2021 FICA Tax Rates

Por um escritor misterioso

Last updated 24 março 2025

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

What are FICA Taxes? 2022-2023 Rates and Instructions

FICA Tax in 2022-2023: What Small Businesses Need to Know

Federal Tax Income Brackets For 2023 And 2024

How Much Does an Employer Pay in Payroll Taxes?

Federal Insurance Contributions Act - Wikipedia

States That Tax Social Security Benefits

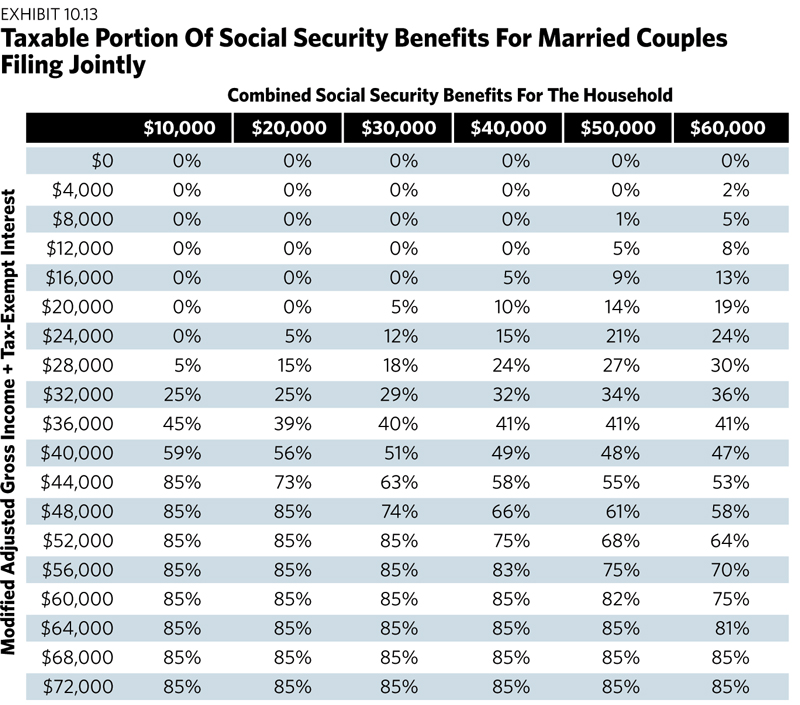

Avoiding The Social Security Tax Torpedo

Uncapping the Social Security Tax – People's Policy Project

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

Financial Considerations for Moonlighting Physicians

Taxes – Payroll taxes, especially Social Security, are regressive … NOT !!!

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses24 março 2025

What Is FICA Tax? A Complete Guide for Small Businesses24 março 2025 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest24 março 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest24 março 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays24 março 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays24 março 2025 -

Social Security and Medicare • Teacher Guide24 março 2025

-

What is the FICA Tax and How Does it Connect to Social Security?24 março 2025

-

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)24 março 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)24 março 2025 -

How An S Corporation Reduces FICA Self-Employment Taxes24 março 2025

How An S Corporation Reduces FICA Self-Employment Taxes24 março 2025 -

What Are FICA Taxes And Why Do They Matter? - Quikaid24 março 2025

What Are FICA Taxes And Why Do They Matter? - Quikaid24 março 2025 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine24 março 2025

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine24 março 2025 -

FICA Tax - An Explanation - RMS Accounting24 março 2025

FICA Tax - An Explanation - RMS Accounting24 março 2025

você pode gostar

-

Is there like a Star Citizen support group or something I can join? I clearly have a problem. : r/starcitizen24 março 2025

Is there like a Star Citizen support group or something I can join? I clearly have a problem. : r/starcitizen24 março 2025 -

Nezuko Gif - GIFcen24 março 2025

Nezuko Gif - GIFcen24 março 2025 -

Como Comprar Ingressos para um Jogo da NBA em Miami - Hellotickets24 março 2025

Como Comprar Ingressos para um Jogo da NBA em Miami - Hellotickets24 março 2025 -

70+ Unforgettable Kurt Vonnegut Quotes24 março 2025

70+ Unforgettable Kurt Vonnegut Quotes24 março 2025 -

Minecraft Beta 1.9 Prerelease 3 Item : r/Minecraft24 março 2025

Minecraft Beta 1.9 Prerelease 3 Item : r/Minecraft24 março 2025 -

Sonic Heroes24 março 2025

Sonic Heroes24 março 2025 -

bet pix futebol - Seu Portal para Jogos Online Empolgantes.24 março 2025

bet pix futebol - Seu Portal para Jogos Online Empolgantes.24 março 2025 -

Bounty Hunter on Behance24 março 2025

Bounty Hunter on Behance24 março 2025 -

Toomies Peppa Pig's Sensory House - Toddler Sensory Bin with Shape Sorting and Color Matching Activities - Peppa Pig Montessori Toys - Toddler Toys Ages 18 Months and Up : Toys & Games24 março 2025

Toomies Peppa Pig's Sensory House - Toddler Sensory Bin with Shape Sorting and Color Matching Activities - Peppa Pig Montessori Toys - Toddler Toys Ages 18 Months and Up : Toys & Games24 março 2025 -

Buy Helpy Plush at Funko.24 março 2025

Buy Helpy Plush at Funko.24 março 2025