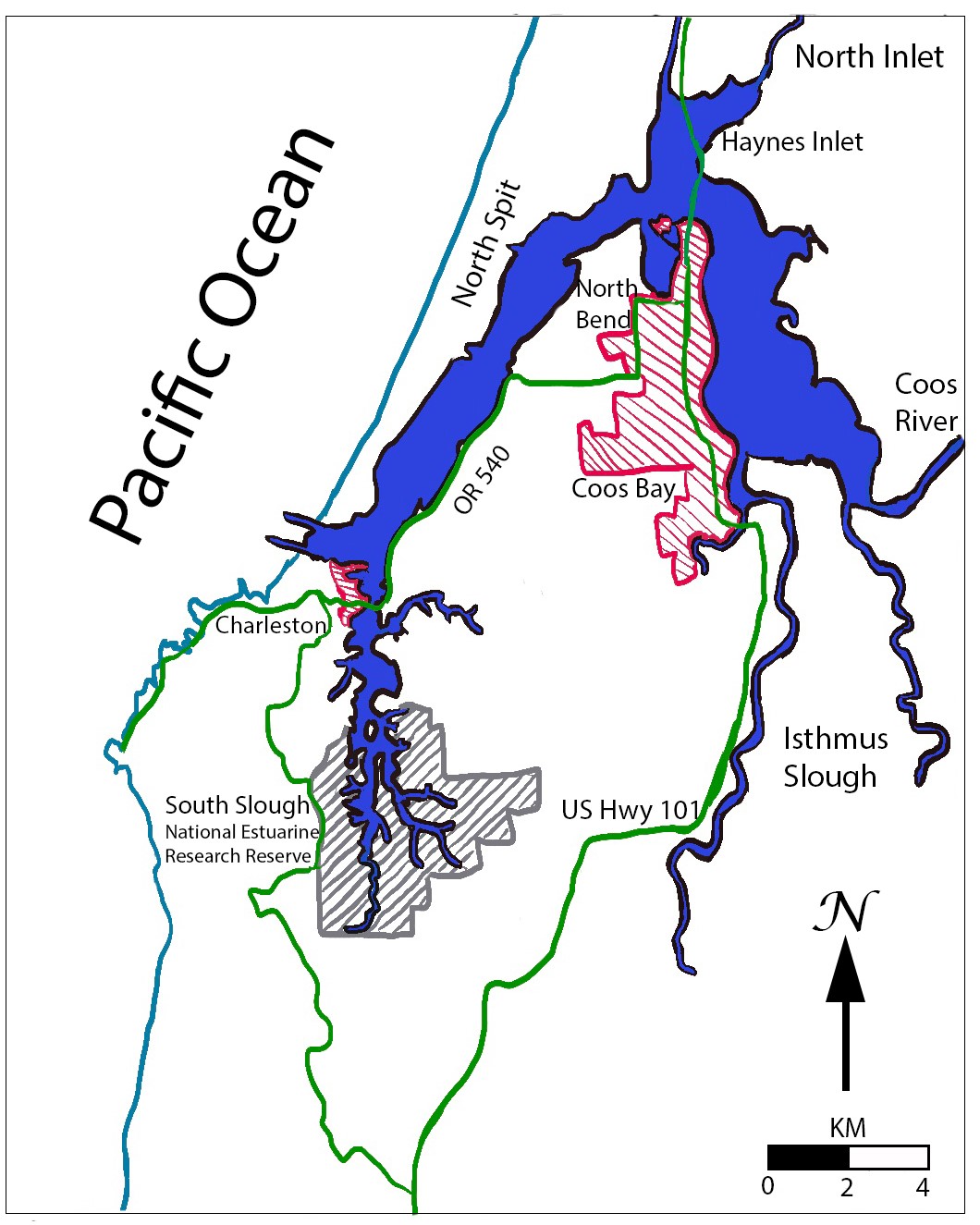

Coos Bay - Wikipedia

Global warming threatens collapse of Atlantic currents this century, new study finds

Recomendado para você

-

Magnus Carlsen, Wesley So Lose In FIDE World Cup Round 406 janeiro 2025

Magnus Carlsen, Wesley So Lose In FIDE World Cup Round 406 janeiro 2025 -

Allie Hodgkins-Brown on X: Thursday's Daily MIRROR: “Utter chaos” #TomorrowsPapersToday / X06 janeiro 2025

Allie Hodgkins-Brown on X: Thursday's Daily MIRROR: “Utter chaos” #TomorrowsPapersToday / X06 janeiro 2025 -

H-DiploRJISSF Roundtable on Zubok Collapse06 janeiro 2025

H-DiploRJISSF Roundtable on Zubok Collapse06 janeiro 2025 -

Gro Harlem Brundtland: Pulling nuclear powers back from the brink06 janeiro 2025

Gro Harlem Brundtland: Pulling nuclear powers back from the brink06 janeiro 2025 -

Michael McVicker on LinkedIn: Blundering on the Brink06 janeiro 2025

-

Boris Johnson's blundering government is about to make the poor poorer—by accident06 janeiro 2025

Boris Johnson's blundering government is about to make the poor poorer—by accident06 janeiro 2025 -

Magnus Carlsen Invitational: On the brink of elimination06 janeiro 2025

-

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/34208805/3067024984_9d8fdde683_o.0.jpg) The world's on the brink of a mass extinction. Here's how to avoid that. - Vox06 janeiro 2025

The world's on the brink of a mass extinction. Here's how to avoid that. - Vox06 janeiro 2025 -

Gambling with Armageddon by Martin J. Sherwin: 978030738633506 janeiro 2025

-

Watch as Russian tank commander takes out FIVE of his own men using turret in blundering footage06 janeiro 2025

Watch as Russian tank commander takes out FIVE of his own men using turret in blundering footage06 janeiro 2025

você pode gostar

-

Halo Series 2 Iridescent Multichrome Eyeshadow – Clionadh Cosmetics06 janeiro 2025

Halo Series 2 Iridescent Multichrome Eyeshadow – Clionadh Cosmetics06 janeiro 2025 -

Welcome Home - Barnaby by PlagueDogs123 on DeviantArt06 janeiro 2025

Welcome Home - Barnaby by PlagueDogs123 on DeviantArt06 janeiro 2025 -

The Witcher Diretora confirma duas temporadas com Liam Hemsworth06 janeiro 2025

The Witcher Diretora confirma duas temporadas com Liam Hemsworth06 janeiro 2025 -

Download Meme Cat Funny Discord PFP Wallpaper06 janeiro 2025

Download Meme Cat Funny Discord PFP Wallpaper06 janeiro 2025 -

Steam Community :: Guide :: GTA Online ALL Gang Attack Locations06 janeiro 2025

-

American bully XL dogs should be banned06 janeiro 2025

American bully XL dogs should be banned06 janeiro 2025 -

If Rockstar were to release a Bully remake, how realistic/stylized do you want the character models to be? : r/bully06 janeiro 2025

If Rockstar were to release a Bully remake, how realistic/stylized do you want the character models to be? : r/bully06 janeiro 2025 -

Subway Surfers World Tour Tokyo .06 janeiro 2025

Subway Surfers World Tour Tokyo .06 janeiro 2025 -

About: Moonlight Lovers Ethan (iOS App Store version)06 janeiro 2025

About: Moonlight Lovers Ethan (iOS App Store version)06 janeiro 2025 -

Amoeba Music on X: .@slipknot's new album The End, So Far was just released via @rrusa! It's available now on CD, clear 2LP, and indie exclusive yellow double vinyl. Get it here06 janeiro 2025

Amoeba Music on X: .@slipknot's new album The End, So Far was just released via @rrusa! It's available now on CD, clear 2LP, and indie exclusive yellow double vinyl. Get it here06 janeiro 2025