What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Last updated 05 julho 2024

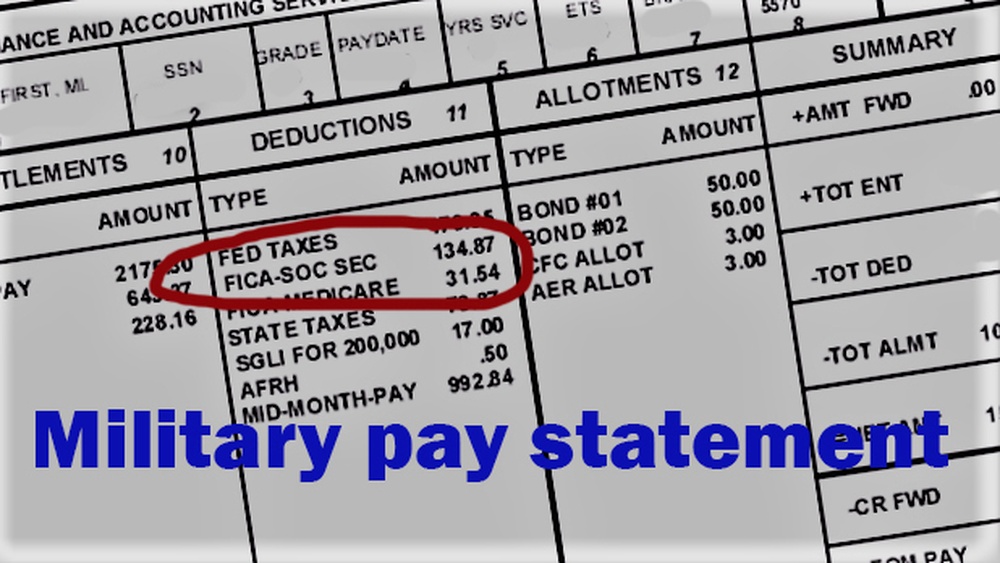

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

IRS Issues Guidance for Executive Order on Payroll Tax Deferral - Sikich LLP

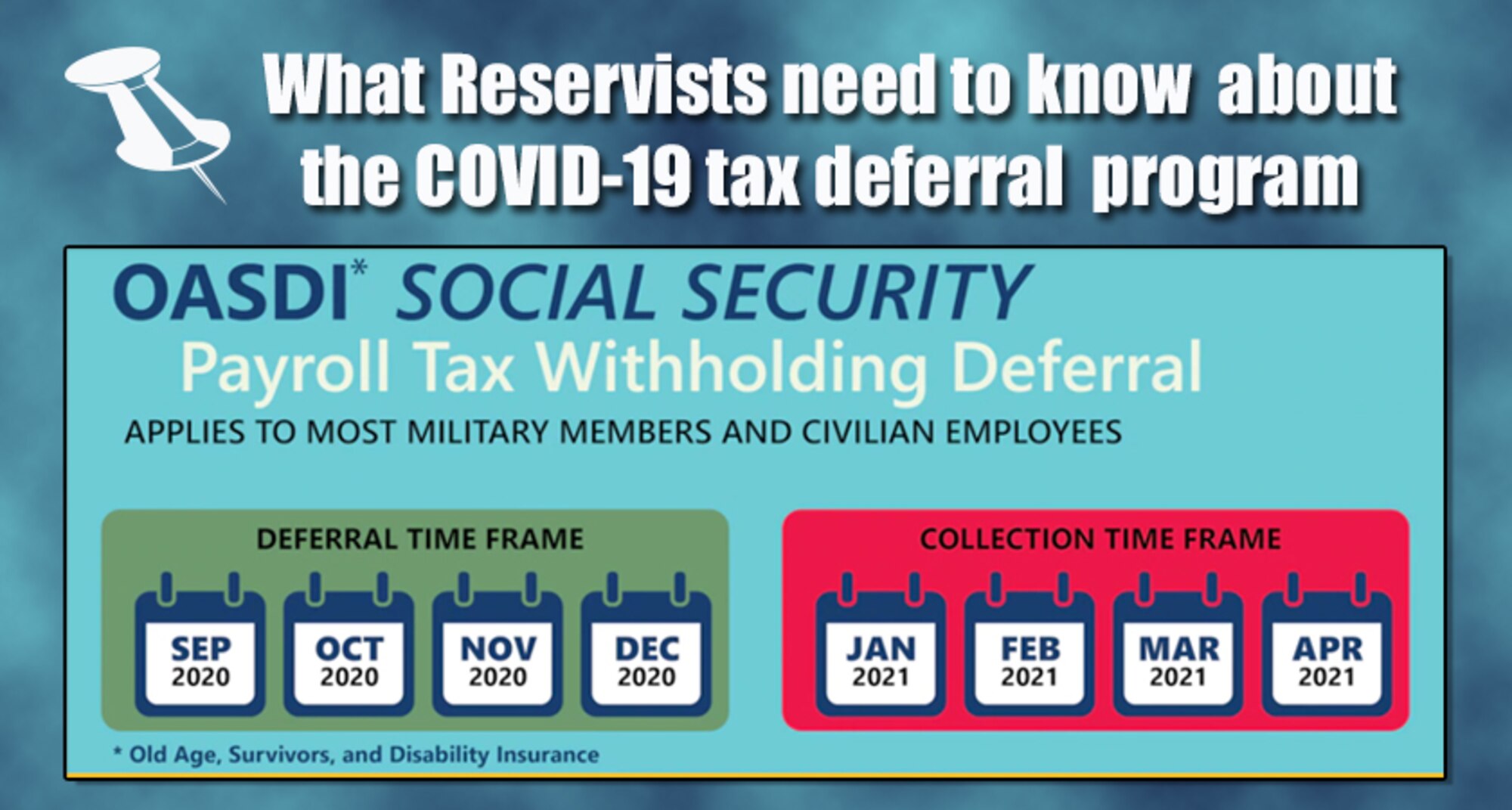

37th Training Wing - Teammates, please see the below details regarding the OASDI Social Security Payroll Tax Withholding Deferral. The deferment is intended to provide temporary financial relief during the #COVID-19 pandemic.

Understanding the COVID-19 Payroll Tax Deferral

DFAS addresses Guard, Reserve specific Tax deferral details > 315th Airlift Wing > Article Display

Treasury Provides Guidance on Employee Social Security Tax Deferral: Nutter McClennen & Fish Law Firm

IRS releases final instructions for payroll tax form related to COVID-19 relief - Miller Kaplan

How to Defer Social Security Tax (COVID-19)

What you need to know about the Social Security Tax Withholding Deferral – Hilltop Times

DVIDS - News - Social Security payroll tax deferral begins for DOD employees

IRS Updates CARES Act Employee Retention Credits & Payroll Tax Deferrals FAQ

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions05 julho 2024

-

What is the FICA Tax and How Does It Work? - Ramsey05 julho 2024

What is the FICA Tax and How Does It Work? - Ramsey05 julho 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks05 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks05 julho 2024 -

Overview of FICA Tax- Medicare & Social Security05 julho 2024

Overview of FICA Tax- Medicare & Social Security05 julho 2024 -

What is the FICA Tax and How Does it Connect to Social Security?05 julho 2024

-

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)05 julho 2024

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)05 julho 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out05 julho 2024

-

What Is FICA on a Paycheck? FICA Tax Explained - Chime05 julho 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime05 julho 2024 -

Withholding FICA Tax on Nonresident employees and Foreign Workers05 julho 2024

Withholding FICA Tax on Nonresident employees and Foreign Workers05 julho 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books05 julho 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books05 julho 2024

você pode gostar

-

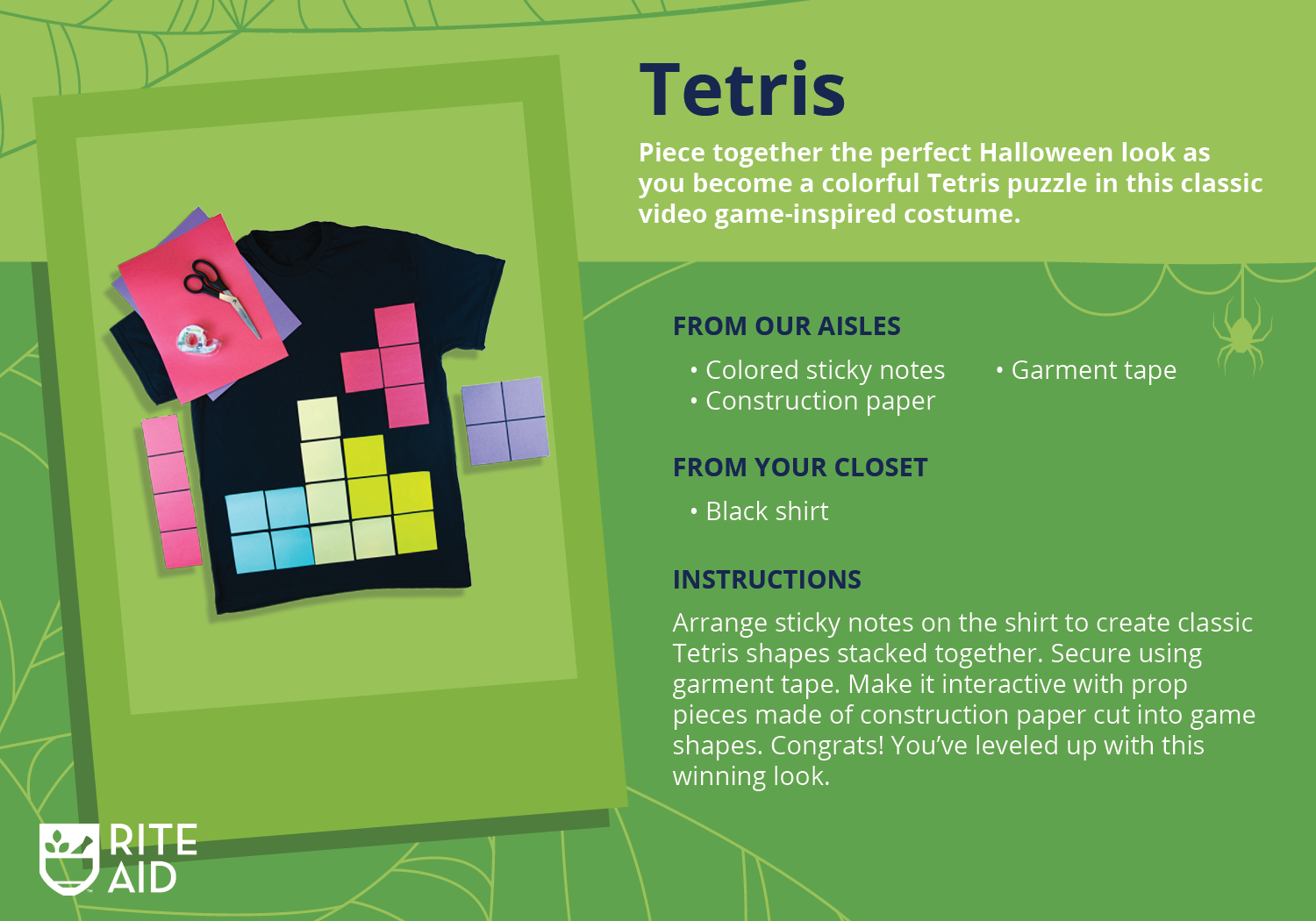

Rite Aid DIY Halloween costume recipe cards05 julho 2024

Rite Aid DIY Halloween costume recipe cards05 julho 2024 -

Lord of the Rings: The Rings of Power Review: 's Big Bet05 julho 2024

-

Dragon Ball Z: Budokai Tenkaichi 3 PS2 ISO Traduzido PT-BR + Gameplay PCSX205 julho 2024

Dragon Ball Z: Budokai Tenkaichi 3 PS2 ISO Traduzido PT-BR + Gameplay PCSX205 julho 2024 -

☎️the walten files☎️ - playlist by ☆🔹blue🔹☆05 julho 2024

-

Ryan Benno's Art Blog: Sunset Overdrive Part 205 julho 2024

Ryan Benno's Art Blog: Sunset Overdrive Part 205 julho 2024 -

gi ☁️🍊🗺️🧭🦁🌻 on X: Usopp and Robin taking care of mini Nami during One Piece Film Z was so cute. / X05 julho 2024

gi ☁️🍊🗺️🧭🦁🌻 on X: Usopp and Robin taking care of mini Nami during One Piece Film Z was so cute. / X05 julho 2024 -

Steam Community :: :: Disney's The Little Mermaid - Princess Ariel05 julho 2024

-

teenage robot Sticker for Sale by GreasyGerbil05 julho 2024

teenage robot Sticker for Sale by GreasyGerbil05 julho 2024 -

Dr.Livesey is a Gigafurry by Crazyimp on Newgrounds05 julho 2024

Dr.Livesey is a Gigafurry by Crazyimp on Newgrounds05 julho 2024 -

Penteado Infantil Fácil com Trança Falsa e Ligas05 julho 2024

Penteado Infantil Fácil com Trança Falsa e Ligas05 julho 2024