Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 24 março 2025

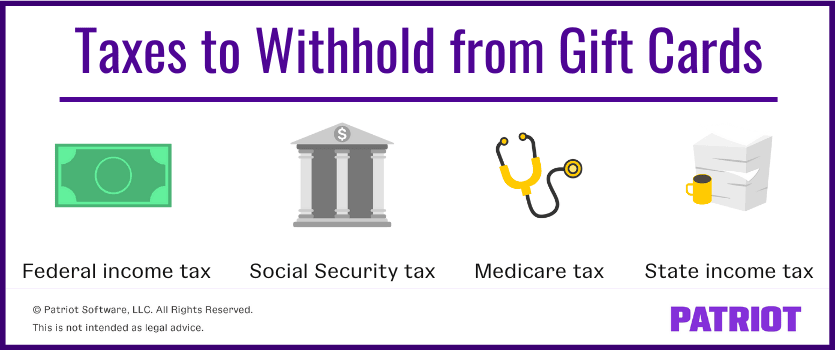

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

Are Gift Cards Taxable? Taxation, Examples, & More

Is That Payment Taxable? 5 Key Tax Facts All Employers Should Know - Procopio

Are Employee Gifts Taxable?: A Complete Guide to the De Minimis Rule - Blue Lion

Are Employee Gift Cards Taxable?

Gift Cards are Taxable • Southwestern University

Are Gift Cards Taxable Employee Benefit?

Must-Know Tax Rules for Employee Gift Cards

Are Gift Cards taxable, Tax on Gift Cards

FAQ: Are Gift Cards for Employees a Tax Deduction?

Taxation of Gifts to Ministers and Church Employees - Provident Lawyers

What employers need to know about employee gifts

If I earn gift cards for taking online surveys, is it considered taxable income? Do I need to report this income if I do not receive a 1099-MISC? - Quora

Recomendado para você

-

Best Beauty Gifts24 março 2025

-

Gift Card in a Welcome Baby Gift Box24 março 2025

Gift Card in a Welcome Baby Gift Box24 março 2025 -

How to Wrap a Gift - Wrapping a Present Step by Step Instructions24 março 2025

How to Wrap a Gift - Wrapping a Present Step by Step Instructions24 março 2025 -

The best Christmas gifts 2023: your guide to the top presents on everyone's wish list this year24 março 2025

The best Christmas gifts 2023: your guide to the top presents on everyone's wish list this year24 março 2025 -

Gift box Royalty Free Vector Image - VectorStock24 março 2025

Gift box Royalty Free Vector Image - VectorStock24 março 2025 -

Gift Tax – GRA24 março 2025

Gift Tax – GRA24 março 2025 -

Preferred Customer Benefits - Free Gift with Purchase24 março 2025

Preferred Customer Benefits - Free Gift with Purchase24 março 2025 -

Need a V-Day gift for him? Shop these awesome options24 março 2025

Need a V-Day gift for him? Shop these awesome options24 março 2025 -

30 Subscription Gifts You Can Send Last-Minute 202324 março 2025

30 Subscription Gifts You Can Send Last-Minute 202324 março 2025 -

How to buy gifts on a budget : Life Kit : NPR24 março 2025

How to buy gifts on a budget : Life Kit : NPR24 março 2025

você pode gostar

-

Melhores Memeblox TENTE NÃO RIR ROBLOX memes de roblox24 março 2025

Melhores Memeblox TENTE NÃO RIR ROBLOX memes de roblox24 março 2025 -

Shimano Deore BB-MT500 Press Fit Bottom Bracket24 março 2025

-

O Gambito da Rainha', a série que mostra o xadrez como nunca antes na televisão, Cultura24 março 2025

O Gambito da Rainha', a série que mostra o xadrez como nunca antes na televisão, Cultura24 março 2025 -

Minecraft Deadlox Coloring page Minecraft para colorir, Minecraft para imprimir, Desenhos minecraft24 março 2025

Minecraft Deadlox Coloring page Minecraft para colorir, Minecraft para imprimir, Desenhos minecraft24 março 2025 -

Chara looked very different when alive : r/Undertale24 março 2025

Chara looked very different when alive : r/Undertale24 março 2025 -

metal sonic 3.024 março 2025

-

Destiny 2 PSA: Anisotropic levels even at high settings are very low, set to 16x on driver options for much better image quality. : r/pcgaming24 março 2025

Destiny 2 PSA: Anisotropic levels even at high settings are very low, set to 16x on driver options for much better image quality. : r/pcgaming24 março 2025 -

Golden Arc Only Struggler spotted on Twitter : r/Berserk24 março 2025

Golden Arc Only Struggler spotted on Twitter : r/Berserk24 março 2025 -

10 filmes em anime mais esperados de 2015 - Tribo Gamer24 março 2025

10 filmes em anime mais esperados de 2015 - Tribo Gamer24 março 2025 -

How to Watch Copa Libertadores in the USA (2023)24 março 2025

How to Watch Copa Libertadores in the USA (2023)24 março 2025